delays biggest challenge for brokers following MCD

Delays to mortgage applications have caused brokers the most difficulty following the implementation of the Mortgage Credit Directive (MCD), according to our latest Broker Sentiment Survey.

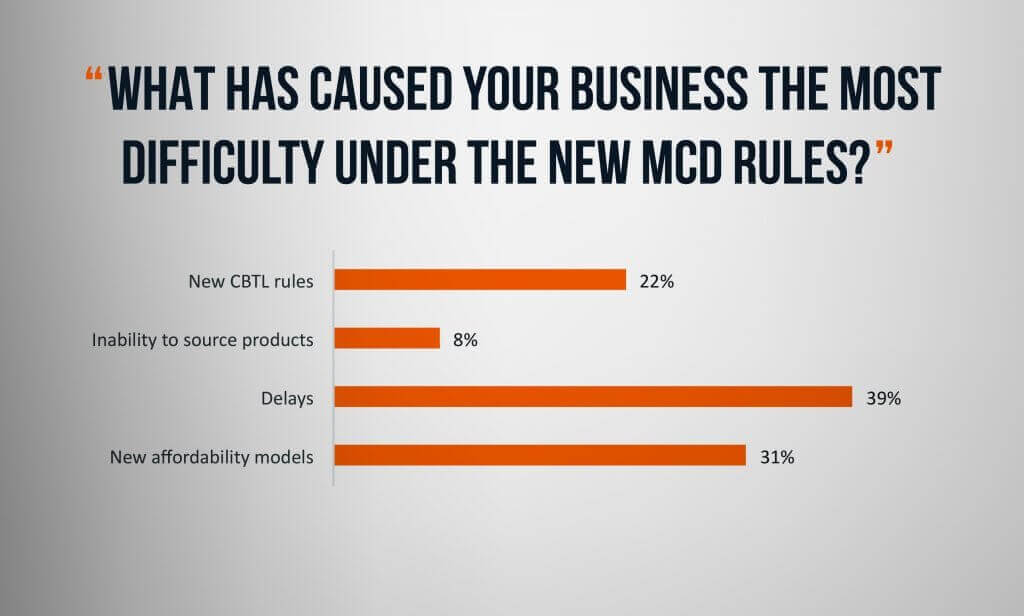

39% of the 101 brokers questioned in the quarterly survey said delays to attaining a mortgage caused the most difficulties since MCD, followed closely by 31% of brokers who blamed complications with new affordability models.

The new MCD rules were implemented by the Financial Conduct Authority (FCA) in March, designed to foster a single market for mortgages and protect consumers.

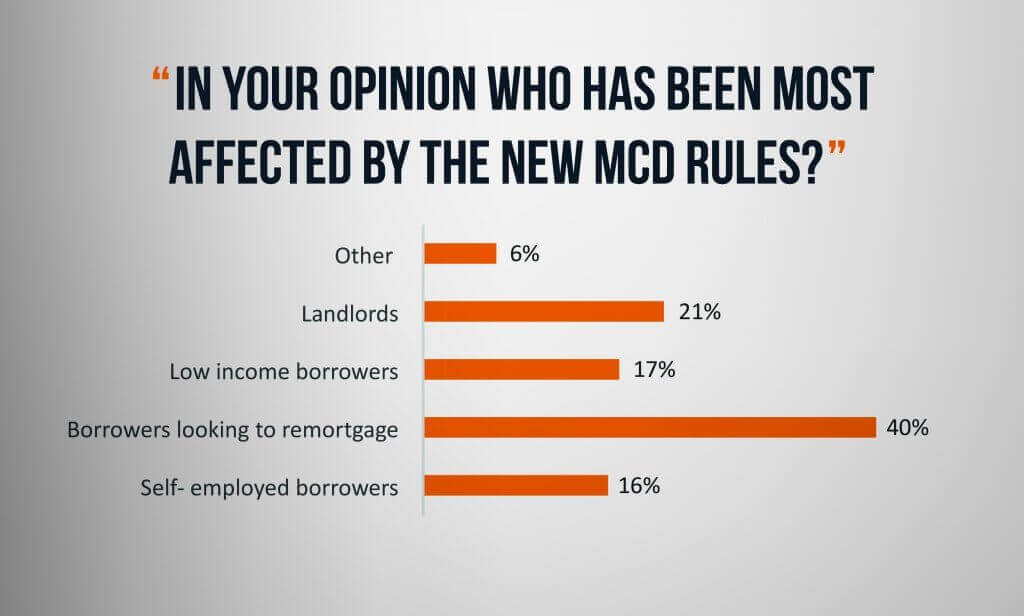

Some 40% of brokers said borrowers looking to remortgage had been most affected by the new MCD rules. The second most affected by MCD were landlords at 21%.

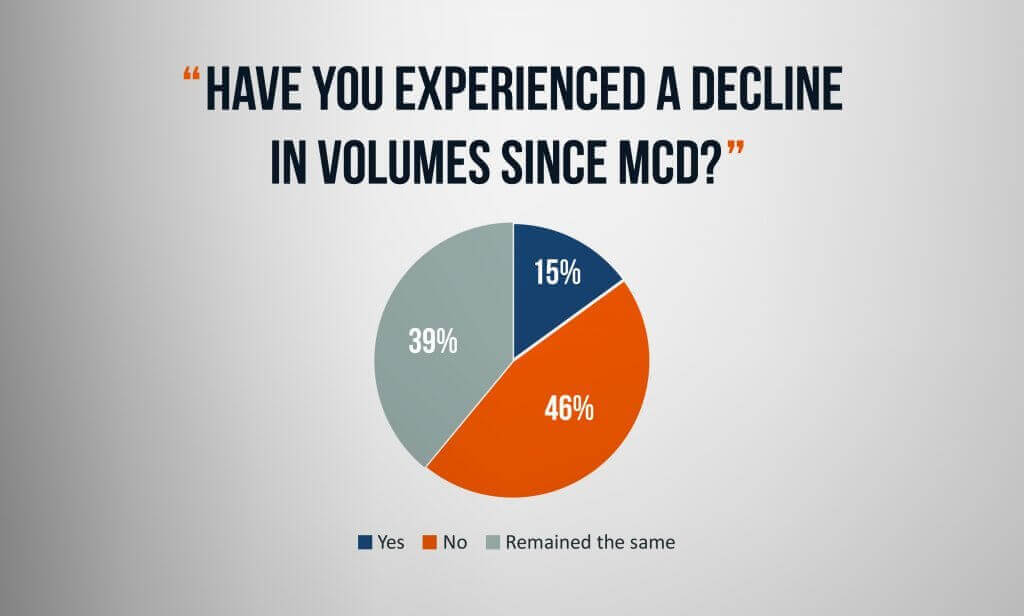

In the run up to MCD, many brokers feared the new rules would lead to a decline in loan volume however, only 15% of brokers surveyed said they had experienced an actual drop in business since it was introduced.

Specifically, 62% of brokers questioned experienced a rise in bridging loan volume in the second quarter of 2016, while 38% said bridging volume remained the same. No one questioned saw a decrease in bridging volume during the quarter.

Development projects were the main reason broker’s clients took out a bridging loan during the second quarter at 42%, followed by mortgage delays at 25% and purchasing an investment property at 16%.

For the sixth consecutive quarter, the South East saw the biggest demand for bridging loans in the UK at 39%, down from 56% in the first quarter of 2016. London saw the second highest demand for bridging loans during Q2 2016, at, 31%- rising significantly from 20% in the previous quarter.

43% of brokers surveyed think the new MCD rules have not improved the market, while 21% said there was an improvement. 36% were undecided.

The results from our survey reflect the introduction of stricter affordability and stress testing, which may be leading to delays on mortgage applications. Equally, the introduction of the Consumer Buy-to-Let has led to a transitional period, during which brokers and borrowers alike become familiar and comfortable with this new regulatory class.

The MCD creates an opportunity and a challenge to both the mainstream and bridging finance markets, which both sectors seem more than well placed to face.

For more information on how a bridging loan could help, call MTF on 0203 051 2331, or fill in our contact form.