HMO property: the pros, cons and funding solutions

An HMO, or House in Multiple Occupation, is seen by many property investors as a great way of generating extra income from a single property. But like any form of investment, there are both pros and cons to converting a property into an HMO.

This article will take a look at both aspects of HMO properties and will look at how investors overcome boundaries that the traditional lending market has towards purchasing a house in multiple occupation.

pros of HMO property:

multiple income sources

One of the most obvious benefits of an HMO is the fact that it will generate several streams of rental income rather than just one. Of cause each rent acquired may not be as large as renting the property as a whole, you may well be able to generate a much higher total pooled amount.

Less exposure to arrears and rental void periods

By having multiple tenants within a single property, if one unit is either unoccupied or behind on their rent payments, there will not be such a detrimental effect on your income flow as if it were a single unit.

tax advantages

When renting out an HMO, the first £1000 of your income from the property is tax-free and referred to as ‘property allowance’ by HMRC. In addition to this, you can claim allowable expenses for a variety of things needed for the day-to-day running of your HMO, including: letting agents’ fees; buildings and contents insurance; interest on property loans and a great deal more. You can also claim tax relief for items such as Beds, sofas and carpets.

high demand for rental properties

The need for short term leasing of dwellings and flexible accommodation is as big as ever. Students and young professionals continue to raise demand for available rooms and according to a recent report from Rightmove, rental prices are increasing along with the demand.

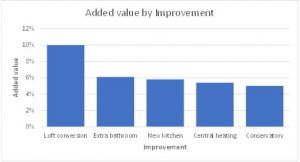

increase in value through heavy refurbishment

When converting a property into an HMO, there are several improvements that may need to be made and these can also add the overall property value. As shown in the chart below based on data from NAEA, Movewithus and TradeAdvisor, converting a loft into a living space can add as much as 10% to the value of your property.

cons of HMO property:

regulation, legislation and planning

Renting and maintaining an HMO comes with a far increased level of regulations and licensing to adhere to compared to a single let. One of the reasons for this includes the higher level of shared facilities and fire regulations to be followed. It can often be prudent to hire a property manager that is experienced in the running of an HMO to make sure that you are always up to spec.

higher entry level due to refurb and furniture

Along with the work needed to be made previously mentioned, dividing the property and furnishing it also brings its costs. Both heavy and light refurbishments are costly operations that can soon add up depending on what is required. This includes converting space into bedrooms and alterations needed to make shared facilities more accommodating. Many HMOs are normally let out furnished, so the purchase of beds, curtains and other household items need to be factored in. All in all, these costs can often make the barrier for entry too high for first time investors.

harder to resell

If you decide to sell your HMO to streamline your property portfolio, it can typically be harder than a single dwelling. There will only be a niche customer base looking to undertake the purchase of an HMO. Either investors looking to take the property on ‘as is’ or somebody looking to retrofit the estate back into a single property. This is a factor that you should bear in mind if a potential exit strategy will be required down the line.

harder to get financing

As highlighted in this article by Property Investments UK, traditional lenders may require a clean credit rating, be able to prove their minimum income and be able to provide a business plan with an expected income of the HMO. All of problematic factors listed above have become a bane of investors looking for funding for an HMO property, however bridging loans have become an ever-popular method of sourcing alternative funding.

financing an HMO with a bridging loan

Considering the difficulties the traditional lending market has with funding HMOs, investors can turn to bridging loans as an alternative. This form of short-term financing will overlook factors like poor credit, CCJs and arrears. In addition, no proof of income is required, and neither is a guarantor.

One of the main reasons that property investors enjoy using bridging loans for funding is the speed that funds can be set in place. Typically, terms for bridging loans can be agreed within hours of an initial enquiry and funding complete in a matter of days.

In addition to the speed, the flexibility of bridging loans is also a key factor. Within the terms of a loan, you can agree to have the funding issued in stages as and when your refurb requires it. Receiving the funding in stages helps to keep down the costs required to maintain the loan. Another accommodating feature of a bridging loan is that no up-front fees are required and there are no early exit fees to be paid if you want to finish the loan ahead of time.

If you would like to make an enquiry about funding a property conversion with a bridging loan, call our team on 0203 051 2331 or get a call back by using this contact form.