bridging rates fall to new lows as volumes rise

2022 has kicked off to a strong start for the UK bridging loan sector. The latest Bridging Trends figures have revealed a total of £156.78m in bridging loans were transacted by those who contribute to the data*, an annual increase of 8.5% (£144.51m) and up 7.8% on the previous quarter (£145.42m).

This increase was predominantly driven by borrowers turning to bridging finance to help unlock property transactions, allowing them to not only meet deadlines as quickly as possible but also prevent chain break situations.

Bridging loan purposes

For the fourth consecutive quarter, the most popular use of a bridging loan was to purchase an investment property at 26% of all loans. Despite a 3% decrease on the previous quarter the figures show that property investors are still fairly active in the market.

However, it was borrowers trying to get property purchases moving that accounted for the greatest increase in demand for bridging, jumping to 23% of all lending in Q1, from 18% in Q4 2021.

The shortage of suitable housing stock has created more pressure on buyers to complete a purchase efficiently to avoid chains collapsing and naturally borrowers are turning to bridging finance to alleviate this pressure.

Bridging loans for business purposes saw the biggest decrease in demand, falling from 15% to 10%. The current economic circumstances are a likely reason for this with business owners seemingly wary about starting or investing in new ventures amid continued unpredictability.

Rates fall to a historical low

Q1 2022 saw borrowing become cheaper as interest rates fell to a historical low of 0.71%, down from 0.77% in Q4 2021.

This drop in interest rates is mainly attributed to the boost in regulated lending as demand for regulated bridging loans increased for the first time since Q1 2021. The number of regulated bridging loans conducted by contributors increased to 43.9% in Q1 2022, compared with 36% in Q4 2021.

Regulated bridging drives market

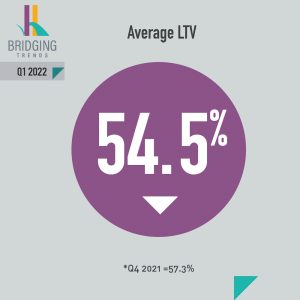

The average loan-to-value (LTV) also decreased in Q1- falling from 57.3% in Q4 2021 to 54.5% in Q1 2022. This was partly fueled by the increase in regulated bridging as these transactions often see unencumbered properties being used to facilitate onward purchases, resulting in a lower LTV and therefore lower interest rates.

Average term & time

As expected, the average term for a bridging loan remained static at 12 months during the first quarter. In terms of speed, it was more positive news with the average completion time on a bridging loan dropping to 53 days, three less than in Q4 2021.

How MT Finance can help

The property world moves fast and so do we. We know that when you need funds to purchase an investment asset, you need the process to be as fast, flexible, and as stress-free as possible. At MT Finance, we make sure you never miss out on an investment opportunity by providing funds with speed and agility.

If you’d like to find out how a bridging loan from MT Finance could help facilitate your urgent property purchases, get in touch with us today.

* Bridging Trends combines bridging loan completions from several specialist finance packagers operating within the UK bridging market: Adapt Finance, Brightstar Financial, Capital B, Clever Lending, Clifton Private Finance, Complete FS, Enness Global, Impact Specialist Finance, LDNfinance, Optimum Commercial, Sirius Group, and UK Property Finance.