borrowers struggle to secure BTL mortgages

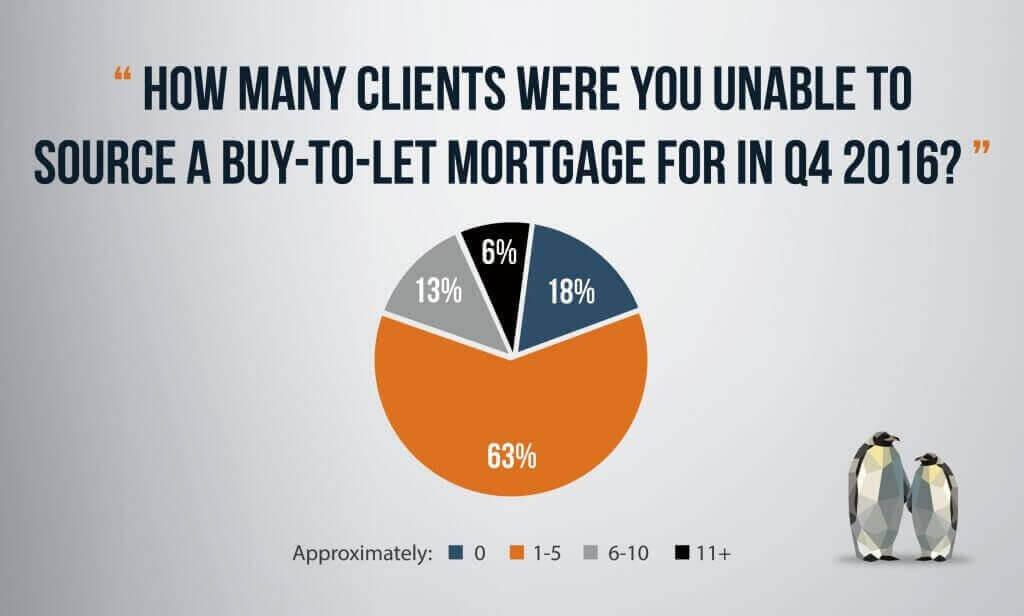

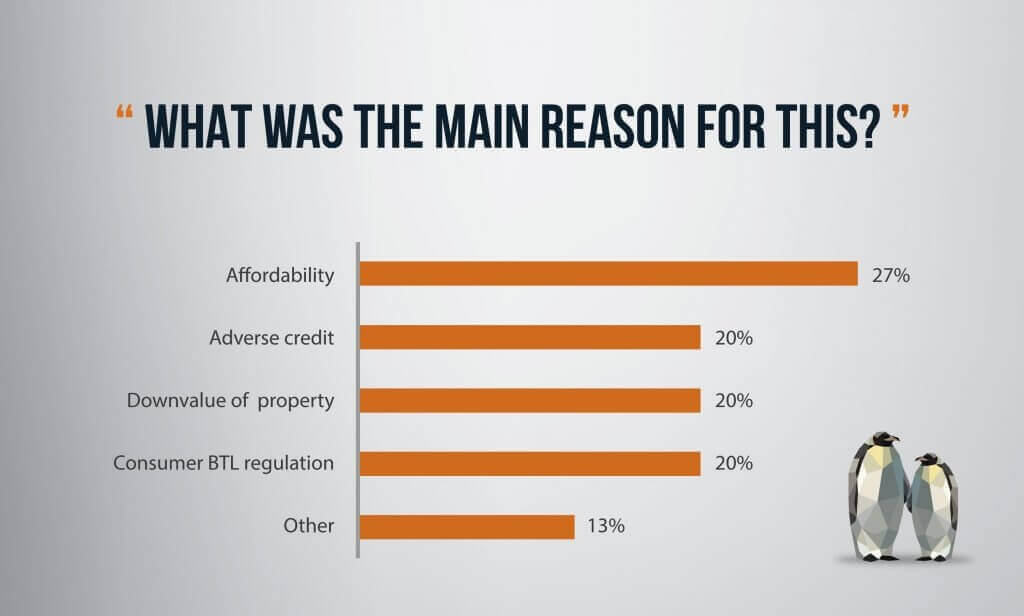

According to our latest Broker Sentiment Survey, 84% of brokers revealed they were unable to source a buy-to-let mortgage for some of their clients in Q4 of last year, with over a quarter (27%) attributing affordability as the main barrier.

20% of the brokers surveyed said they were unable to get buy-to-let mortgages for clients with adverse credit and equally, 20% blamed consumer buy-to-let regulations.

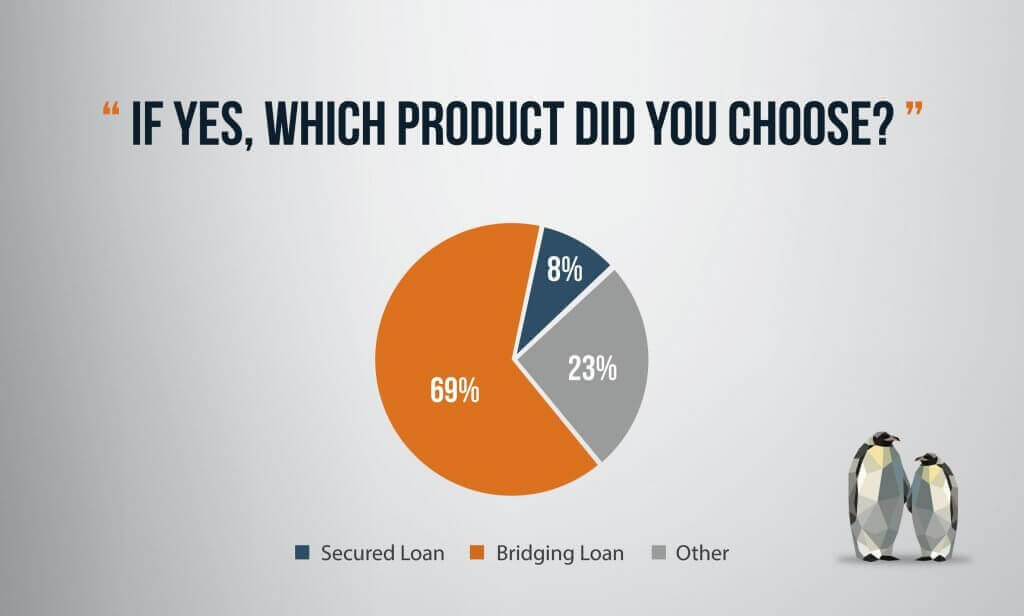

69% of brokers said they opted for bridging finance after being unable to raise a buy-to-let mortgage for their clients in instances where time is of the essence. Some 8% of brokers opted for secured loans as an alternative.

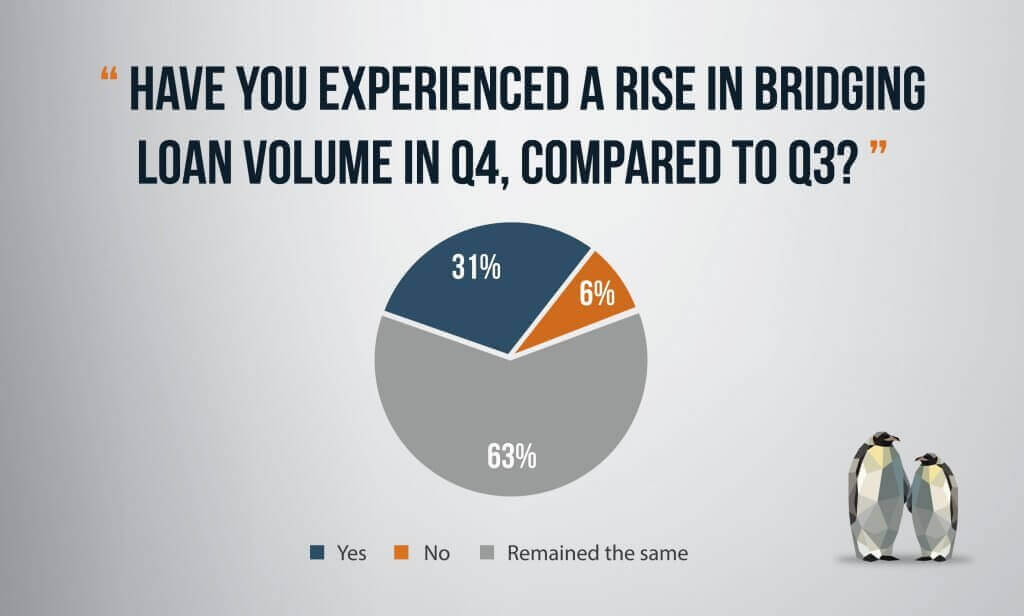

Bridging finance had a good fourth quarter, with 31% of brokers noticing a rise in bridging loan volume, up from 13% in the previous quarter. The South East saw the biggest demand for bridging loans in the UK at 50%, up from 29% in Q3.

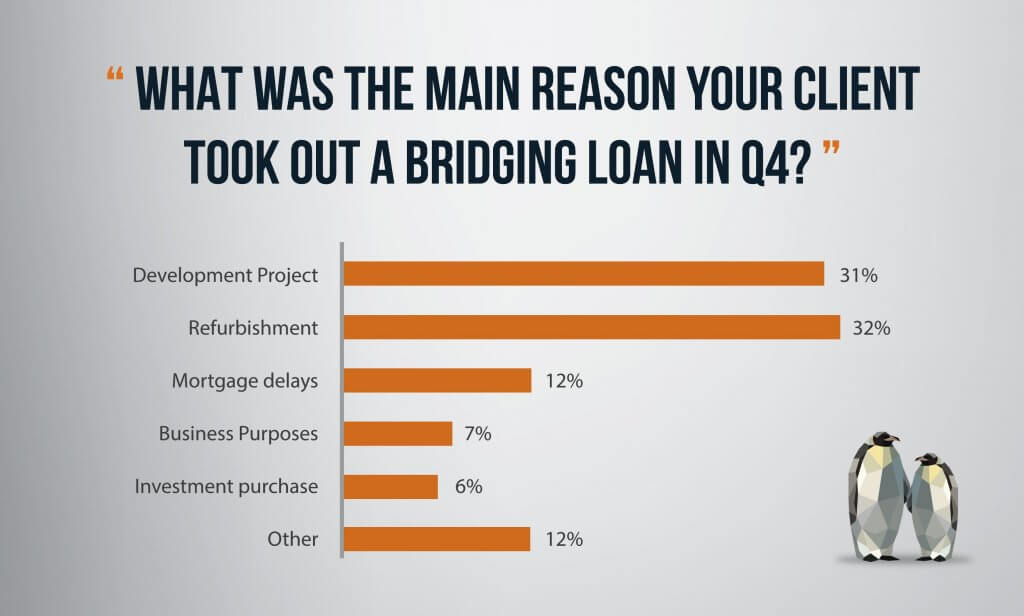

Refurbishment was the main reasons borrowers took out a bridging loan in the fourth quarter at 31%, followed by development projects at 15%, highlighting how bridging loans are being used to increase rental income, due to the interest cover ratio increasing from 125% to 145%.

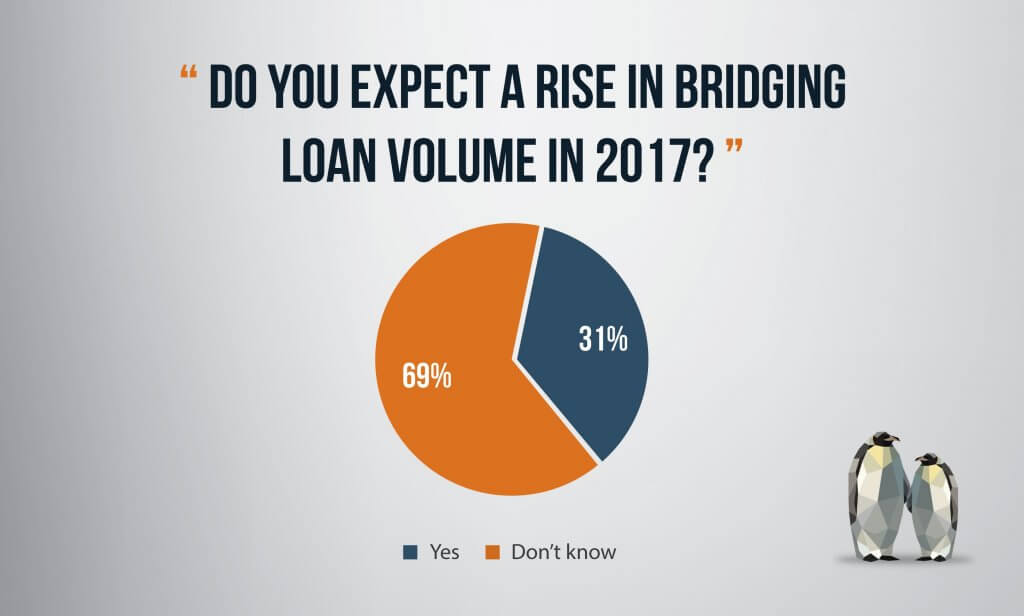

Three-quarters of brokers experienced a rise in overall bridging loan volumes in 2016 compared to 2015, with 69% expecting a further rise in 2017. None of the respondents expect bridging loan volumes to decrease in 2017, showing its growing prominence as a loan product.

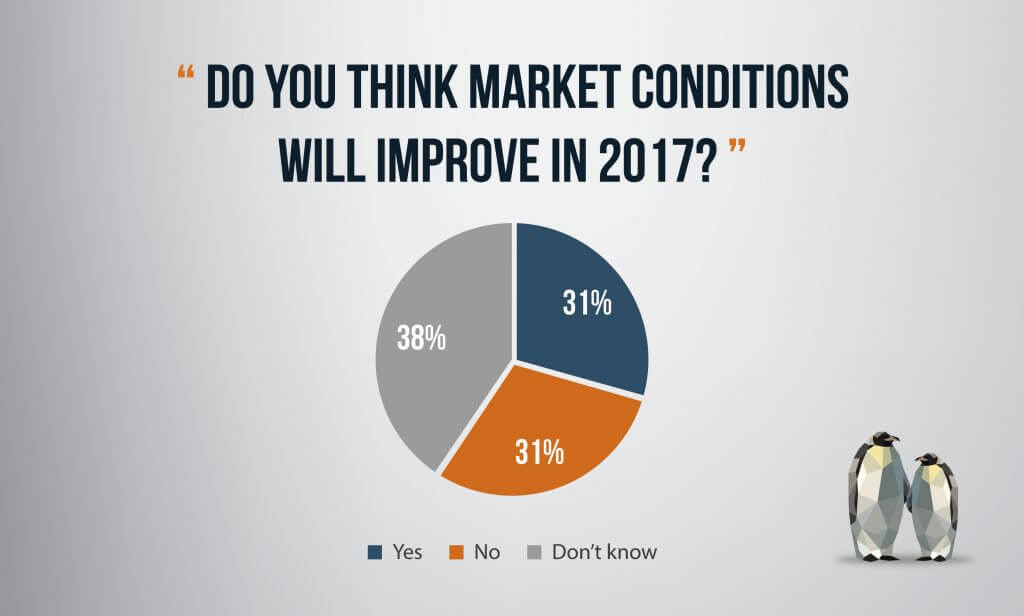

However, brokers remain uncertain over wider market conditions in 2017. When asked if market conditions will improve in 2017, the majority of brokers (38%) said they didn’t know. 56% highlighted the economy as their greatest concern, followed by property prices at 19%.

The results from our Q4 survey reflect the adverse impact of stricter affordability and stress testing from mainstream lenders on professional property investors’ ability to obtain buy to let mortgages. Despite uncertainty in the wider markets, we expect strong demand for bridging loans to continue in 2017.

If you have a bridging loan enquiry you wish to discuss, please don’t hesitate to give us a call on 0203 051 2331 or fill in our online form.