MT Finance launched in 2008 with a clear and simple philosophy: to provide loans quickly and effortlessly and with utmost flexibility – core values we maintain to this day.

We are committed to supporting the UK intermediary community by providing fit-for-purpose specialist funding solutions that meet your client’s needs and have built our reputation around an exceptional service proposition – something we are consistently recognised for within the financial services industry.

BTL Mortgages

Guided by a streamlined process, a hands-on service and a flexible approach, our BTL mortgage products are tailored to suit. We tackle everything with a can-do attitude so if you think your case works on its own merits, chances are, we will too.

Commercial Mortgages

Bridging Loans

When your client needs a bridging loan, they want a fast and stress-free process. By adopting a common-sense and fuss-free approach, we can deliver funds exactly when, and how, they are needed – preventing your client from missing out on time-sensitive opportunities.

Regulated Bridging

Our regulated bridging products are designed to be fit for purpose, with an emphasis on speed and efficiency. By stripping back to the essentials and applying a result-driven mindset, we can quickly meet your client’s residential funding needs.

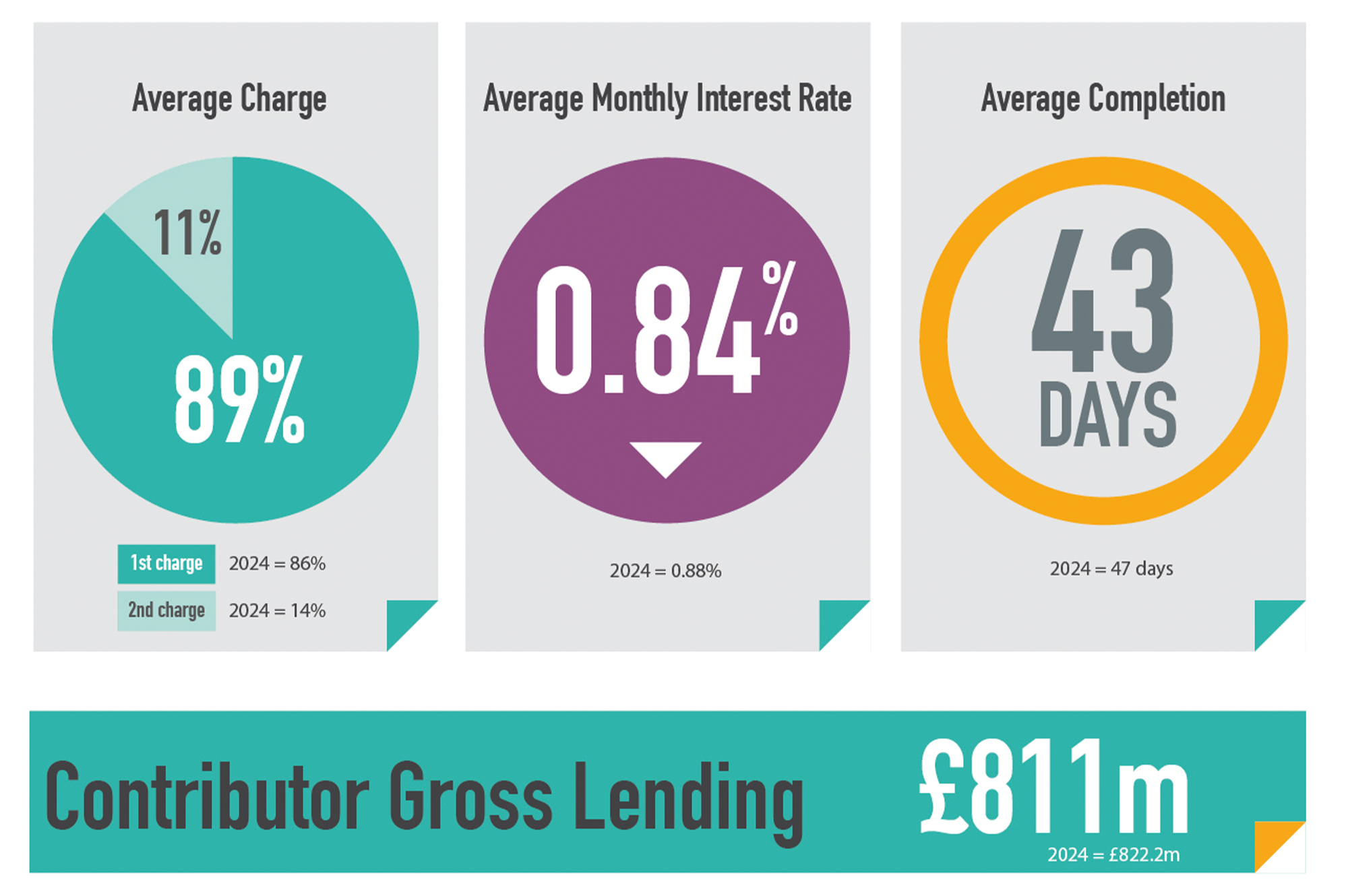

Bridging Trends data for 2025 is live

⚡Bridging speed hit an 8-year low

💰 Average monthly interest fell to 0.84%

💪 Annual contributor gross lending totals £811 million

📈 Investment purchases the number 1 reason for bridging loans

Bridging Finance. Made Simple.

In specialist finance, complexity is unavoidable — but it doesn’t have to slow you down. We simplify regulated and unregulated bridging deals to keep things moving smoothly for you and your clients. Got a case that needs to get over the line?

Meet James Briggs – Our New National Account Manager

Meet James Briggs, our dedicated National Account Manager for the Northern region. With a career spanning 25 years in specialist finance, he is perfectly placed to help you navigate our Commercial and Buy-to-Let offerings. Interested in working with James?

What makes our Commercial Mortgages stand out?

Created to fill a gap in the market, our commercial mortgages have been designed to be different. With a focus on flexibility, clarity, and customer experience, we’ve created commercial mortgage options that stand apart from the crowd. Read our latest blog to find out how they stand out from the rest.