stamp duty holiday fuels bridging activity in Q2

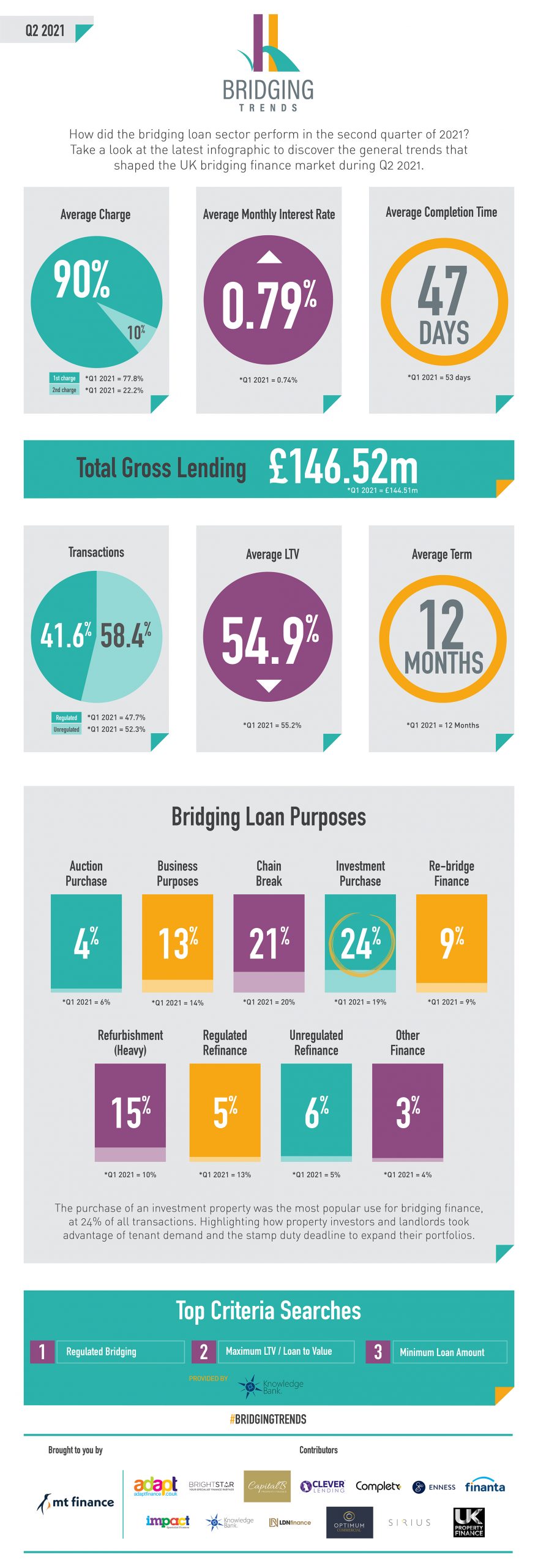

Funding the purchase of an investment property returned as the most popular use for bridging finance in the second quarter, at 24 per cent of all contributor transactions – up from 19 per cent in Q1.

The latest figures from Bridging Trends contributors highlight how property investors and landlords took advantage of tenant demand and the stamp duty holiday deadline at the end of Q2 to expand their portfolios.

First-charge bridging loan applications also soared in the second quarter, again motivated by the desire to take advantage of the full stamp duty holiday. They accounted for 90 per cent of total market volume in Q2, up from 77.8 per cent in Q1.

A traditional chain break was the second most popular use of bridging finance at 20 per cent of transactions, a decrease from 21 per cent in Q1. Meanwhile, demand for regulated refinance saw the biggest change in Q2, dropping to 5 per cent of contributor transactions from 13 per cent in the previous quarter.

The bridging loan market held steady in the second quarter at £146.52 million, a nominal percentage rise on the previous quarter (£144.51m), contributors reported. However, regulated bridging loans transacted by contributors dipped in Q2 – falling from 47.7 per cent to 41.6 per cent.

The average monthly interest rate in Q2 2021 was 0.79 per cent, marginally higher than in Q1 2021 (0.74 per cent). Encouragingly, average loan-to-value (LTV) levels decreased to 54.9 per cent, from 55.2 per cent LTV in Q1, suggesting borrowers are not overstretching themselves.

The average term of a bridging loan was once again 12 months. Bridging loan application processing times reduced significantly as brokers, lenders, surveyors, and solicitor firms all battled to complete property deals before the stamp duty holiday started to taper off. The average completion time on a bridging loan application in the second quarter reduced to 47 days, from a record 53 days in the first quarter. This is the lowest figure recorded since Q2 2019 (44 days).

According to data supplied by Knowledge Bank, the top criteria search made by bridging finance brokers during the second quarter was “regulated bridging”, previously second in Q1. This was followed by “max LTV” and “minimum loan amount.”

As purchases would have been at the top of people’s minds due to the stamp duty saving it’s no surprise to see that first charge lending has significantly increase its share of transactional volumes. It will be interesting to see if this percentage decreases in the coming months as consumers look to raise finance out of existing properties to fund further property acquisitions or businesses.

For more information, visit the Bridging Trends website.