property investors call for support from UK government

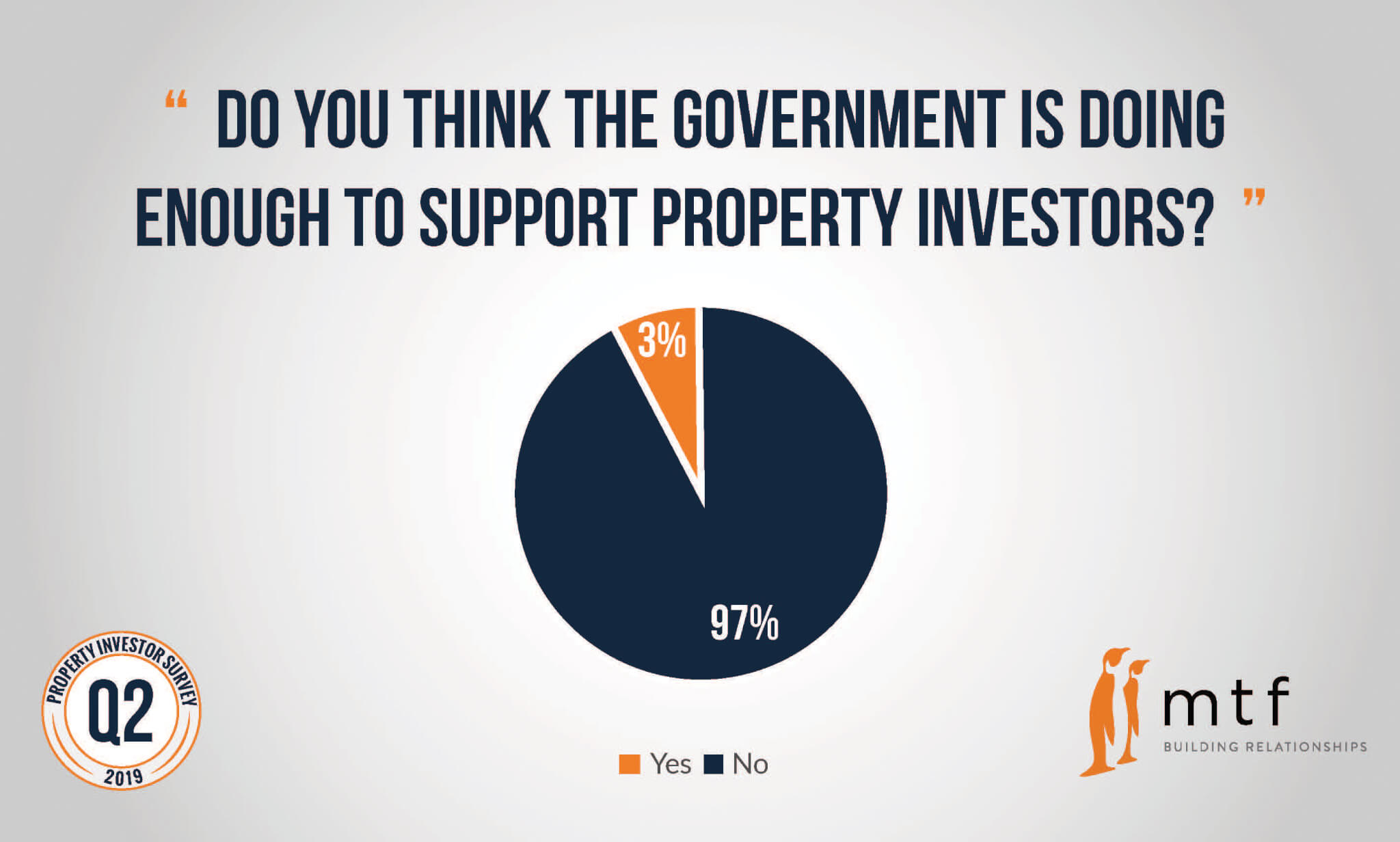

The results from our latest Property Investor Survey has revealed 97% of property investors do not think the Government is doing enough to support the UK property market.

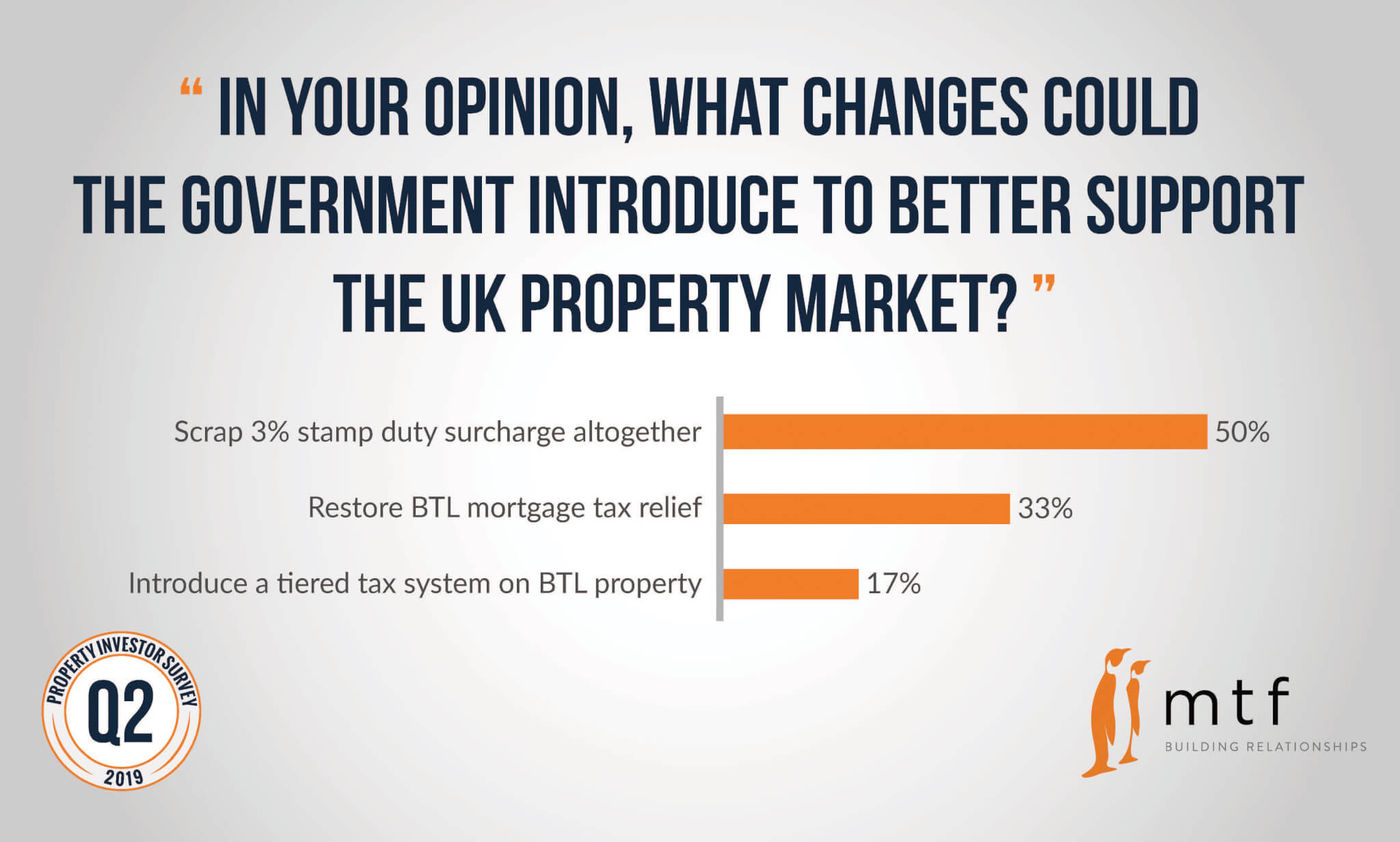

When asked what changes the government could introduce to better support the UK property market, 50% of the 135 property investors surveyed said scrapping the 3% stamp duty surcharge would improve conditions in UK real estate.Meanwhile, 33% of property investors called for a reversal on the changes to tax relief on buy-to-let mortgages. Whilst 17% believed introducing a tiered tax system on buy-to-let property would better support the UK property market.

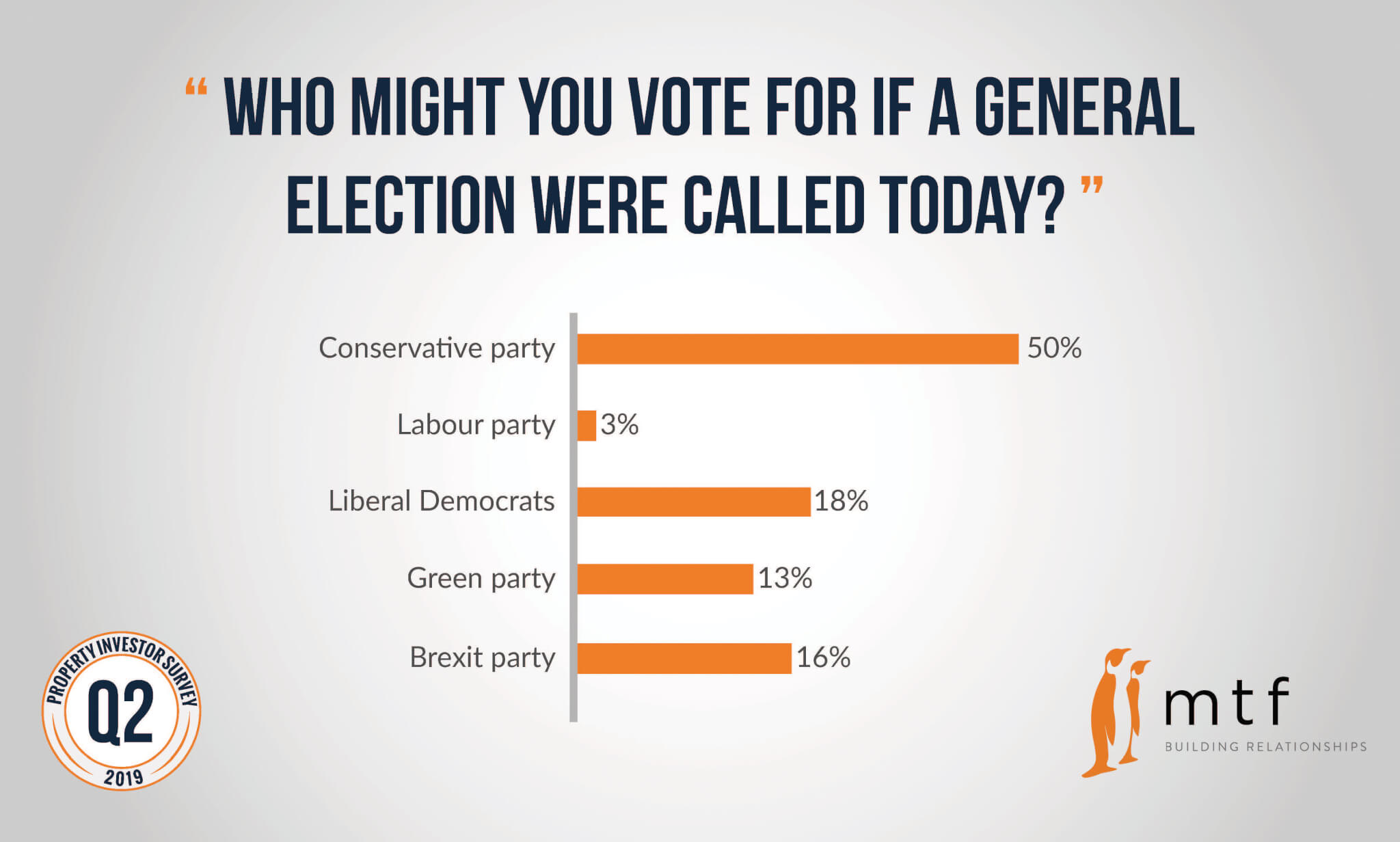

When asked who they would vote for if a general election was called today, half revealed they would back the Conservative Party. 18% said the Liberal Democrats, followed by the Brexit Party at 16%.

Only 3% of property investors revealed they would back the Labour Party in a general election.

It is interesting that the Stamp Duty surcharge and removing it is more important to property investors than mortgage interest tax relief – it suggests this group of investors are the ones who are most likely to expand their portfolios.

The government has introduced a series of changes to slow down an overheated property market and reduce the number of buy-to-let investors over the years. Property investors have been dealt some serious setbacks, impacted by changes to stamp duty and changes to tax relief but despite the changes, many remain resilient and still see property investment as a key tool for retirement planning, and a good home for their monies whilst interest rates are low.

For more information on how a bridging loan could help you purchase a buy-to-let property, call us on 0203 051 2331 or fill in our contact form and a member of the team will contact you shortly to discuss your requirements.