investor demand for bridging finance gathers pace

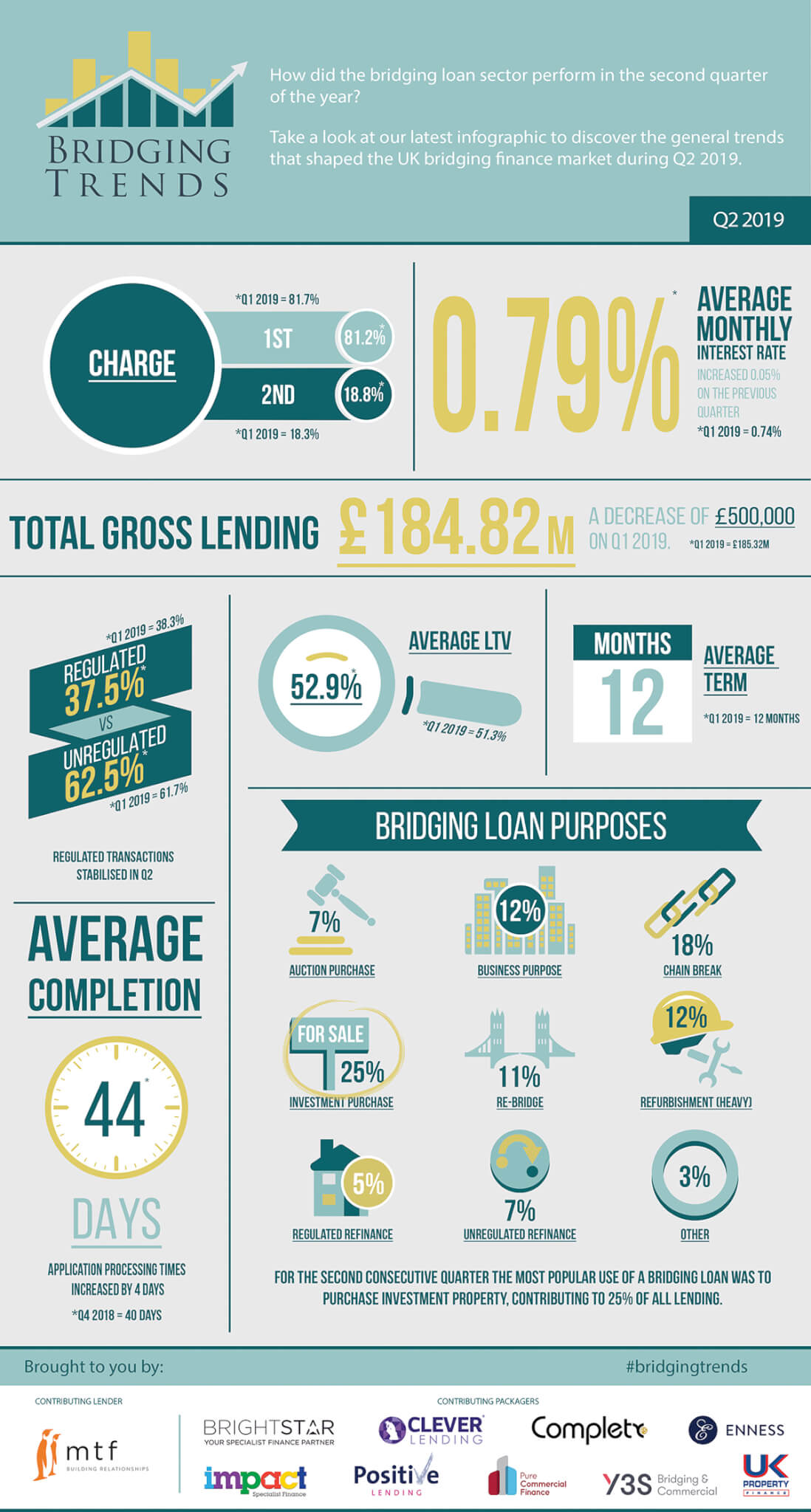

Data from Bridging Trends revealed that for the second consecutive quarter the most popular use of a bridging loan was to purchase investment property, contributing to 25% of all lending in Q2 2019, up from 22% during Q1 2019.

The data highlights how bridging finance has become an increasingly attractive proposition to property investors who are looking to expand their portfolio and need to move swiftly to capitalise on opportunities while property prices are low.

A traditional chain-break was the second most popular use for bridging finance in the second quarter, contributing to 18% of all lending. Meanwhile, bridging loans for business purposes increased to 12%- up from 8% in Q1 2019.

Bridging Trends groups together the figures from lender MT Finance and specialist finance brokers Brightstar Financial, Clever Lending, Complete FS, Enness, Impact Specialist Finance, Positive Lending, Pure Commercial Finance, Y3S, and UK Property Finance.

Data from Bridging Trends confirmed bridging growth stabilised in the second quarter, with bridging loan volume transacted by contributors hitting £184.82 million, a £500,000 decrease on the previous quarter (£185.32m).

Average LTV levels increased by 1.55% in the second quarter to 52.85%. Whilst the average monthly interest rate in Q2 was 0.79%, representing an increase of 0.05% on the previous quarter.

The number of regulated loans transacted by Bridging Trends contributors decreased from 38.3% in Q1 2019, to 37.5% in Q2 2019. However, second charge loan transactions saw a slight increase in Q2, up from 18.3% in the previous quarter, to 18.7%.

For the third consecutive quarter, the average term of a bridging loan remained at 12 months. Whilst the average completion time on a bridging loan application in the second quarter increased by 4 days to 44.

Now that Boris Johnson has been announced as the new PM and has made Brexit top of his to-do list, this should help give the market the certainty it needs. If the rumours of a stamp duty overhaul are true- we expect the change to ease the pressures of regulation and excessive taxation on UK property investors. It will be interesting to see what happens over the coming months, but hopefully the sector can look forward to buoyant growth.

To find out more about Bridging Trends please visit the Bridging Trends website