investors tap alternative funds in BTL struggle

Property investors are opting to raise alternative finance after struggling to secure buy-to-let mortgages, according to the results from our latest property Investor Survey.

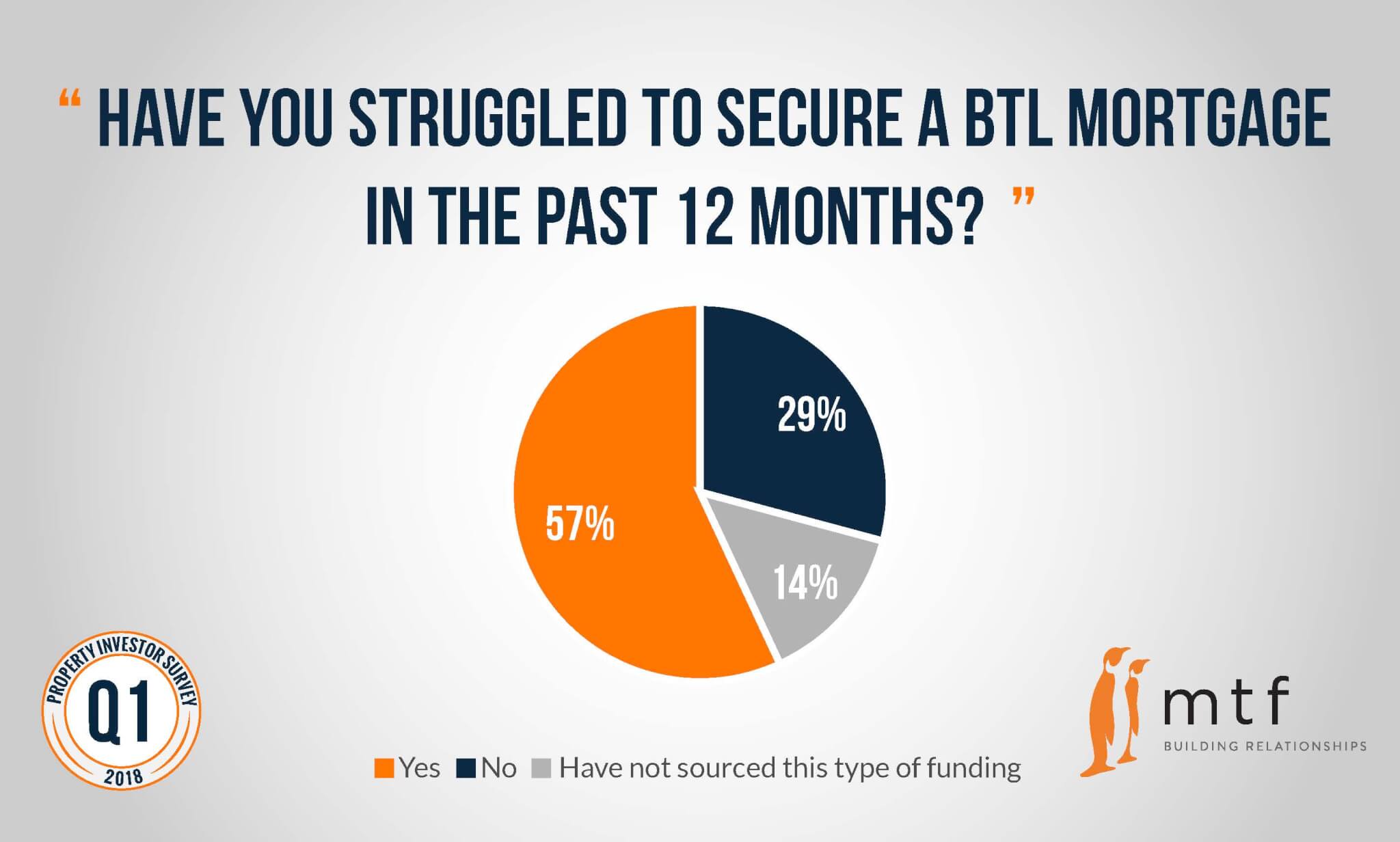

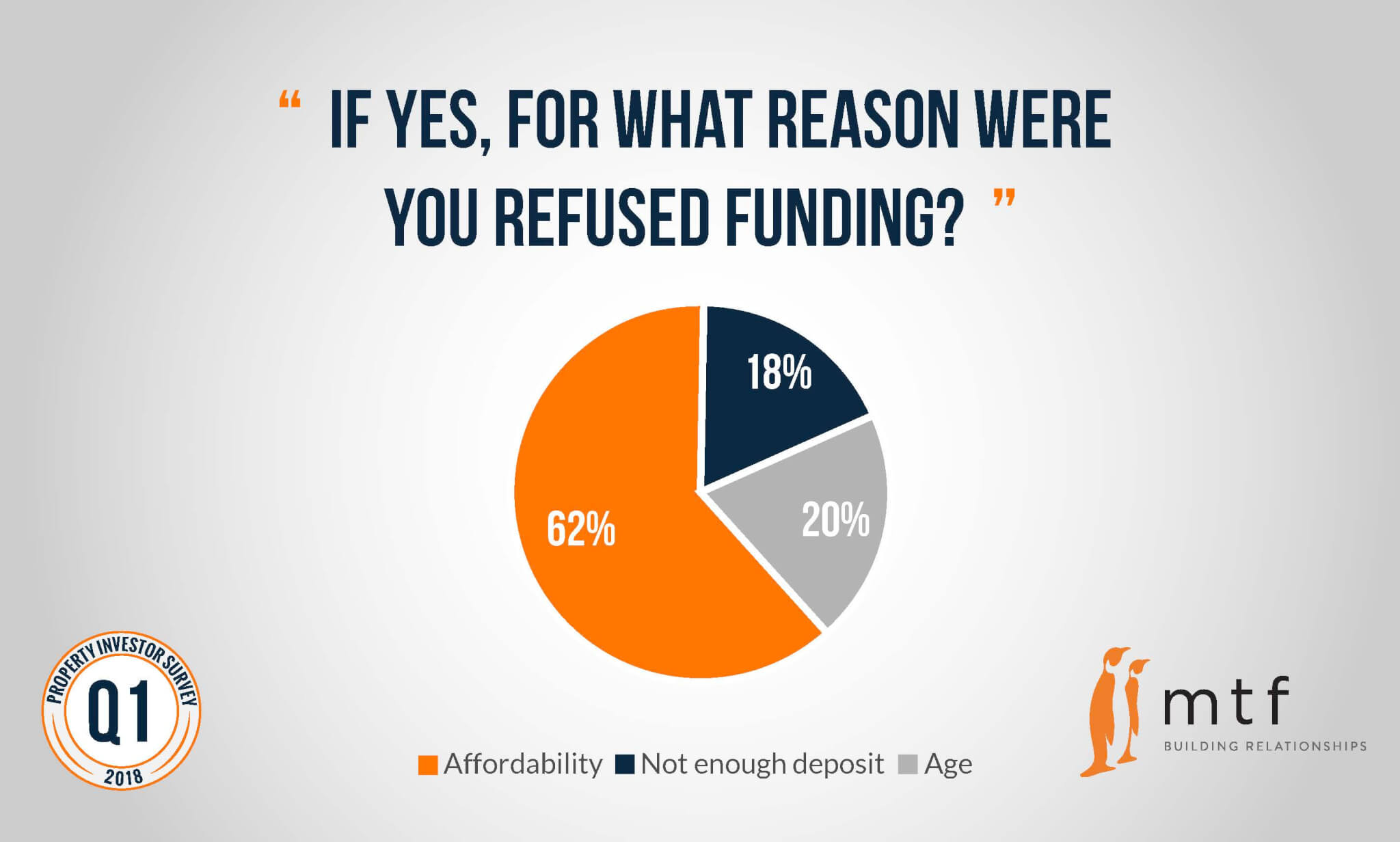

57% of 84 property investors surveyed struggled to secure a BTL mortgage in the past 12 months, with 62% citing affordability criteria as the primary barrier to mainstream funding, followed by age restrictions at 20% and insufficient deposit capital at 18%.

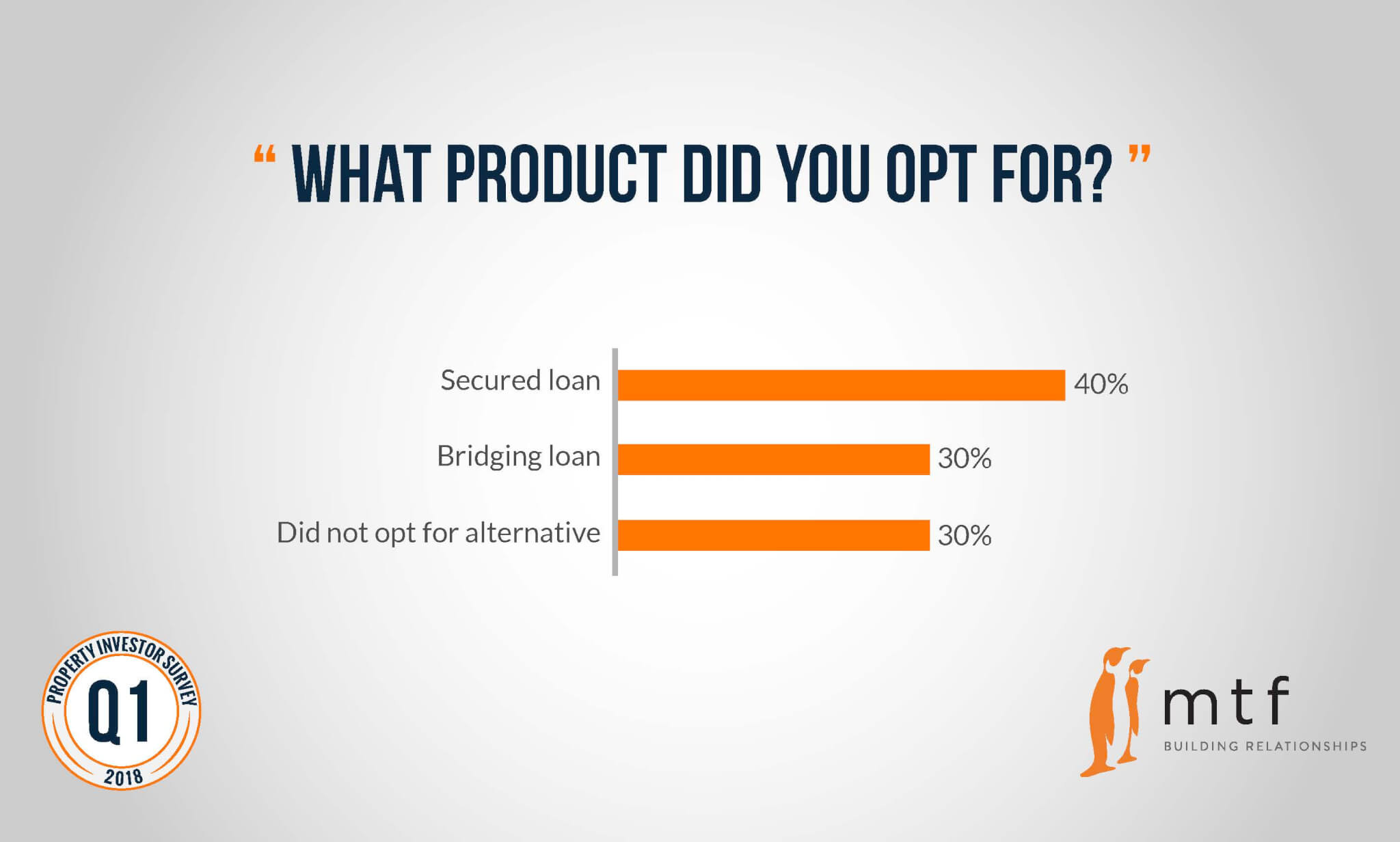

Yet, 43% surveyed filled the funding gap with other sources of liquidity, as 40% of those opted for secured loans and 30% raised bridging finance.

When asked what could mainstream BTL lenders do to improve, 57% of respondents said a more flexible approach to lending was key. 29% said a reduction of processing times would be the best improvement, while 14% said offering better rates would help greatly.

The results from our Q1 Property Investor Survey reflect the impact of stricter affordability and stress testing from lenders on professional property investors’ ability to obtain mainstream funding. However, specialist lenders are stepping in to meet the needs of borrowers and fill the liquidity gap.

For more information on how a short-term loan could help you purchase an investment property, call mtf on 0203 051 2331 or send us a quick enquiry.