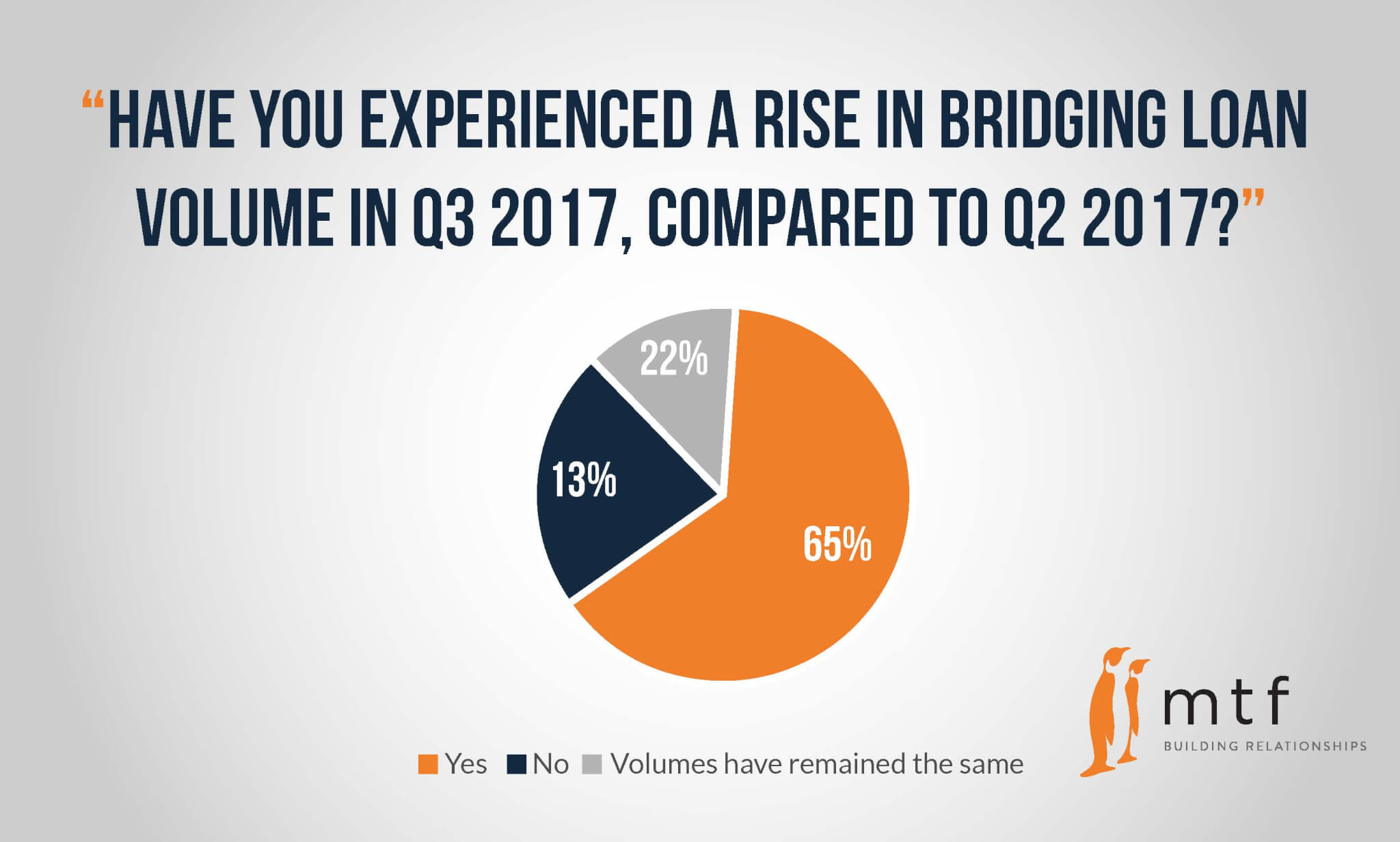

two-thirds of brokers see rise in bridging loan volume

Some 65% of brokers noticed a rise in bridging loan volume in the third quarter of 2017, an increase on 48% in the second quarter, according to our latest Broker Sentiment Survey.

Bridging finance continues to plug a funding gap for borrowers that are struggling to obtain loans from mainstream lenders, which have implemented tougher restrictions.

The geographical spread of bridging loan demand also broadened in the third quarter and for the first time 9% of the 96 brokers surveyed cited an increase in demand in Scotland and Northern Ireland, respectively. For the fourth consecutive quarter, the South East saw the biggest demand for bridging loans in the UK at 48%, although this represented a drop from 62% in Q2. The second highest area of demand was London, at 25%.

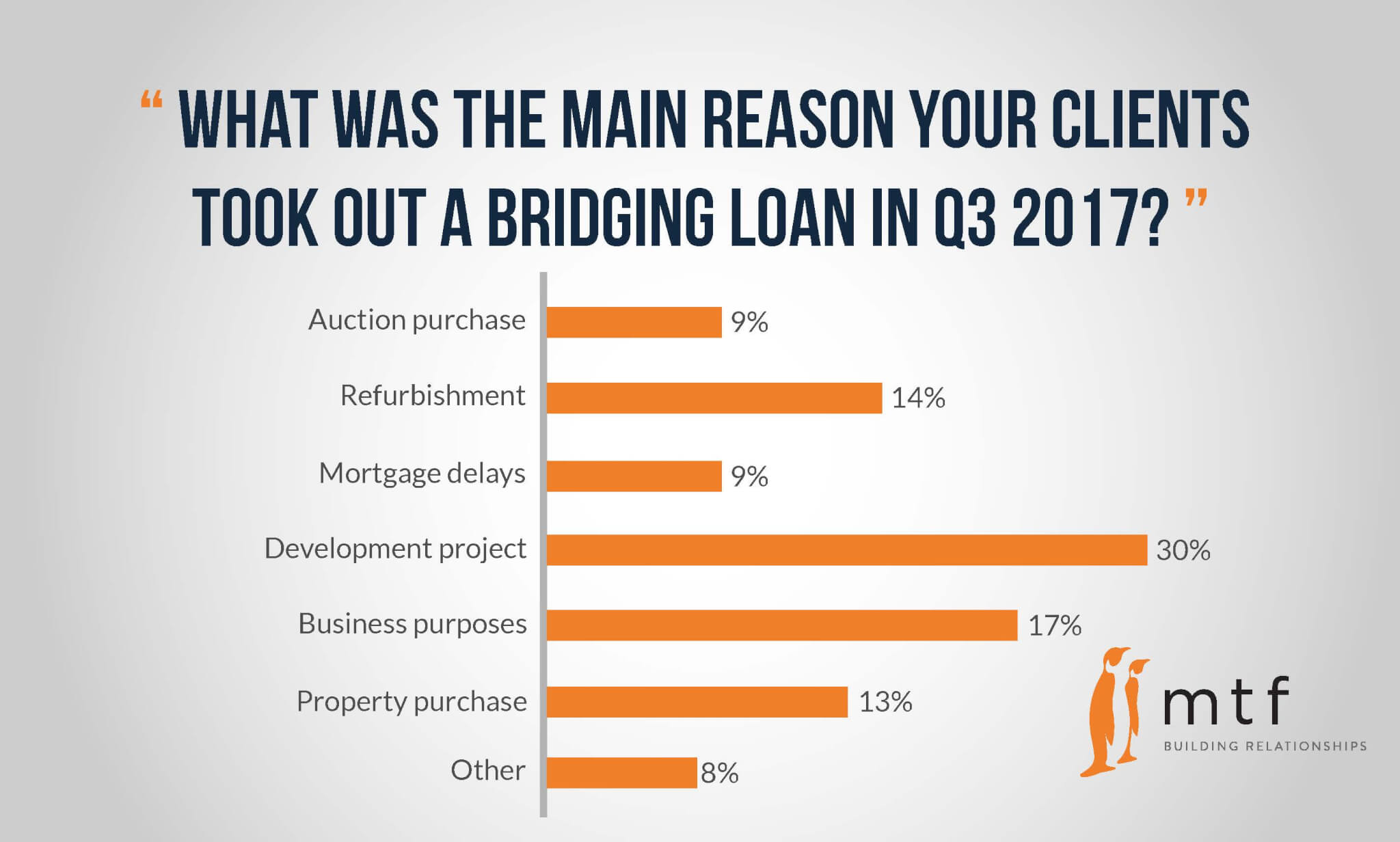

For the fourth consecutive quarter, funding development projects was the most popular reason for taking out a bridging loan at 30%, followed by business purposes at 17% and refurbishment loans at 14%.

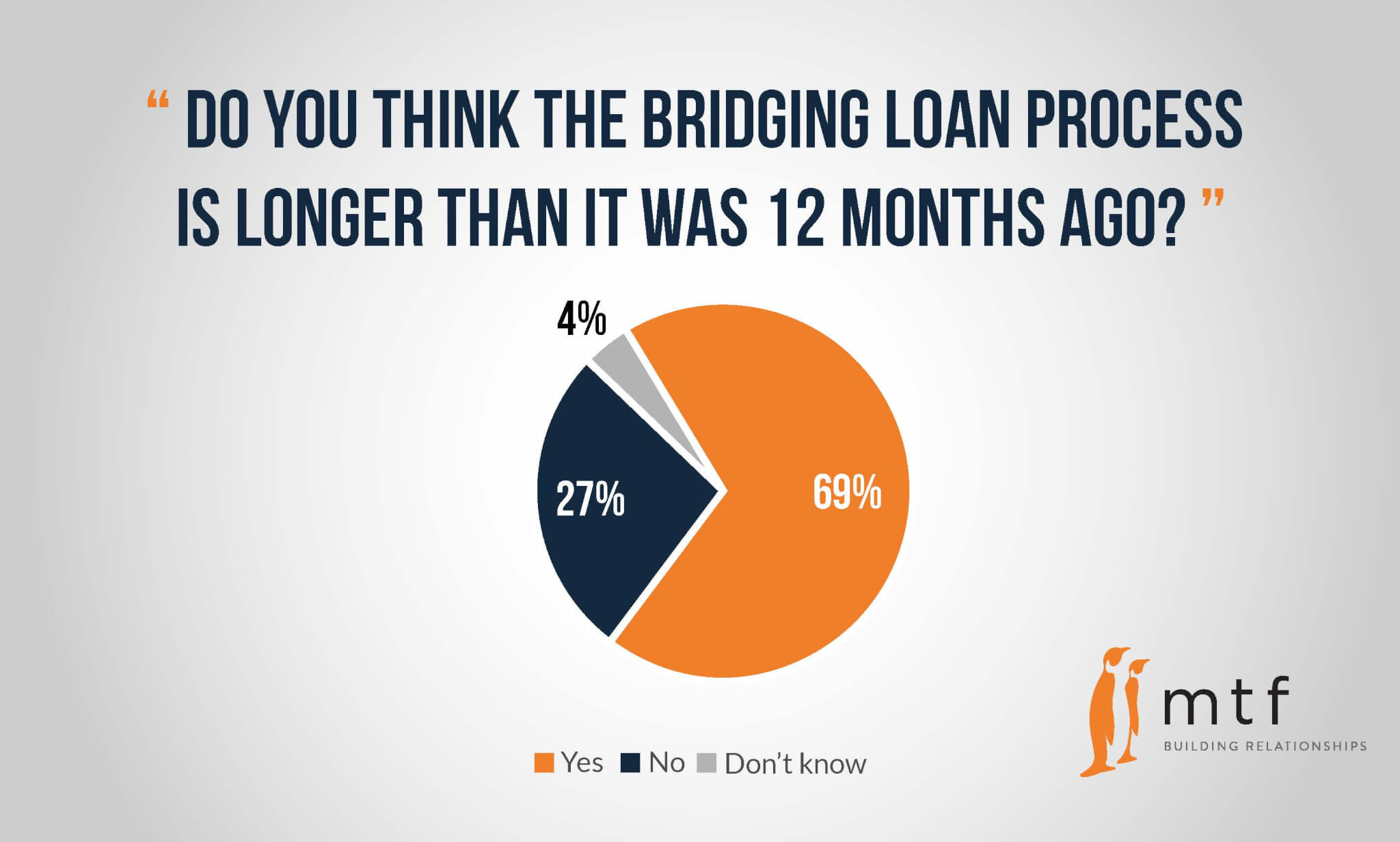

However, some 69% of brokers said the bridging loan process took longer than it was 12 months ago.

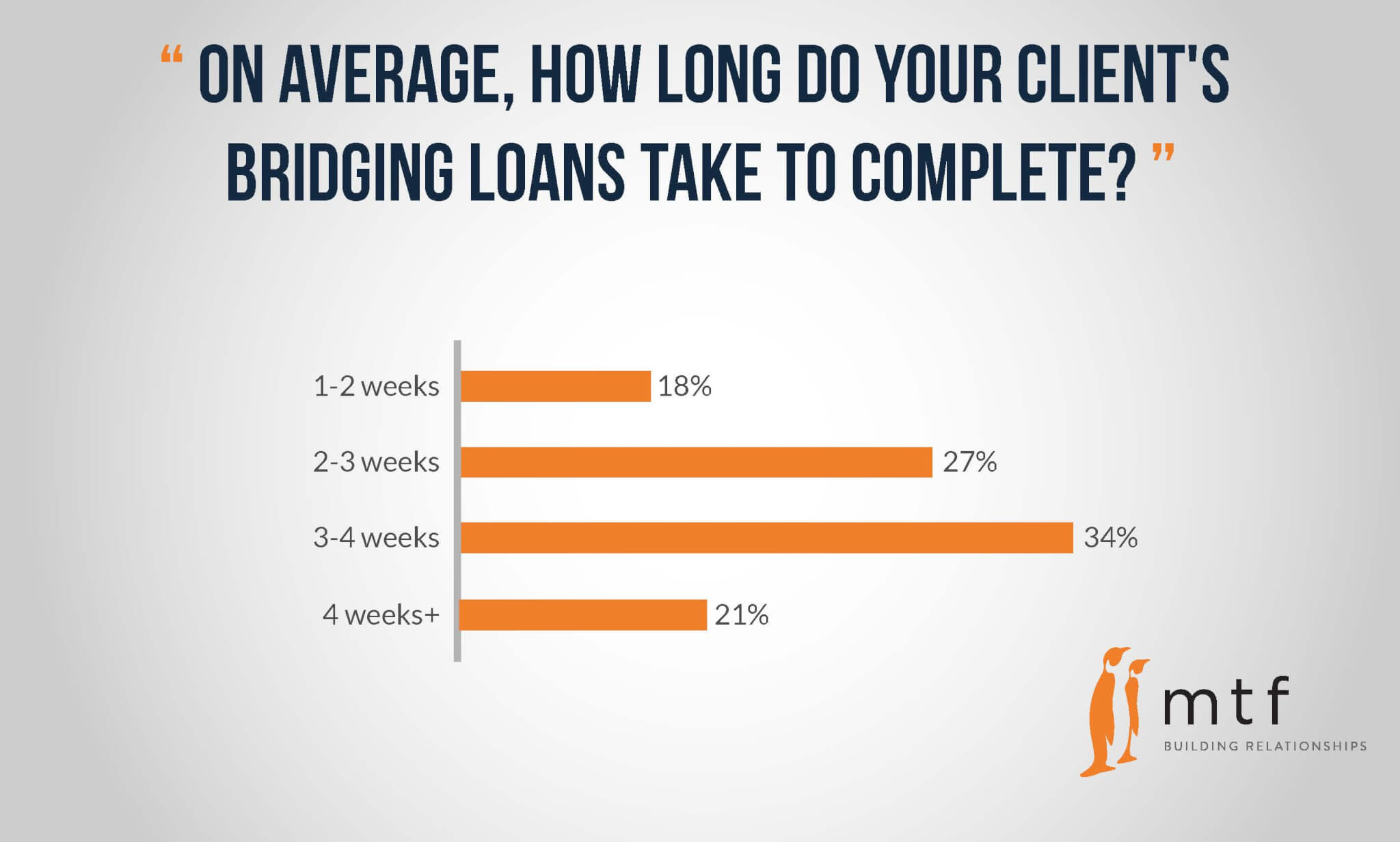

While 45% said it took under three weeks to complete a bridging loan, and 18% cited a mere 1-2 weeks, some 55% said it took in excess of 3 weeks.

34% suggested 3-4 weeks was the average length to complete a bridging loan, while 21% indicated that bridging loan cases generally took more than four weeks to complete.

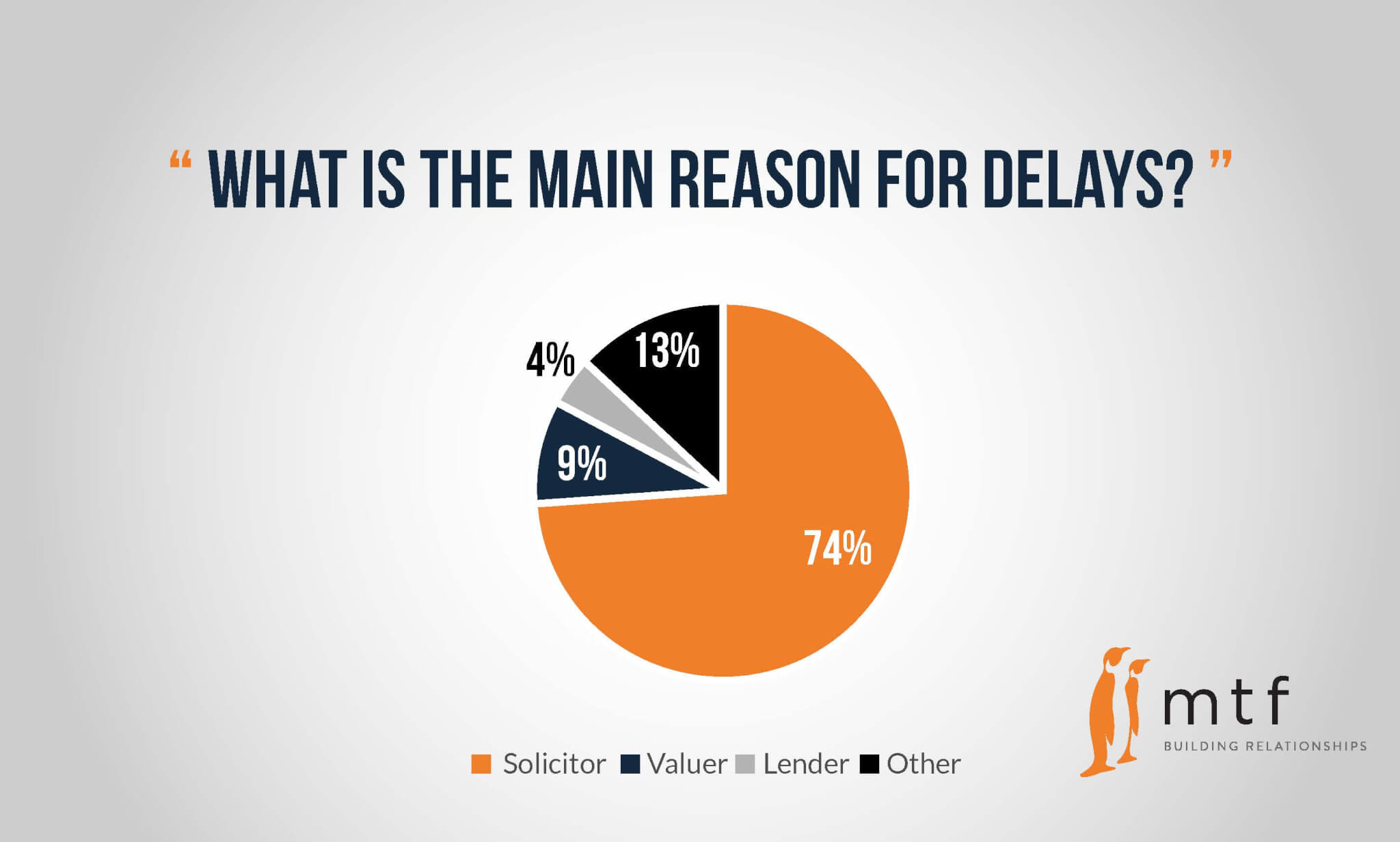

Almost three-quarters of brokers surveyed blamed solicitors as the main reason for delay, followed by the valuer at 13%.

Bridging loans remain an important financial tool for borrowers and demand continues to grow. Speed has always been a vital element in bridging finance and it is important that solicitors understand what is required, so that bridging finance requests can be completed as quickly and accurately as possible.

There are some excellent firms of solicitors to choose from and many bridging loan lenders, like mtf, use a panel of pre-approved firms to help speed up a bridging loan transaction for an applicant.

At mtf, we take a fast, non-status based approach to lending going back to the traditional roots of bridging finance. Our approach is streamlined; no application forms, no upfront fees, offers in principal within 12 hours of enquiry and valuations within 48 hours.

For more information, or to speak to a member of the team, call us on 0203 051 2331.