-

Countdown to the general election: What the experts say

-

How will the general election impact the property market?

-

Ngage Finance’s Nathan Raffour and Andrew Gage: “Why giving back matters”

-

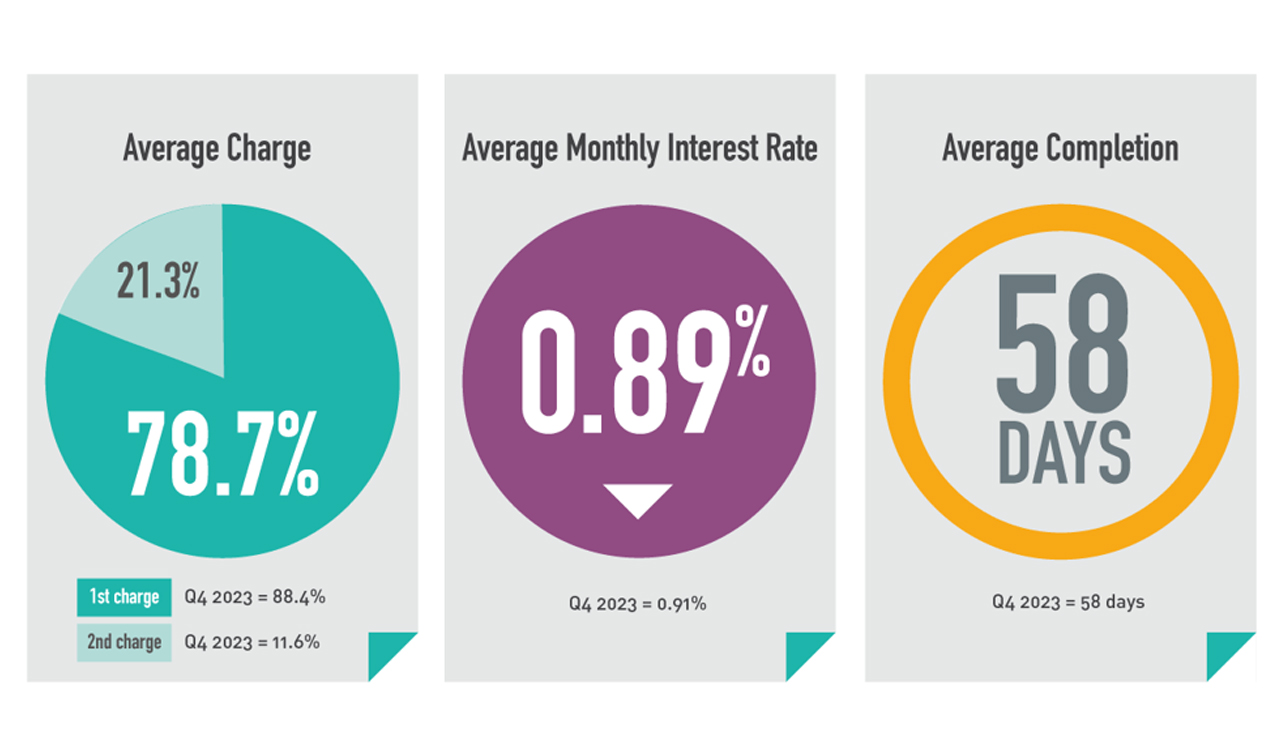

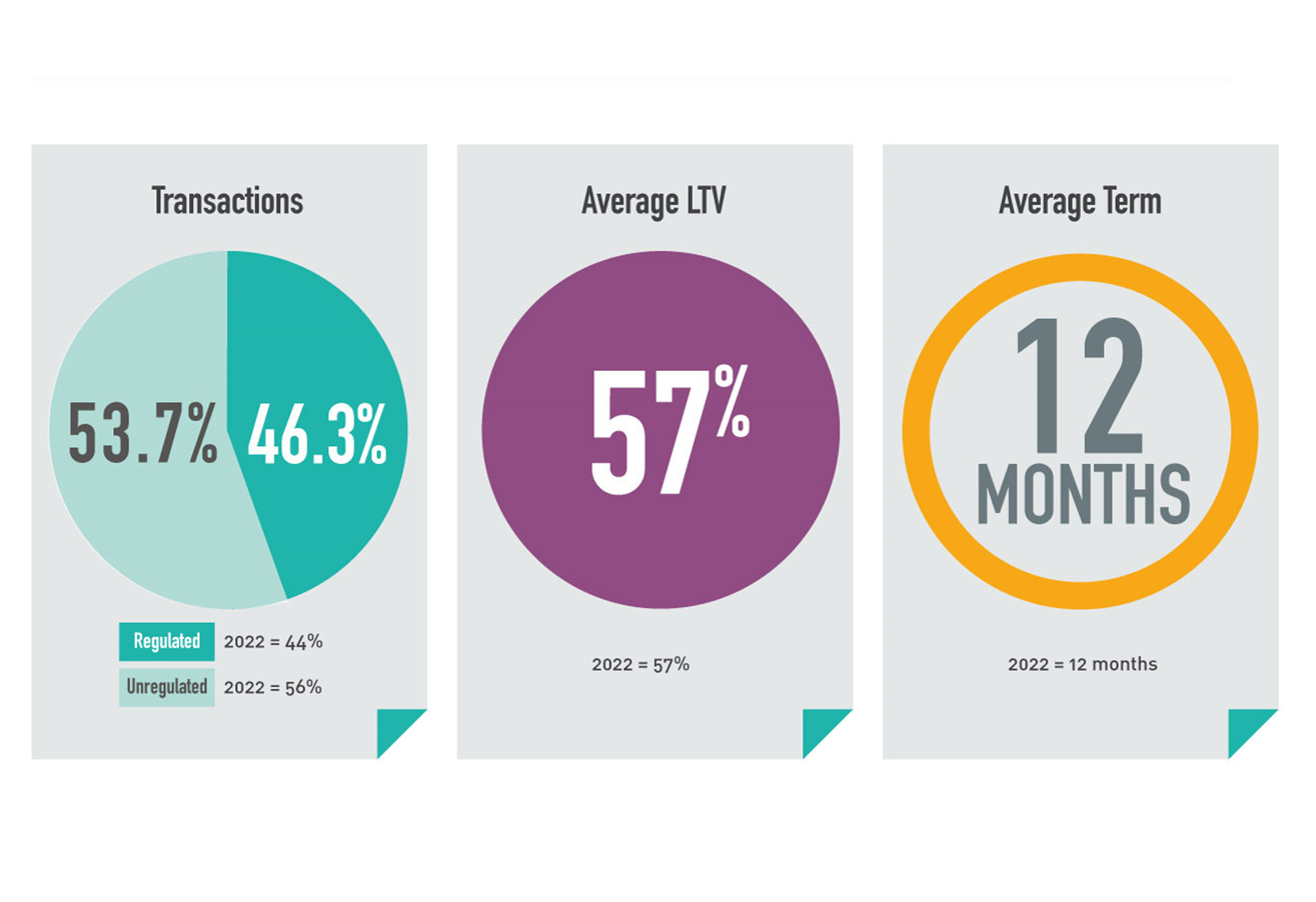

Bridging Trends reveals sector certainty in Q1 2024

-

Maximising rental returns: how specialist finance can help

-

MT Finance celebrates International Women’s Day 2024

-

Annual bridging loan transactions hit record high in 2023

-

We’ve added AVMs to our bridging finance range!

-

Is now a good time to diversify? The pros and cons your clients need to consider