bridging activity rises to highest-ever figure

After a year of many twists and turns, the latest Bridging Trends figures have been released and show that a total of £214.7m in bridging loans was transacted during the third quarter of 2022 by those who contribute to the data*. This is a record high and a 20% increase on Q2’s figure of £178.4m.

interest rates start to rise

After two quarters of falling interest rates, they began to increase slightly in Q3, rising to 0.73%. which was up from 0.69% in Q2 but almost on par with Q3 2021, which came in at 0.72%.

Reasons for this rise are varied. Not only have the Bank of England base rates increased, as has the cost of borrowing across the financial services industry, but the average loan-to-value also rose. Often linked to higher interest rates, the average LTV was 59.6% in Q3, up from 56.1% in Q2.

chain breaks drive bridging activity

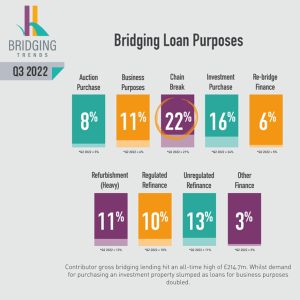

Despite being the most popular use of a bridging loan for five consecutive quarters, purchasing an investment property fell from 24% in Q2 to 16% in Q3. This drop could have been down to an increased amount of caution amidst the current climate.

Funding a chain break drove the most amount of bridging transactions and accounted for a total of 22% in Q3, up from 21% in Q2. It is likely too early for this to be linked to the mortgage fallout from September’s mini-Budget but we will certainly be keeping an eye on the next few quarters.

The product which saw the biggest increase was business purposes which nearly doubled, rising from 6% in Q2 to 11% in this quarter. Purchasing a property at auction also jumped in the third quarter, from 5% in Q2 to 8%.

demand continues for regulated bridging

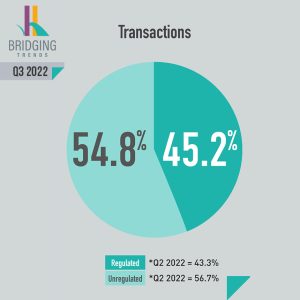

We have seen regulated bridging retain its popularity in recent quarters and Q3 was no different, with it accounting for 45.2% of the market share, up from 43.3% in Q2. This is the highest percentage in regulated bridging transactions since Q1 2021 when we were in the midst of the stamp duty holiday.

how MT Finance can help

MT Finance remains committed to supporting the landlord and investor community. If you would like to find out more about our bridging loans or a particular product then we can be contacted via email, online or on 0203 051 2331.

* Bridging Trends combines bridging loan completions from several specialist finance packagers operating within the UK bridging market: Adapt Finance, Brightstar Financial, Capital B, Clever Lending, Clifton Private Finance, Complete FS, Enness Global, Impact Specialist Finance, LDNfinance, Optimum Commercial, Sirius Group, and UK Property Finance.