government is not doing enough to support the property market, say brokers

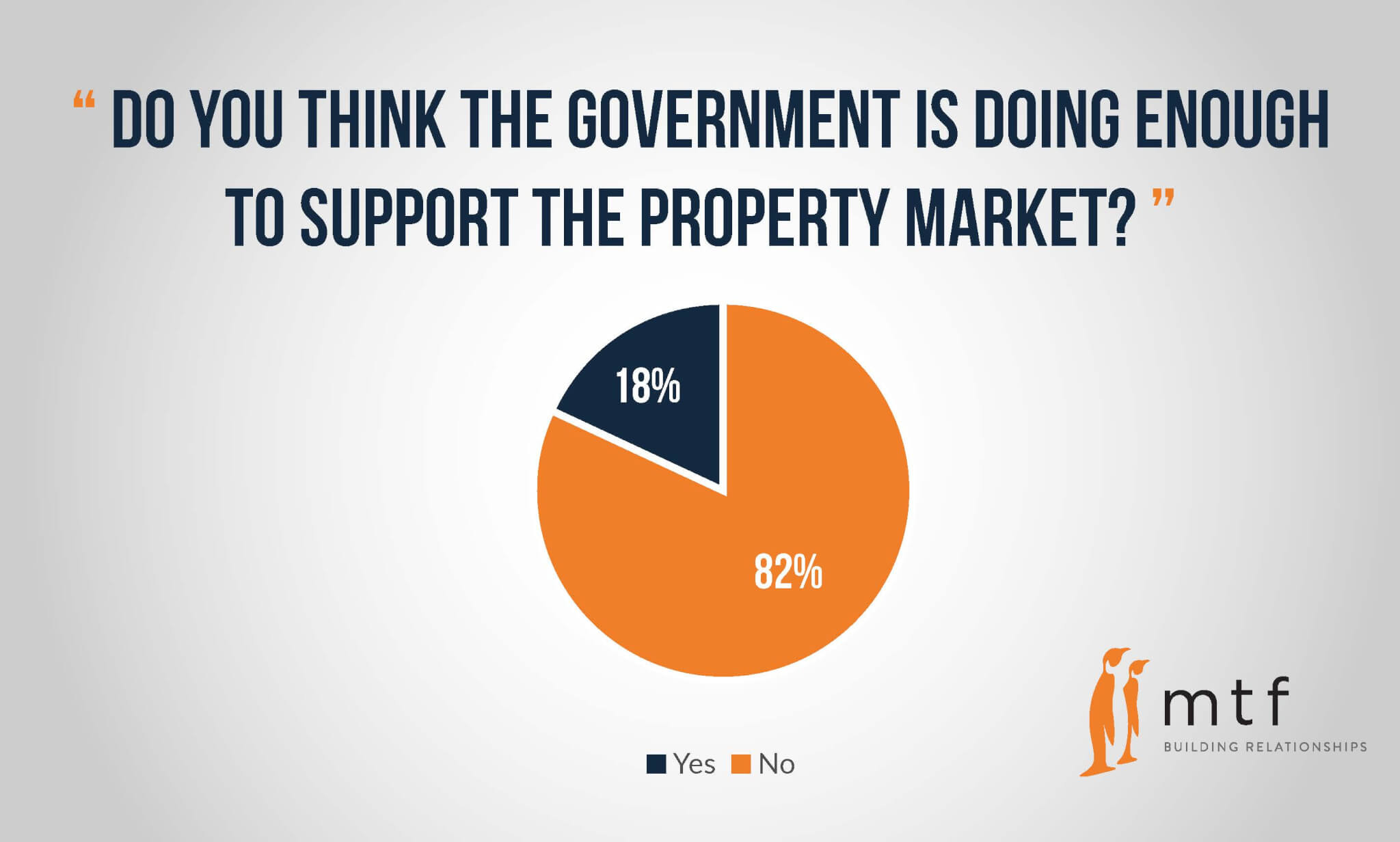

According to the data from our most recent quarterly Broker Sentiment Survey, 82 per cent of brokers do not think the Government is doing enough to support the UK property market.

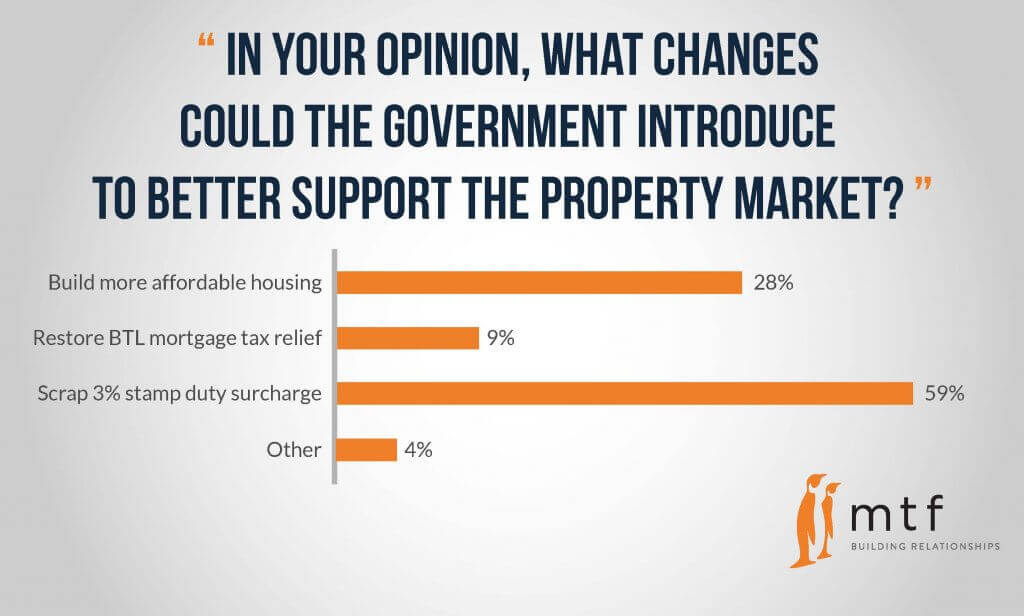

When asked what changes the Government could make, over half (59 per cent) of brokers said scrapping the 3 per cent stamp duty surcharge would better support the property market. Followed by building more affordable housing at 28 per cent.

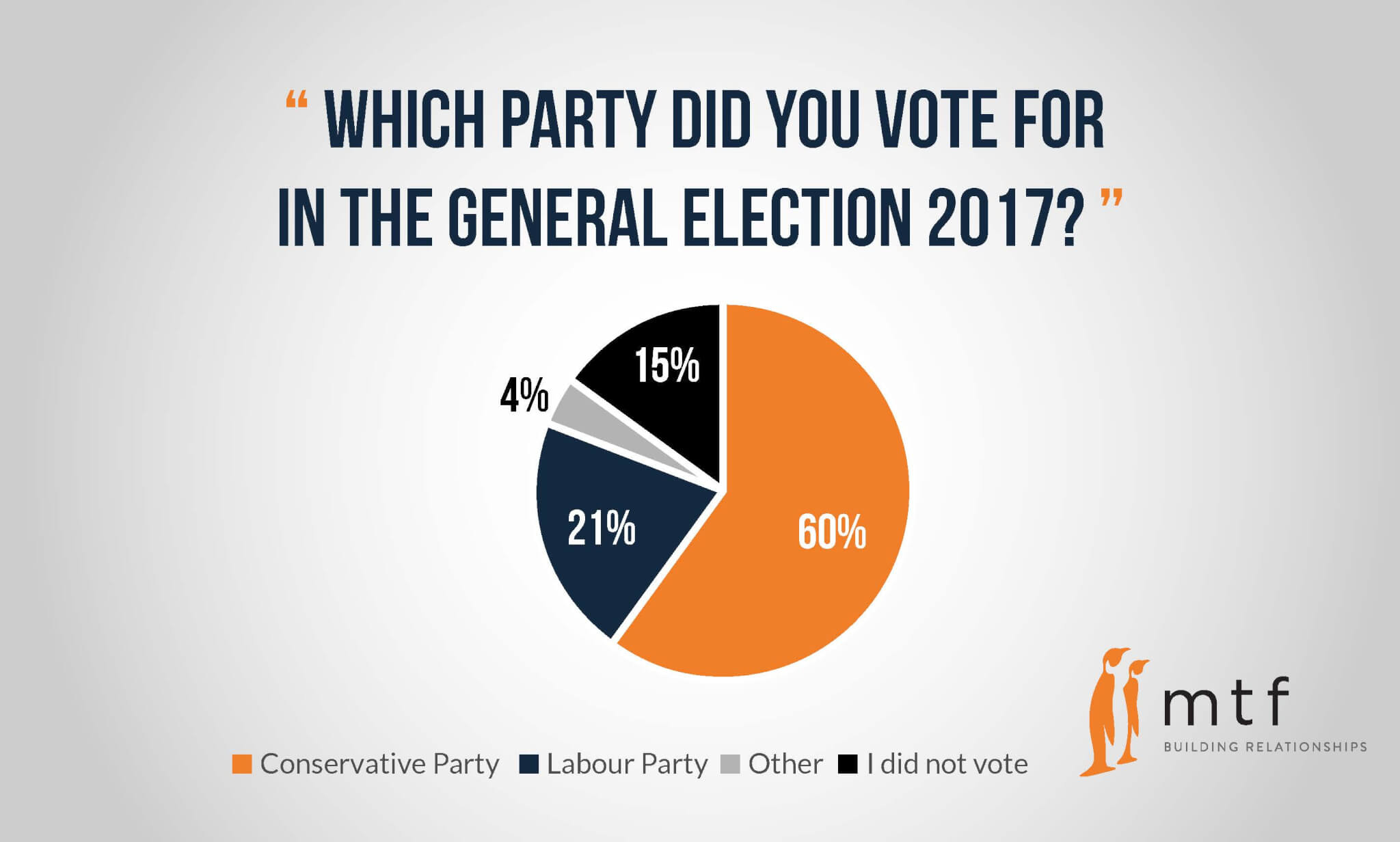

Despite the unexpected election result that lead to a hung parliament, the majority (60 per cent) of the 92 brokers surveyed revealed they backed the Conservative Party. 21 per cent of brokers voted for the Labour Party.

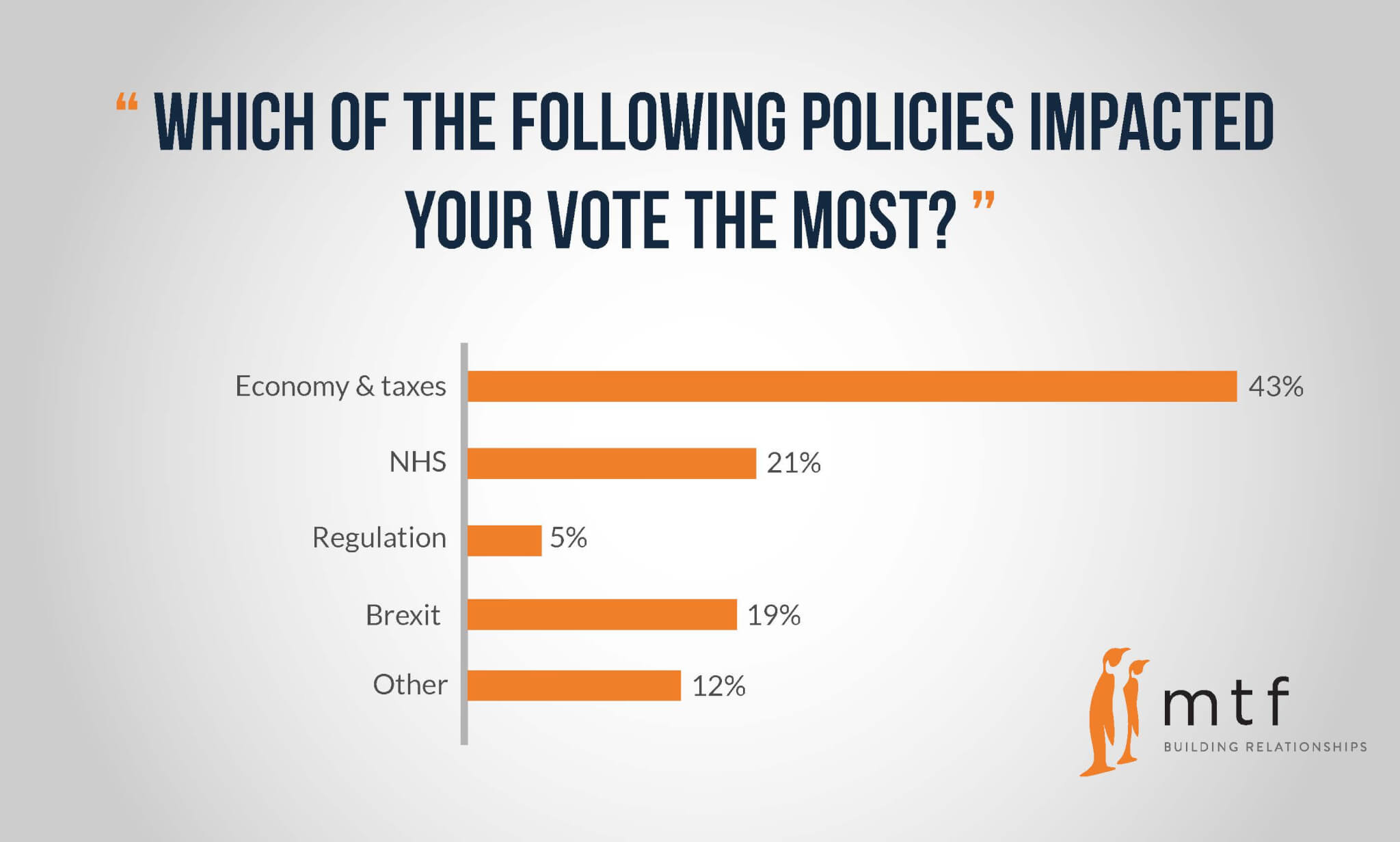

43 per cent of brokers said economy and taxes impacted their vote the most.

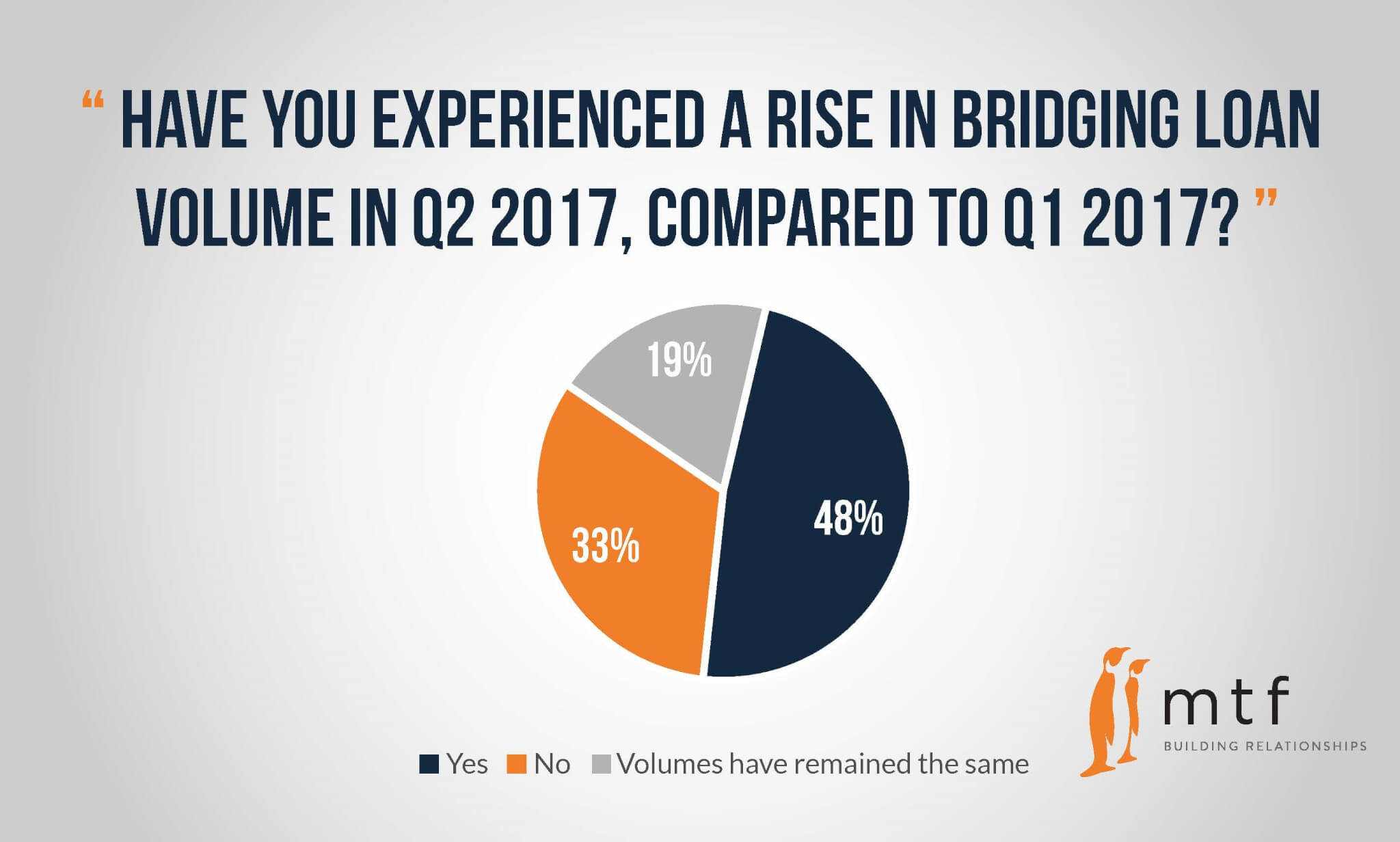

Some 48 per cent of brokers noticed a rise in bridging loan volumes in Q2, compared to Q1- down from 59 per cent in the first quarter. 33 percent said loans volumes had declined.

The South East saw the biggest demand for bridging finance in the Uk, at 62 per cent, up from 40 per cent in Q1 2017. The second highest area of demand was the Midlands at 24 percent. Only 9 per cent of brokers reported a rise in London- down from 30 per cent in Q1.

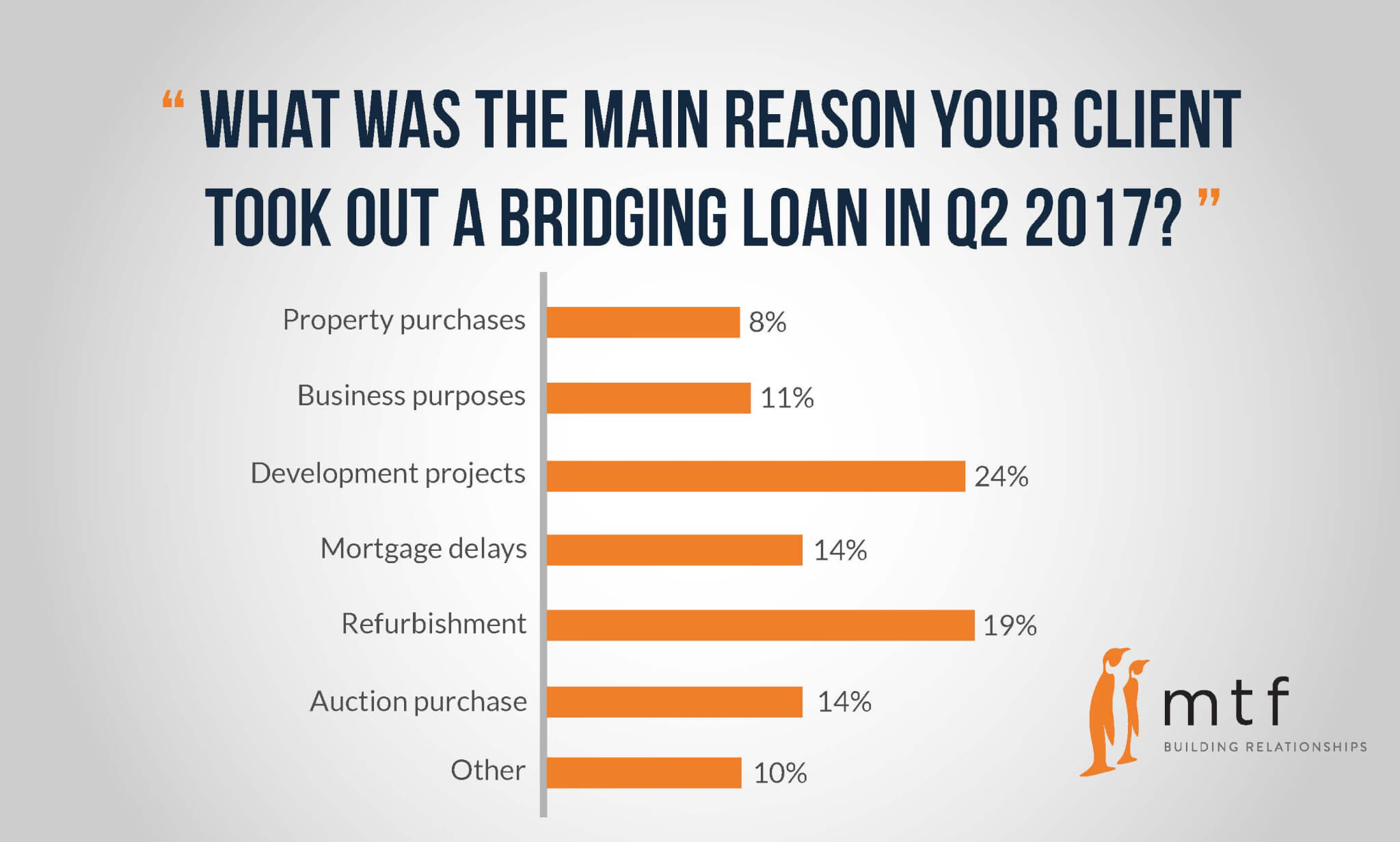

For the second consecutive quarter, funding a development project was the most popular reason for their clients taking out a bridging loan, at 24 per cent, followed by refurbishment at 19 per cent.

At a time of heightened uncertainty in the housing market stemming from numerous factors, brokers are exceptionally well placed to identify factors affecting activity. It is clear that stamp duty is having a negative effect, perhaps beyond what was anticipated, to slow the growth in prices by reducing transaction levels. This is borne out by the reduced number of brokers seeing a rise in lending volumes in London – the area most cited as feeling the effects of the stamp-duty ‘surcharge’.

The good news is that the market is responding by developing new opportunities, as more and more property professionals realise the potential of assets through refurbishment and ground-up development. Both of which mtf is here to fully support. For more information on how a bridging loan could help, call mtf on 0203 051 2331.