brokers confident post Brexit

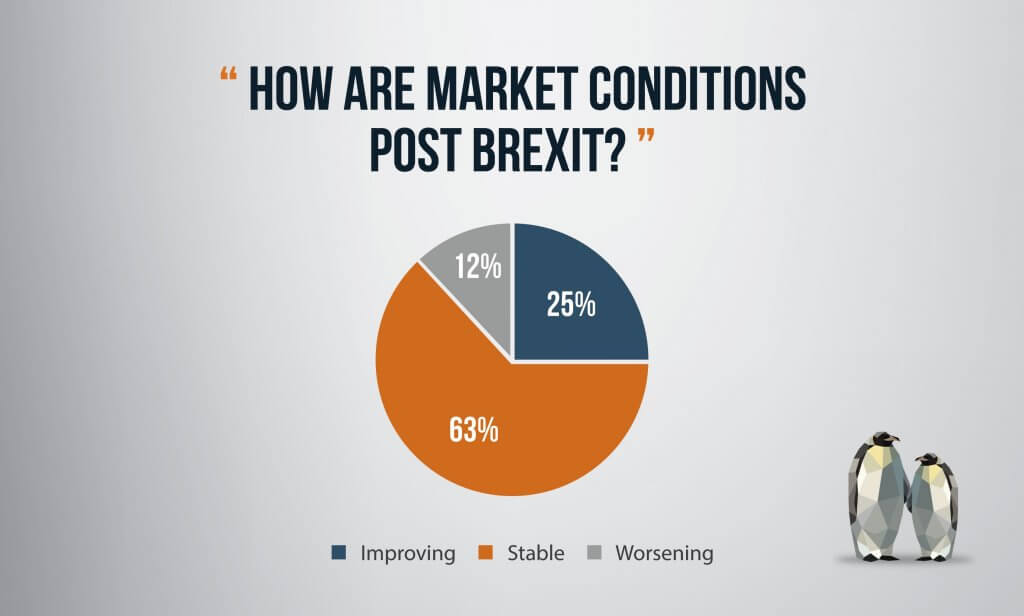

A majority of brokers found market conditions remained stable in the aftermath of Britain’s historic decision to leave the Europe Union, MTF’s most recent survey found. According to our Q3 Broker Sentiment Survey, 63% of the 92 brokers questioned thought market conditions post Brexit remained stable, while a quarter of brokers thought market conditions had actually improved.

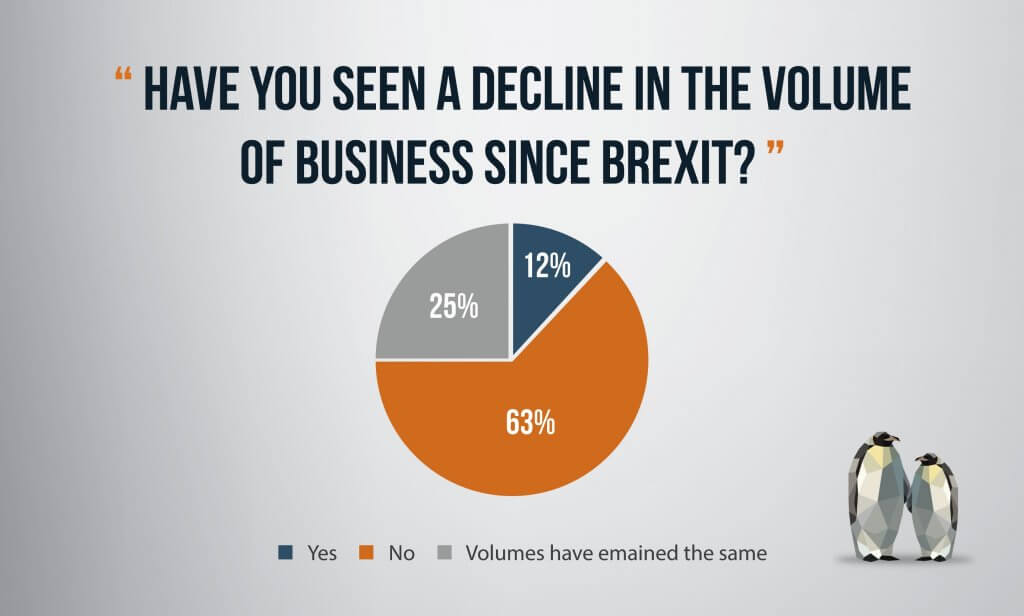

After the referendum result, many brokers feared uncertainty would lead to a decline in business volumes but only 12% of brokers surveyed said they had experienced an actual drop in business since the vote.

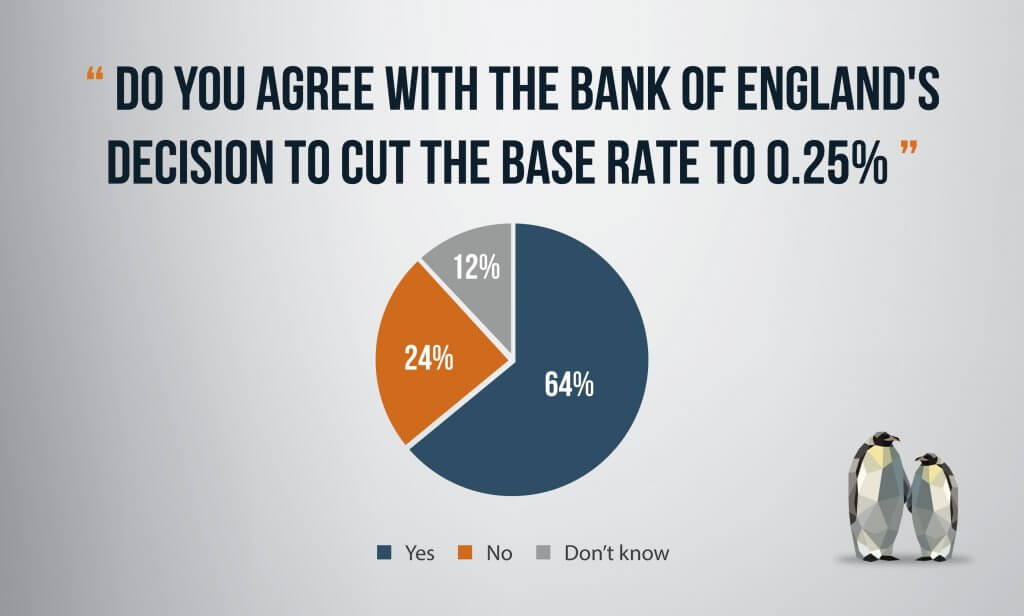

64% of brokers agreed with the Bank of England’s decision to cut the Base Rate to 0.25% to help stimulate the economy following the vote to leave the EU.

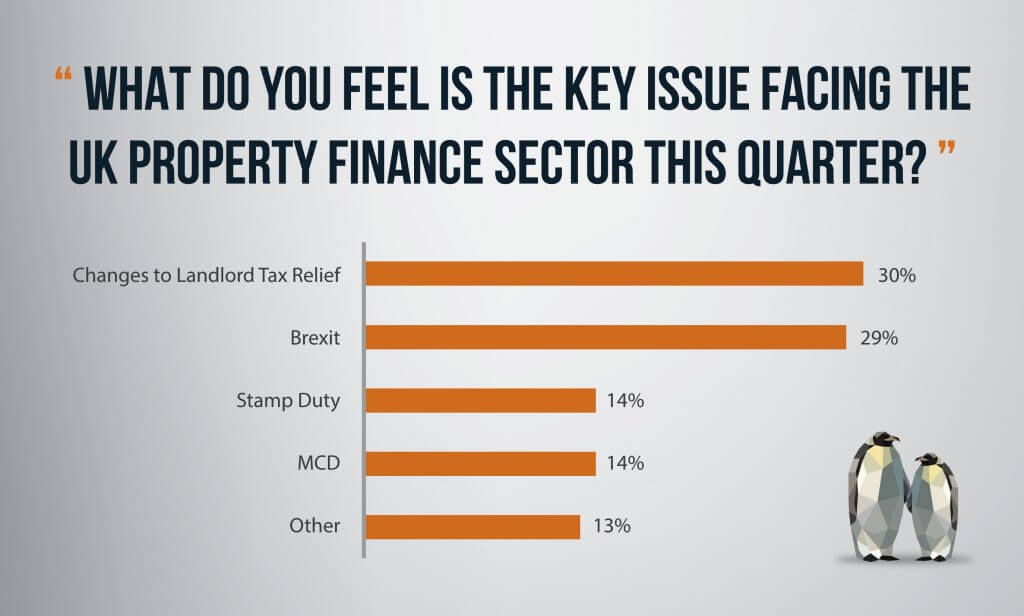

30% of brokers surveyed thought the changes to landlord tax relief was the key issue facing the UK property finance sector, followed closely by Brexit at 29%.

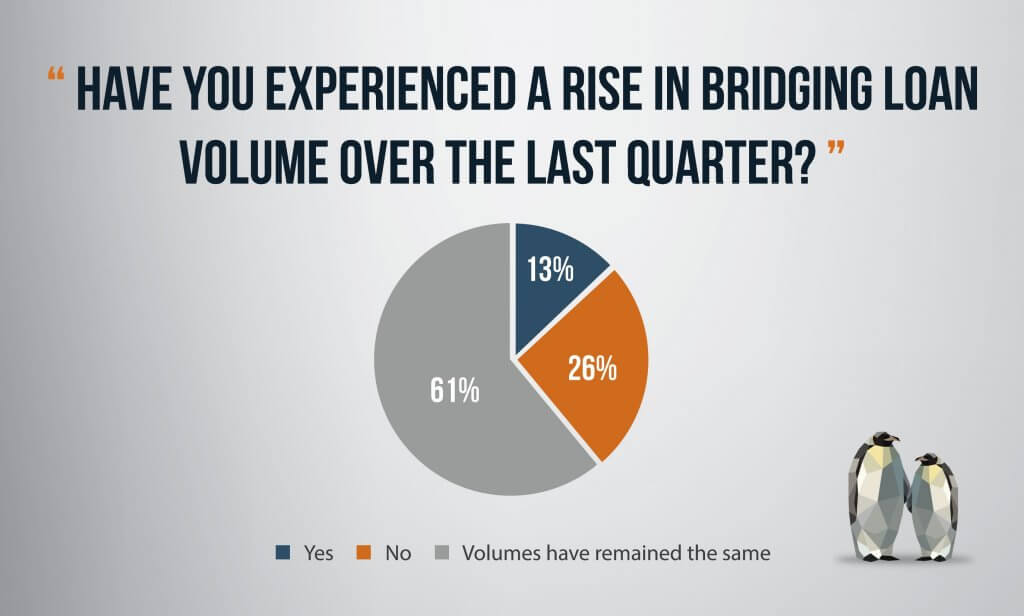

During the third quarter of 2016, 13% of brokers experienced a rise in bridging loan volume, while 61% said it remained the same as the previous quarter.

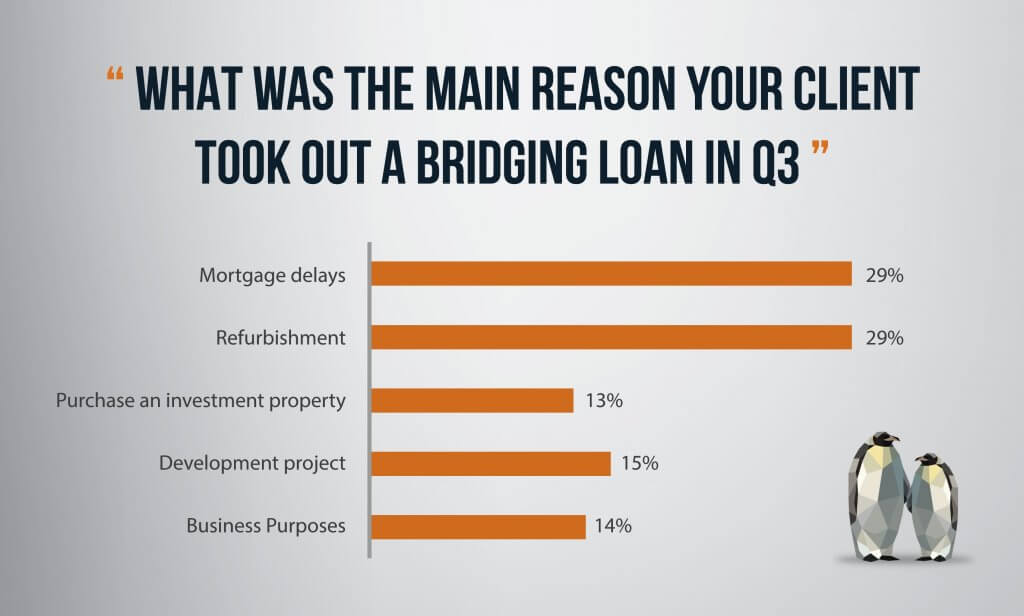

Mortgage delays and refurbishment were the main reasons broker’s clients took out a bridging loan in the third quarter both at 29%, followed by development projects at 15%.

London saw the biggest demand for bridging loans in the UK at 57%, followed by the South East. For the first time, brokers revealed they had experienced most demand for bridging loans in the North West.

The Referendum result certainly caused initial market volatility and perhaps some anxiety for brokers and their clients but the positive news is that for many it is now absolutely business as usual. It is an exciting time in the industry at the moment but the opportunities and challenges ahead will make for an interesting end to a busy year.

For more information on how a bridging loan could help, call MTF on 0203 051 2331, or fill in our contact form.