BRIDGING TRENDS Q3 2016- bridging rebuffs Brexit fears

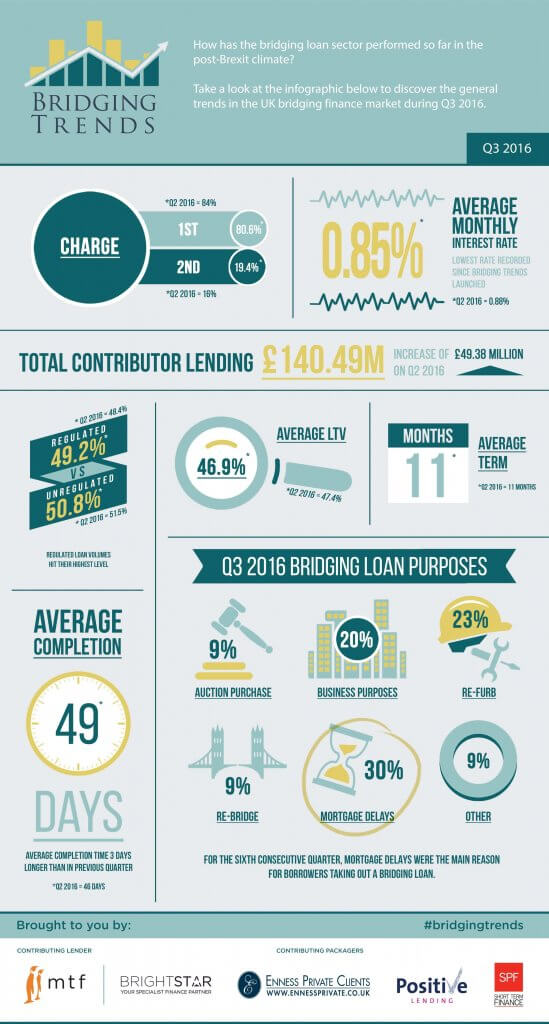

According to the latest data from Bridging Trends, bridging loan volume bounced backed during the third quarter of 2016 peaking at £140.49m, brushing off volatility that had plagued the financial markets from Brexit fears.

Third quarter volume among contributors was 54% higher than £91.11m in the second quarter of 2016, when activity was suppressed by uncertainty surrounding the referendum. The bridging loan market fought back in the third quarter reaching an annual high, with volume 12% higher than £125.3m in Q1 2016 and 6.6% higher than £131.7m during the third quarter of 2015.

Contributor figures demonstrate the strong demand for bridging finance as investors and developers look for quick and accessible alternatives to traditional bank lending in order to take advantage of opportunities on offer.

Second legal charge lending increased to 19.4% of all loans during Q3 2016, from 16% in Q2 2016, despite several lenders temporarily stopping second charge lending following the Brexit decision.

Unregulated bridging loans continued to outperform regulated bridging loans, though the gap between unregulated and regulated bridging lending is starting to close, with the number of regulated loans climbing to 49.2% of all lending.

For the sixth consecutive quarter, mortgage delays were the most popular reason for borrowers to access a bridging loan, coming in at 30% of all bridging volume during Q3 2016, in line with the previous quarter. Refurbishment was the second most popular reason for getting a bridging loan at 23%, following by business purposes at 20%.

Average Loan-To-Value (LTV) levels fell to 46.9% in Q3 from 47.4% in Q2, which could be attributed to a number of specialist first charge lenders removing high LTV products from their ranges.

Average monthly interest rates in bridging fell to a low of 0.85% in the third quarter, dropping from 0.88% in the previous quarter and 0.92% in Q3 2015, as cash-rich lenders competed to put money to work.

Director’s comment

“The figures are very positive with a large increase in the reported levels of lending. We also see a significant increase in the total percentage of the reported lending activity which is regulated. This invariably is attributable to the implementation of the MCD, with its introduction of regulated consumer buy to let lending.

“This larger total percentage of regulated lending appears to have had an adverse impact on the average time a loan takes to complete, and more positively on the average weighted monthly interest rates being charged. The results continue to point to bridging finance as an important financial tool, with demand remaining strong at sensible LTVs.”

View the Bridging Trends Q3 infographic below, or visit www.bridgingtrends.com