property Investors want stamp duty surcharge scrapped

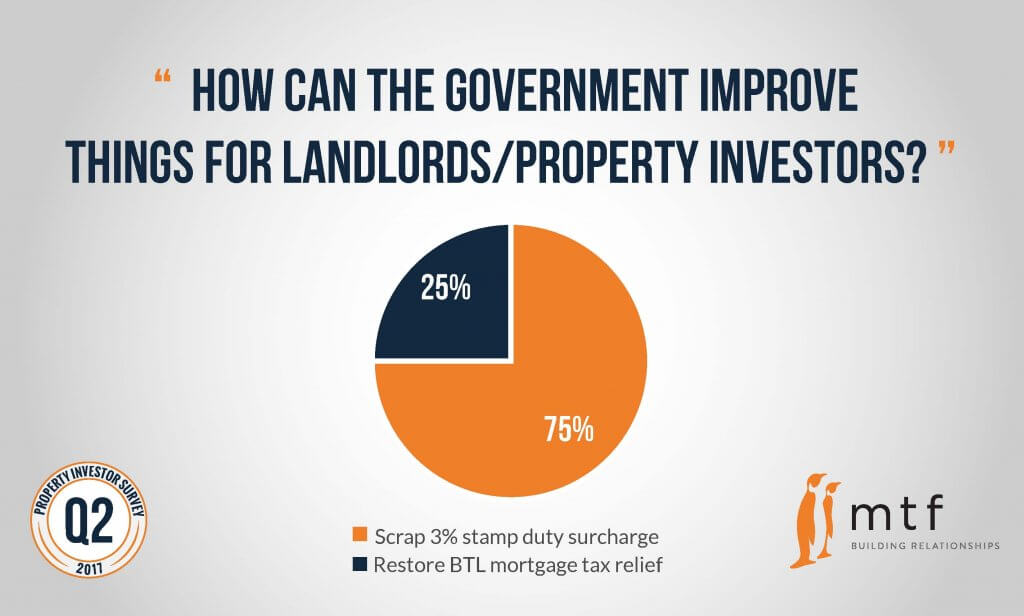

Three quarters of property investors said scrapping the additional 3% stamp duty hike on buy-to-let and second homes would improve conditions in UK real estate, mtf’s Q2 Property Investor Survey showed.

The introduction of the 3% surcharge in April 2016 has severely limited investor appetite for buying properties with the intention of renting them out. It comes as the property market has slowed across the board amid other changes to stamp duty, including a hike on higher value assets.

The government introduced a series of changes to slow down an overheated property market and reduce the amount of buy-to-let investors.

Meanwhile, 25% of property investors called for a reversal on the changes to tax relief on buy-to-let mortgages. Those changes were introduced in April 2017 and have cut buy-to-let tax relief to 20% from 45%, for top rate taxpayers.

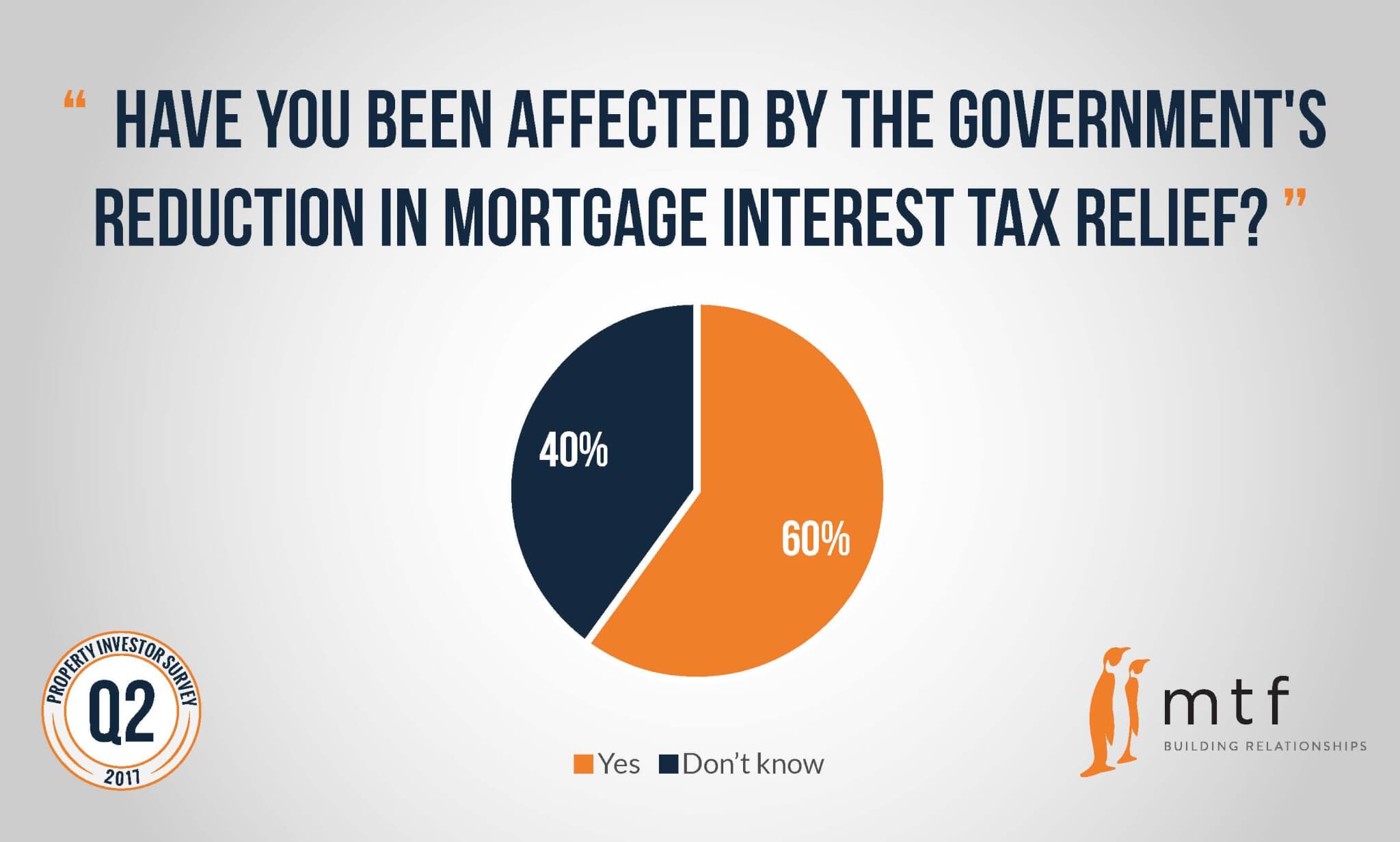

60% of those surveyed revealed they had been negatively affected by the Government’s reduction in mortgage interest tax relief.

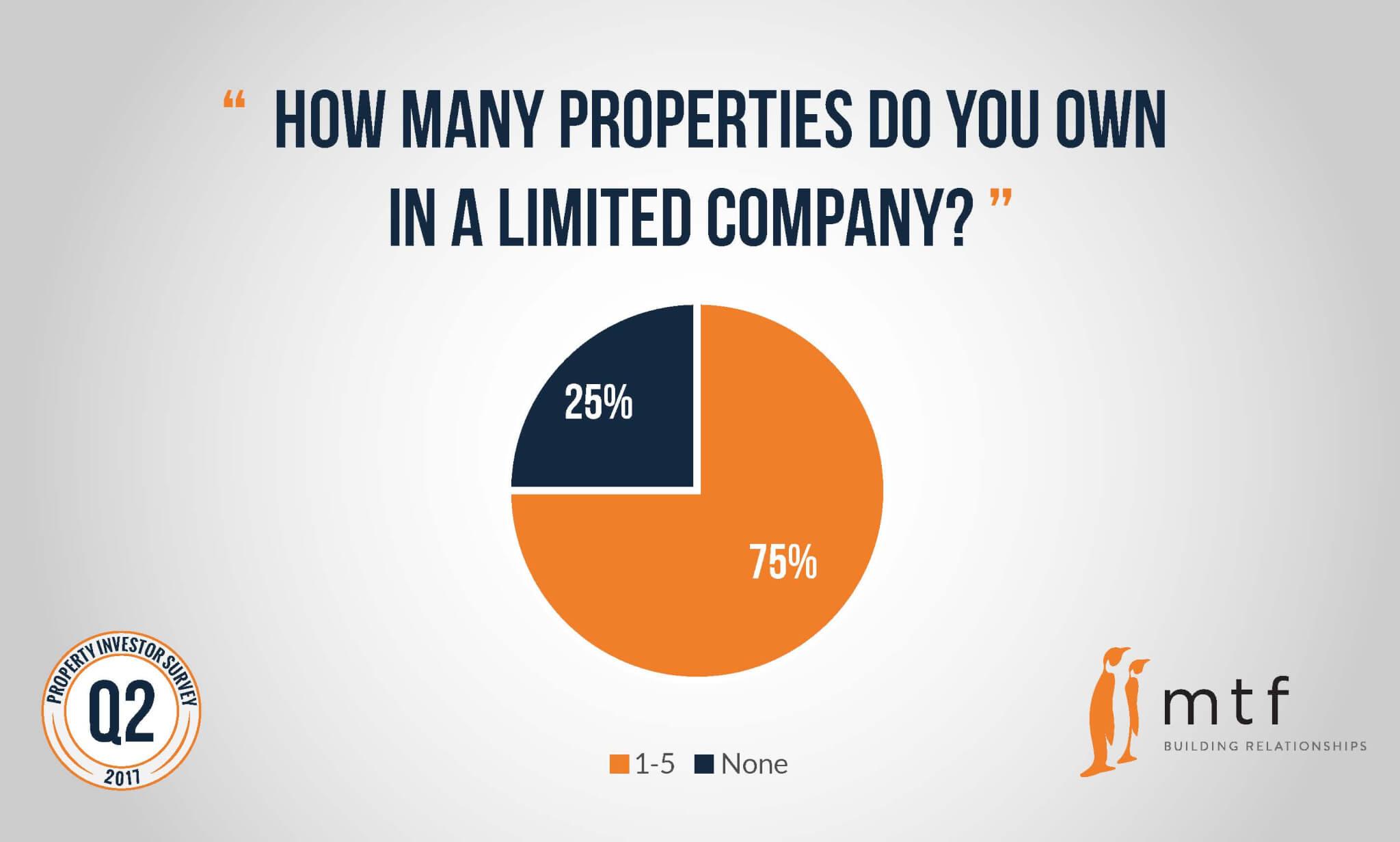

However, landlords borrowing through limited companies can avoid the changes, instead paying corporation tax. Some 75% of property investors surveyed revealed they now own properties in a limited company.

In June’s general election, 60% of property investors voted for the Conservative Party.

With 35% citing housing as the policy that impacted their vote the most, followed by the economy and taxes at 30% each.

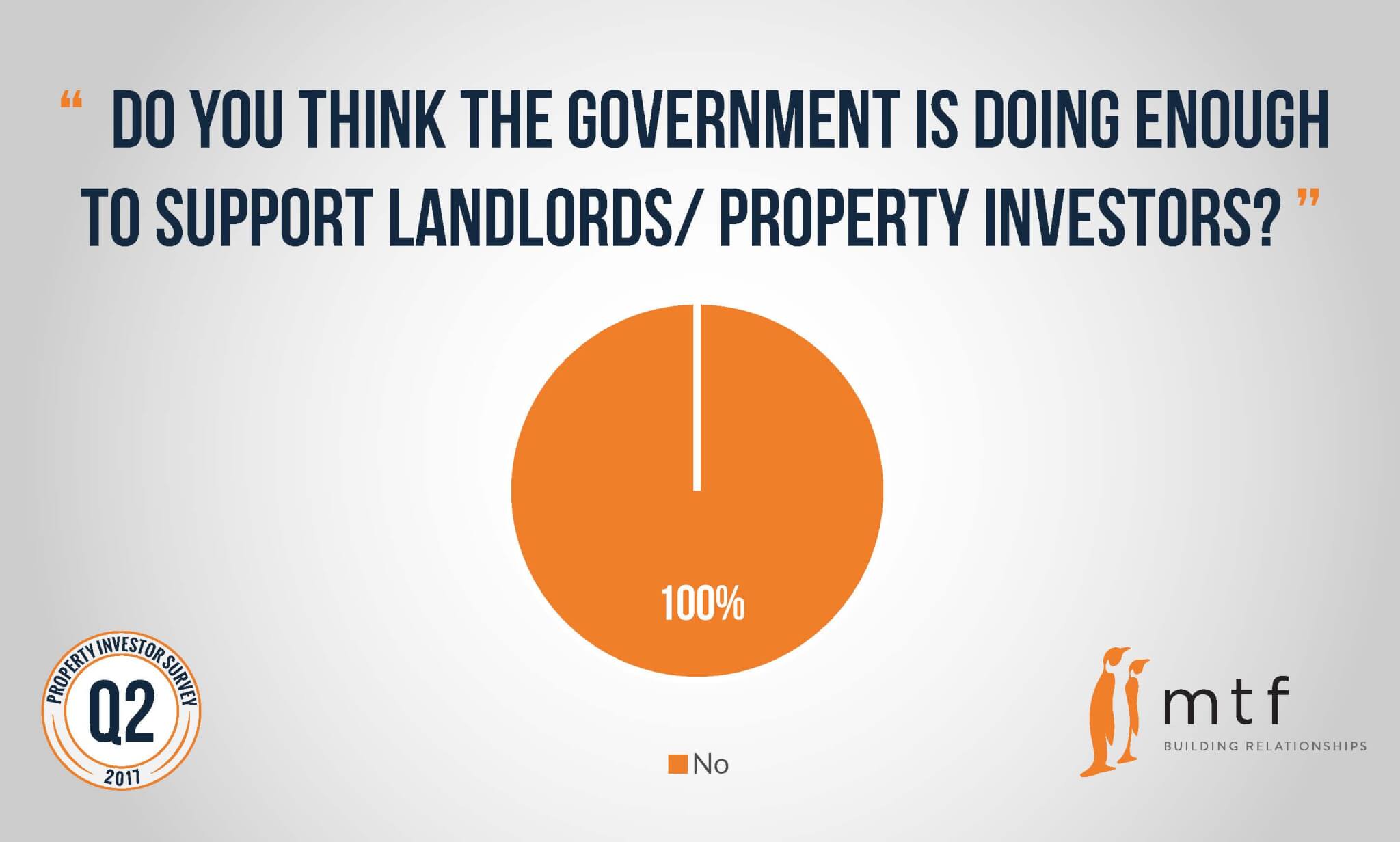

In total, 100% of those questioned said they felt the Government was not doing enough to support them.

Property investors have been dealt some setbacks, impacted by changes to stamp duty and more recently, changes to tax relief. Despite the changes, many investors remain resilient and mtf is there to support them and fulfil their funding needs.

For more information on how a bridging loan could help, call mtf on 0203 051 2331 or fill in our contact form and a member of the team will be in touch with you shortly.