Our approach to meeting the Products & Services Outcome and Price & Value Outcome – Information for distributors of the Product.

This summary document is being provided to you to fulfil our responsibilities under PRIN 2A.4.15R and PRIN 2A.3.12 R (2). It is designed to support you to comply with your responsibilities under PRIN 2A.3.16 R and PRIN 2A.4.16 R. Please note that you are ultimately responsible for meeting your obligations under ‘The Consumer Duty’. This information is intended for intermediary use only and should not be provided to customers.

1. Summary of our assessment

We have assessed that:

- Our Regulated Bridging Mortgage product continues to meet the needs, characteristics, and objectives of customers in

the identified target market. - The intended distribution strategy remains appropriate for the target market.

- The Product provides fair value to customers in the target market (i.e., the total benefits are proportionate to total costs).

2. Product characteristics & benefits

The products is designed to meet the needs of the target group, this being customers with a requirement to borrow

quickly, to help purchase a new residence, raise monies to support the refurbishment of their home or for further

investment. The product features and criteria are designed to support these needs.

- Short term funding facility with a maximum term of up to 12 months.

- Fixed interest rates for the term.

- Interest retained for the full term, resulting in no requirement for monthly payments to be made by the customer.

- No early repayment charges after the 1st month.

- Case-by-case underwriting based on requirement and exit strategy over affordability assessments.

- Multiple properties can be accepted as security.

- Speed and service of progression of a loan.

- No minimum credit score; adverse credit information.

3. Target market assessment and distribution strategy

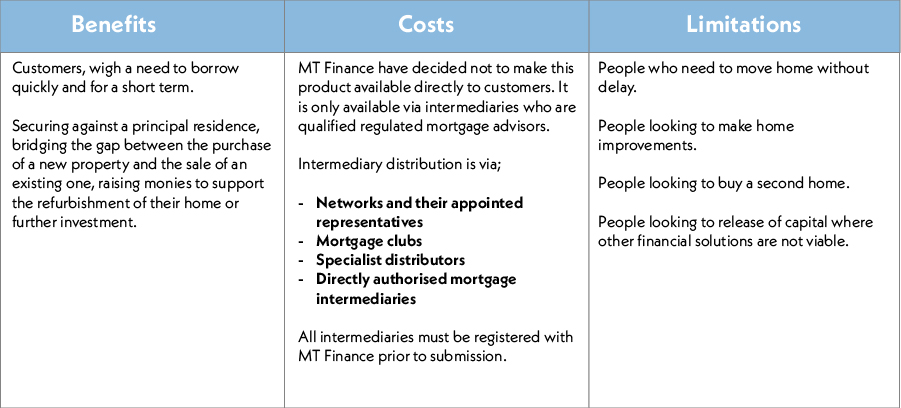

This target market assessment matrix segments the target customers for the Product, recognising their different needs to

enable you to tailor the services you provide when you distribute the Product.

The Product is not designed for customers who:

- Want a term longer than 12 months.

- Want to repay the loan via monthly repayments (Capital and repayment).

- Do not have the means to repay the loan in full at the end of the term.

- Want to use the loan for credit repair.

4. Customers with characteristics of vulnerability

The Product is designed for the Regulated Bridging sector, which is likely to include some customers with characteristics

of vulnerability or who will experience vulnerability over time. Some of our customers may have a lack of understanding,

be susceptible to coercion or experience situations where they need to have to borrow to meet the need of IHT following a

bereavement.

Other borrowers are less likely to have a comprehensive understanding of mortgages or of the mortgage market.

Therefore, they may require additional advice and support to ensure they understand the information being presented

to them and the implications of the arrangement they are entering into to reduce the risk of harm occurring. We have

in place a Vulnerable Customer Policy, which allows MT Finance to achieve and support good outcomes for vulnerable

customers, which includes:

- The requirement for customers to receive independent mortgage advice from a appropriately qualified mortgage advisor.

- The requirement for customer to receive independent legal advice from an appropriately qualified solicitor.

- Education and training to our staff ensure they have the necessary skills to recognise and respond to the needs of

vulnerable customers. - A clearly defined policy lending policy that explains our lending criteria of what can be done and cannot.

- Continue to adhere to high levels of quality assurance and audit checks on our service and product to ensure that

they are suitable for our customers.

Please contact us if you need any further information about how we support the needs of all our customers in relation to

the Product.

5. Our assessment of value

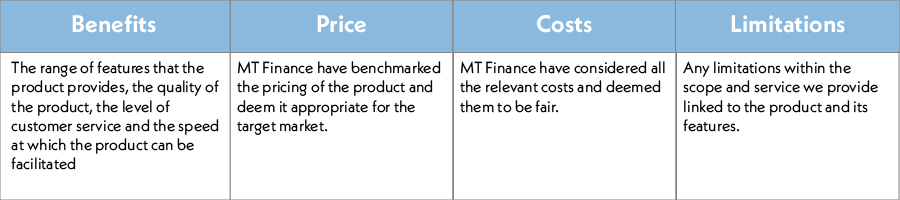

This target market assessment matrix segments the target customers for the Product, recognising their different needs to

enable you to tailor the services you provide when you distribute the Product.

We have developed a comprehensive and robust assessment process which evaluates several aspects of our business to

determine the value of our mortgage product. This analysis is used to ascertain whether the Product delivers fair value for

customers.

The outcomes of the assessment process are presented to the Board, allowing for challenge and further investigation

before we sign-off the outcomes and share the summary of our assessment with you. Our fair value assessment has

considered the following:

Results of our assessment

Our assessment concluded that the Product continues to deliver fair value for customers in the target market for the Product.