refurbishment most popular use for bridging loans in Q2

Funding refurbishments was the most popular reason for obtaining bridging finance in Q2 2018, according to the latest Bridging Trends data.

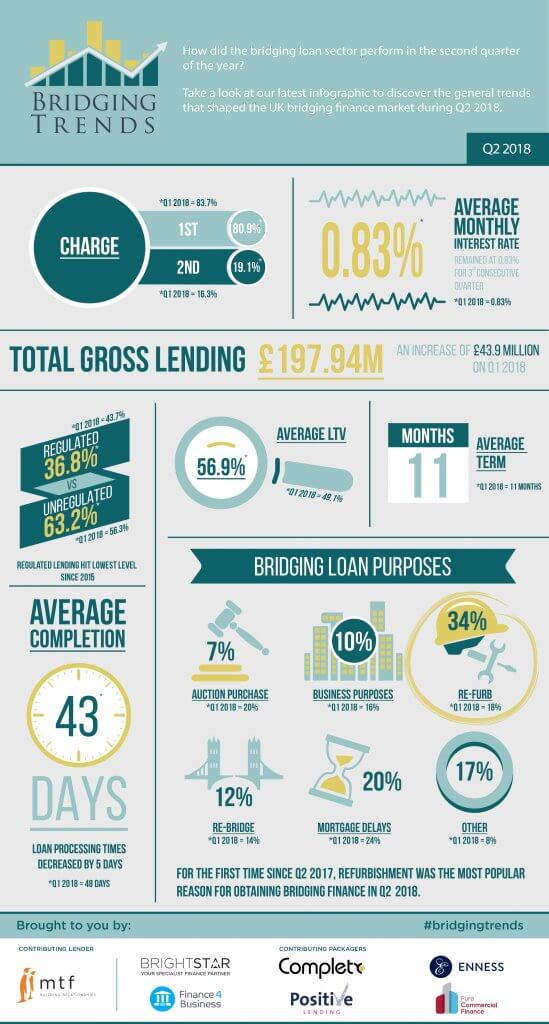

Just over a third (34%) of all lending in the second quarter of 2018 was for refurbishment purposes, up from 18% during the first quarter of 2018, as borrowers sought to maximise the value of their existing assets.

This is the second time refurbishments and home improvements were the most popular purpose since Bridging Trends launched in April 2015- the previous time was during the same quarter last year.

Investors are evidently opting for fast and flexible bridging loans to make improvements to properties and bolster yields against a backdrop of legislation that has made it tougher to buy new properties. At the same time, mainstream banks continue to reign in lending.

Consequently, bridging loans for mortgage delays and auction purchases were down on the previous quarter falling by 4% and 13%, respectively.

Bridging loan volume transacted by contributors hit £197.94 million in Q2 2018, an increase of £43.9 million on the previous quarter. This is the highest figure to date and comes as three new contributors joined Bridging Trends- Complete FS, Finance 4 Business and Pure Commercial Finance, have

Regulated bridging loans fell to the lowest level since 2015, coming in at 36.8% of lending in Q2, from 43.7% in Q1.

However, second charge lending increased to 19.1% of all loans during Q2, up from 16.3%.

Average LTV levels increased by 7.8% in the second quarter to 56.9%, whilst the average monthly interest rate remained at 0.83% for the third consecutive quarter.

Turnaround times were quicker in the second quarter, as the average completion time on a bridging loan application decreased by 5 days in Q2 2018, to 43 days.

The average term of a bridging loan in the second quarter remained at 11 months.

key data points from Bridging Trends Q2 2018:

- 3 new contributors join Bridging Trends

- Refurbishment most popular use for bridging finance

- Regulated lending hits lowest level since 2015

- Average monthly interest rate stays at 0.83% for 3rd consecutive quarter

To view the Bridging Trends Q2 2018 infographic, please visit www.bridgingtrends.com