speedy bridging loans help investors prior to stamp duty rise

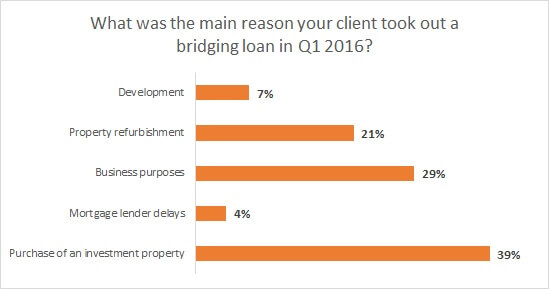

Buying an investment property was the main reason people took out a bridging loan in the first quarter of 2016, according to MTF’s most recent quarterly Broker Sentiment Survey.

Some 39% of the 106 brokers surveyed said the purchase of an investment asset was the main reason their client tapped bridging finance in Q1 2016. Property investors needed fast access to cash in order to complete any purchases before hefty changes to stamp duty land tax kicked in.

A 3% increase in stamp duty on additional properties above £40,000 took effect from April 1 2016, impacting buy-to-let properties and second homes.

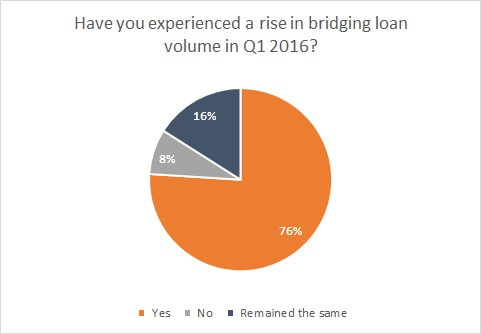

A massive 76% of brokers questioned said they experienced a rise in bridging loan volume during the first quarter, as the financial product is increasingly seen as an important alternative source of liquidity, filling a funding gap left by mainstream lenders under pressure from increased regulation and capital requirements rules.

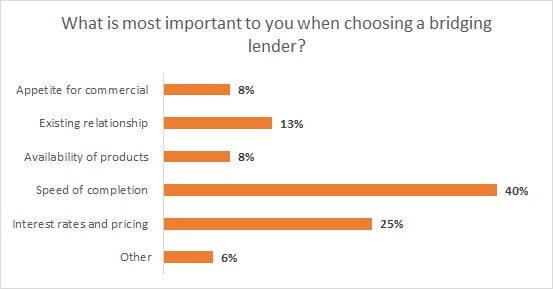

Speed of completion was the most important factor under consideration when choosing a bridging lender according to 40% of the brokers surveyed, followed by interest rates and pricing at 25%.

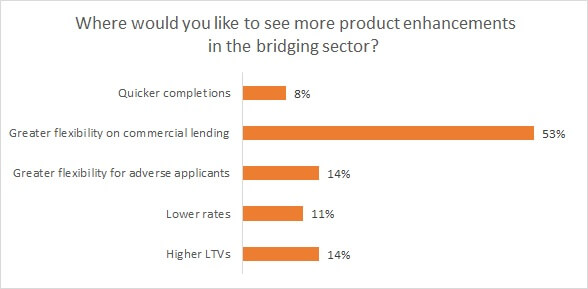

When asked ‘where would you like to see more product enhancements in the bridging finance sector?’ 53% of brokers said they would like greater flexibility from lenders on commercial lending.

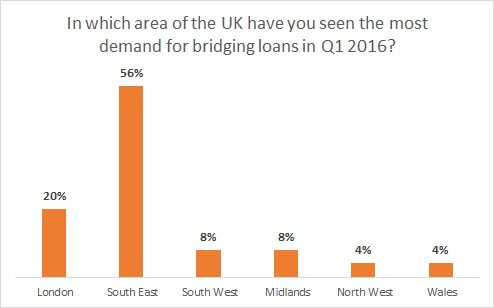

For the fifth consecutive quarter, the South East saw the biggest demand for bridging loans in the UK at 56%, up from 50% in the fourth quarter of 2015. London saw the second highest demand for bridging loans during Q1 2016, at 20%.

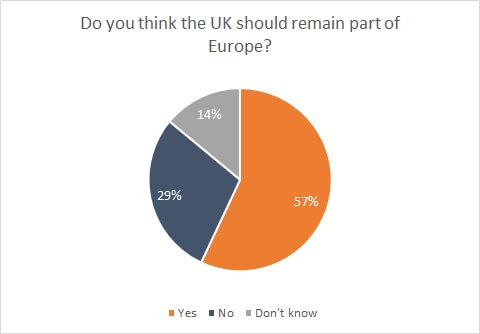

Demand for bridging finance remained strong in the first quarter as people continued to buy properties, despite volatility caused by wider macro events including a potential Brexit.

A majority of brokers surveyed (57%) would like the UK to remain part of the European Union, as opposed to 29% that would support an exit.

The results from our survey highlight how many buyers wanted to complete on investment assets before expensive changes to stamp duty came in. They turned to bridging finance, due to the fast and flexible nature of the product, enabling them to take advantage of opportunities on offer, before putting in place a longer term financing solution.

Due to the speed in which bridging lenders can make decisions and funds can be distributed, bridging finance can offer a practical solution to a plethora of situations including auction purchases, renovations and for business purposes. Despite uncertainty in the wider markets, we expect strong demand for bridging loans to continue.

For more information on how a bridging loan could help, call MTF on 0203 051 2331, or fill in our contact form.