what is stamp duty?

Stamp Duty is a compulsory tax paid upon the purchase of property or land in the UK and Scotland. It is a one-off payment that you have to make within 30 days of completion otherwise you risk being charged a penalty. The payment is always made in full and not in instalments.

For those looking at taking out bridging finance to purchase a new build or fixer upper, it is essential that you incorporate stamp duty into your overall costs.

How much stamp duty will I pay?

The rule of thumb is that the higher the value of your property, the more tax you pay. So you should understand what stamp duty you will be paying when deciding how much you need to borrow.

Prior to 2014, the stamp duty was based on the percentage of your property and this percentage would increase as the value went up. For instance, properties between £125,000 and £250,000 would pay 1% stamp duty and properties between £250,000 and £500,000 would pay 3%.

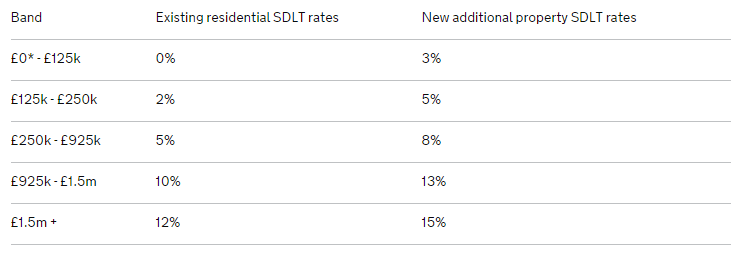

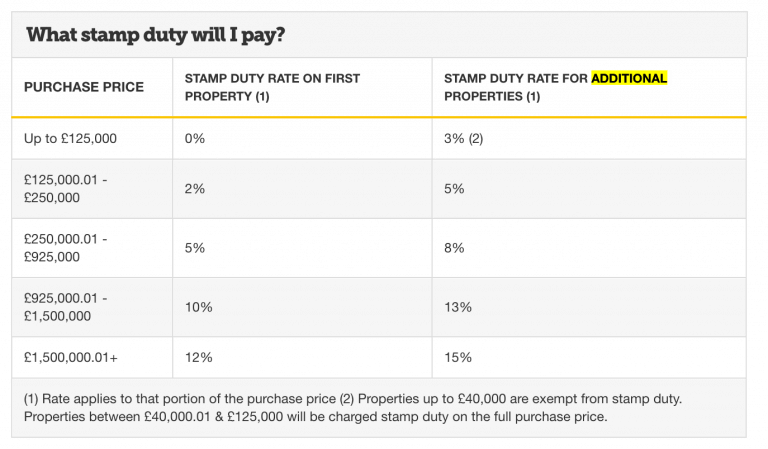

Since the Chancellor’s Autumn Statement in December 2014, the stamp duty charged is now based on a tiered structure meaning that you pay a percentage on every level.

Example: Based on buying a property for £500,000:

Old system:

- 1% on a property between £125,000 and £250,000

- 3% on a property between £250,000 and £500,000

- At £500,000, you would pay 3% which would equal £15,000 in stamp duty

New system:

- You pay nothing below £125,000, which is £0

- You pay 2% between £125,000 and £250,000, which is £2,500 (based on taxable sum of £125,000)

- Then you also pay 5% on the value of the property above £250,000, which is £12,500 (based on taxable sum of £250,000)

So in total this means you’ll pay £15,000 (£0+£2,500+£12,500). Whilst the amount of stamp duty you pay on a £500,000 property is the same as the old system, the new structure is designed to help those looking to purchase properties of lower amounts.

Recent changes to stamp duty tax

In the Chancellor’s budget of November 2017, he declared that there will be no stamp duty charged for first-time buyers looking to buy homes below £300,000. (The Independent) This will give them a saving of £15,000 (5% of £300,000) and certainly help young buyers and new homeowners get on the ladder.

Phillip Hammond also declared that in London and other property hotspots, stamp duty would be axed on the first £300,000 of a purchase price up to £500,000 – a cut of up to £5,000.

How much is stamp duty for additional properties?

If you are a property developer with a portfolio of several properties or looking to get a second mortgage on an addition property, you should be aware that stamp duty applies for an additional property and the rate is higher. In fact, the tax charged can sometimes be as much as double than your first property and the minimum property value where stamp duty becomes applicable is £40,000 compared to £125,000.

This uses the same tiered structure, so based on a property worth £200,000, you will pay a total of £7,500 in stamp duty, based on 3% on the first £125,000 (£3,750) and 5% on the next £75,000 (£3,750).

Source: MoneySavingExpert

How do you pay stamp duty?

The solicitor who handles your mortgage and property purchase will usually be responsible for paying your stamp duty directly. Some solicitors are eager to have your stamp duty payment cleared as soon as possible which is why some will ask for payment upfront, and others prefer to pay after the property has been full completed.

There is also the option to pay for stamp duty yourself without the help of a solicitor. You will need to locate your unique 11-digit reference number (UTRN) which can be found online here or through your stamp duty return. You can pay the amount in full to the HMRC by phone or transfer funds to the specific HMRC back account, quoting your reference.

There are also options to pay by cheque, post or credit card (this will incur a fee). You may be required to present a valid payslip if you wish to pay by cheque or post as verification.

What happens if you do not pay your stamp duty?

Paying stamp duty is compulsory and not paying it within 30 days can lead to a fine. For the first 12 months, your fine will be 10% of the overall sum, capped at £300 and this can increase to 20% after 12 months and 30% for over 24 months. This will not have any impact on you completing on the flat or property.

Payments can take up to 3 days which is why lawyers and solicitors like to proceed early on. If you are making payment yourself, you are recommended to get payment in nice and early to avoid any fines and don’t leave things to the late minute.