refurbishment most popular use for bridging loans

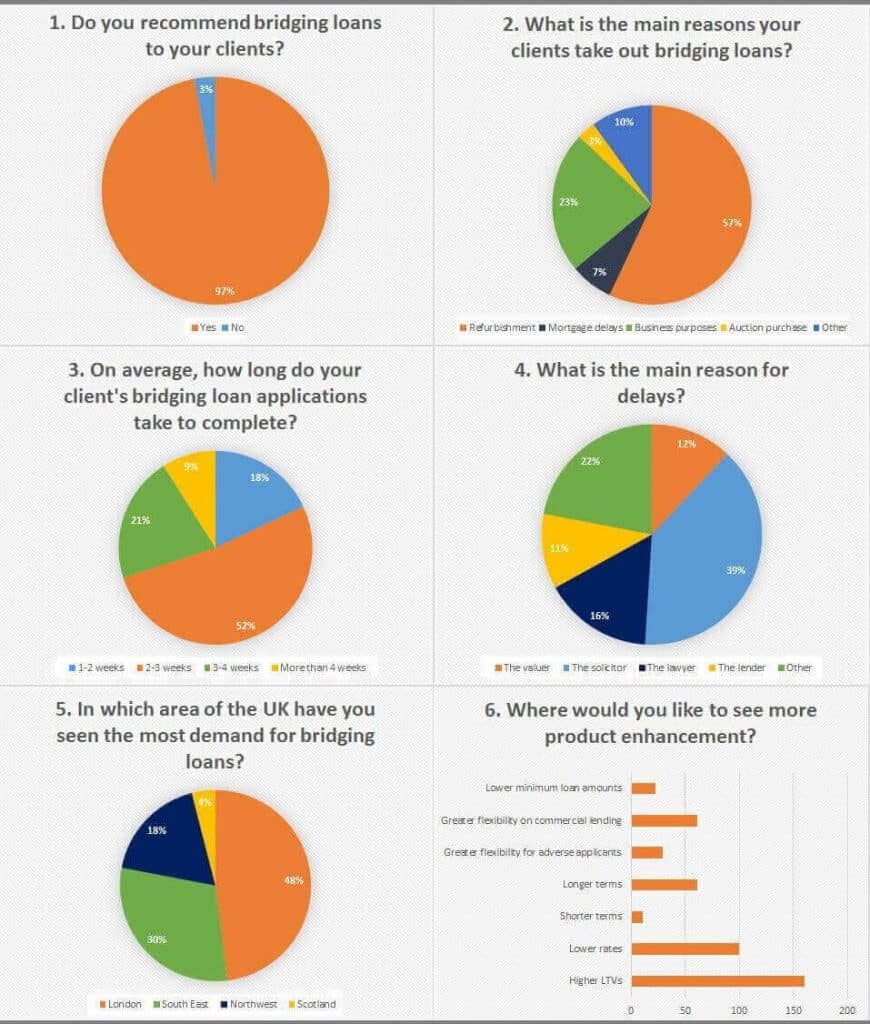

Property refurbishment is the most popular use for bridging finance, according to the latest results from our broker sentiment survey.

57% of the 360 respondents listed refurbishment as the most popular use for bridging loans over the first quarter of this year.

As rising property prices push down rental returns, property investors are increasingly seeking out assets in need of work so they can buy them at a low price, make renovations and sell them on or rent them out at a decent profit. However, with mainstream lenders implementing tougher restrictions, it has been harder for investors to access funds and more are turning to bridging finance to finance these projects as a result.

Figures from our Broker Sentiment Survey also revealed that 39% of brokers blamed solicitors for delays to their client’s bridging loan cases.

Key points of the survey:

- 57% listed refurbishment as the most popular use for bridging loans

- 18% said, on average, bridging loan applications take 1-2 weeks to complete

- 39% blamed solicitors for delays

- Economic adjustments main reason for the increase in demand

MTF Broker Sentiment Survey Q1 2015 Results

The winner of the £50 Amazon vouchers was Tony from Platinum Options. Thank you to all who took the time to complete the survey.