BRIDGING TRENDS Q2: bridging market cools in run up to referendum

Demand for bridging loans tapered during the second quarter of 2016 amid Brexit uncertainty, according to the latest Bridging Trends data.

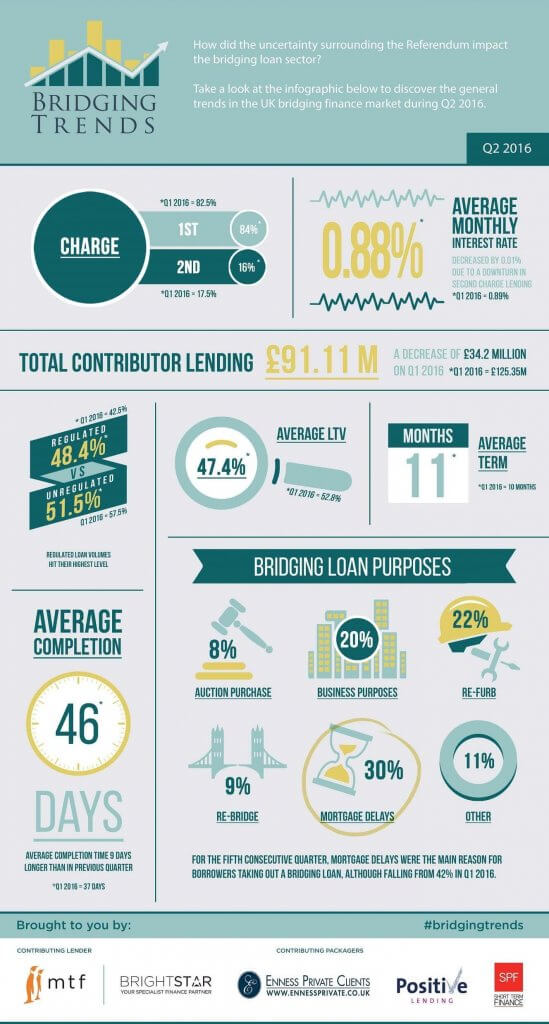

Bridging lending fell to £91.11m in the second quarter, 8% lower than £99.11m during the same quarter of 2015 and a 27.3% decrease on Q1 2016, when lending reached £125.35m, according to contributor data.

Bridging Trends, conducted by bridging lender MTF and specialist finance brokers Brightstar Financial, Enness Private Clients, Positive Lending and SPF, monitors the general trends in the bridging finance market on a quarterly basis.

Uncertainty over Britain’s position in Europe depressed bridging loan volume, as borrowers and lenders took a step back in the run up to the referendum in June.

Bridging loan volume was also impacted by the implementation of the Mortgage Credit Directive (MCD), a new set of rules introduced by the Financial Conduct Authority in March, to foster a single market for mortgages.

Unregulated bridging loans attributed for 51.5% of all contributor lending in Q2 2016, although the number of regulated loans hit a new high of 48.4% since Bridging Trends launched.

Second legal charge lending decreased to 16% of all loans during Q2 2016, from 17.5% in Q1 2016, impacted by the regulatory changes resulting from MCD.

Average Loan-To-Value (LTV) levels fell to 47.4% during Q2 2016 from 52.8% in Q1 2016 and the average completion time on a bridging loan application took 46 days, up from 37 days in Q1 2016, as lenders took a more cautious and conservative approach to lending amid Brexit and MCD.

For the fifth consecutive quarter, mortgage delays was the most popular reason for borrowers accessing a bridging loan, at 30% of all lending.

Refurbishment was the second most popular reason for getting a bridging loan in Q2 at 22% of all lending, followed by business purposes at 20%.

Key data points from Bridging Trends Q2 2016

- Total contributor lending decreased to £91.11m, from £125.35 in Q1 2016 and £99.11 in Q2 2015

- Average completion time increased to 46 days

- Average LTV decreased to 47.4%

- Marginal movement in average monthly interest rates to 0.88%

- First charge bridging loans reached 84%

Uncertainty in the run up to the Referendum seems to have contributed to a cooling off of the market. However, though there was a drop in lending volumes in Q2, the latest data has in fact shown a degree of consistency with the same quarter last year, where lending volumes were only 8% higher at £99.11 million.

Overall, the sector is in good health. Cheaper rates of interest and lower loan to values continue to show that the bridging market is behaving responsibly.