bridging lending bounces back after lockdown

The latest data from Bridging Trends has revealed a 46 per cent increase in bridging loan volume in the third quarter of the year, as Covid-19 lockdown restrictions eased.

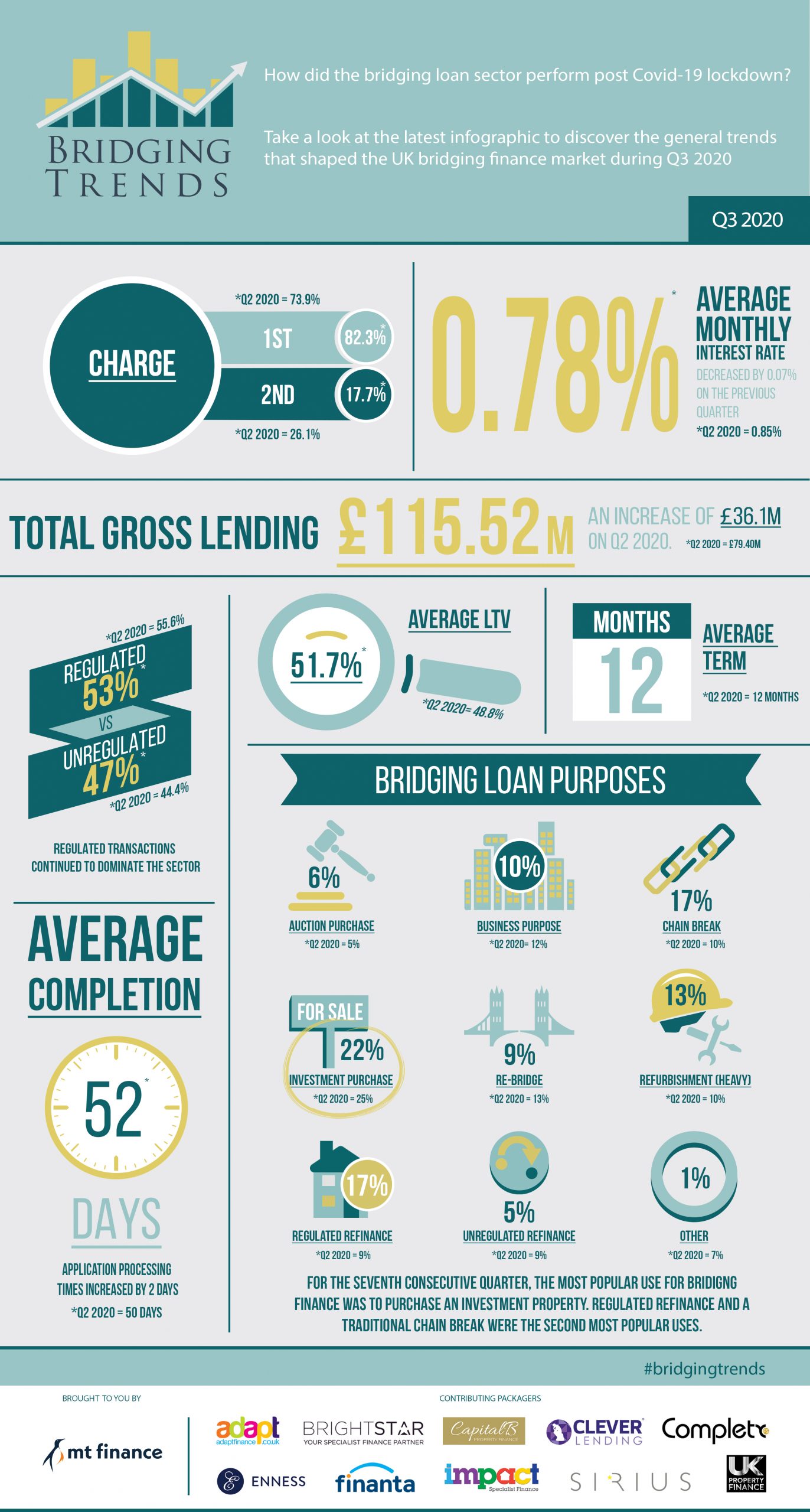

Contributor lending transactions totalled £115.52 million in the third quarter of 2020 and although lending figures were 36 percent below the pre Covid-19 levels of £180.94 million, they had risen significantly (46 per cent) from the £79.4 million of bridging loans transacted in the previous quarter.

Regulated bridging lending continued to dominate the sector in Q3 at an average of 53 per cent of all lending, compared to 47 per cent of unregulated transactions.

The average weighted monthly interest rate in Q3 decreased to 0.78 per cent, from 0.85 per cent in Q2- falling back in line with rates offered before the Covid-19 outbreak (0.75 per cent).

Average LTV levels in the third quarter increased to 51.7 per cent, from 48.8 per cent in Q2. This is likely attributed to borrowers turning to bridging finance as mainstream lenders continue to tighten their maximum LTV restrictions.

Demand for second charge lending dropped significantly, accounting for an average of 17.7 per cent of total market volume in Q3 – down from 26.1 per cent in Q2.

For the eighth consecutive quarter, the average term of a bridging loan remained at 12 months.

The average completion time of a bridging loan increased in Q3, with average processing times increasing to 52 days, from 50 days in the previous quarter. This could be attributed to operational capacity issues.

For the seventh consecutive quarter, the most popular use of a bridging loan was to purchase investment property. 22 per cent of all lending transacted by the report’s contributors in Q3 was for investment purchase purposes, dropping slightly from 25 per cent during Q2 2020.

Both regulated refinance and a traditional chain break were the second most popular uses for bridging finance, contributing to 17 per cent of all lending in Q3. Demand for regulated refinance increased by 8 per cent and chain break by 7 per cent.

The stamp duty holiday and rising house prices has ensured that the market remains busy and it has been well publicised that the mortgage market is currently feeling the strain when it comes to delivering acceptable processing turnaround times, which can add to an already stressful experience. Luckily, bridging finance is a useful tool for brokers to help unlock a transaction for a client allowing them to meet deadlines.

Given the stress on a chain, presented by the slow processing times, it is unsurprising to see more clients turning to regulated bridging finance to support their purchases.

Bridging Trends is a quarterly publication developed by short-term finance lender, MT Finance and covers data gathered from several specialist packagers operating within the UK bridging market: Adapt Finance, Brightstar Financial, Capital B, Clever Lending, Complete FS, Enness, Finanta, Impact Specialist Finance, Sirius Group, and UK Property Finance.

To find out how MT Finance could help you with your urgent property transactions, contact one of our short-term loan experts on 0203 051 2331 or fill in our contact form and someone will be in touch with you shortly.