election uncertainty boosts bridging activity

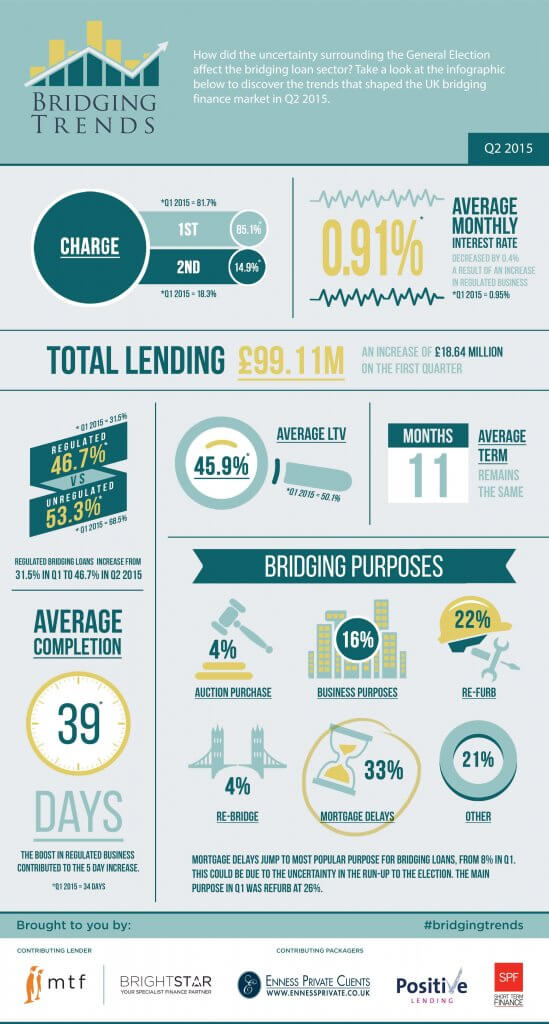

UK bridging lending activity increased in the second quarter as uncertainty over the general election led to delays in lending decisions from the residential mortgage market.

According to the Bridging Trends data, Q2 saw a significant uplift in bridging loan applications for mortgage delays – increasing from 8% in Q1 to 33% in Q2 and reflecting the uncertainty from the mortgage market in the run-up to the election.

Bridging Trends contributors also reported an increase in lending volumes in the second quarter, which climbed to just under £100 million, from £80.47m in the previous quarter, demonstrating the strong demand for bridging finance.

The rise in applications for mortgage delays appears to have influenced the regulated side of the bridging sector, with the number of regulated loans increasing by 15%. This activity translated into lower monthly interest rates and LTVs, but longer turnaround times.

Refurbishment was the second best preforming area of the industry, while bridging loans for businesses fell to 16%, from 24% in the first quarter.

Key data points from Bridging Trends in the second quarter of 2015 are as follows:

– Total contributor lending reached £99.11m, an increase of 23%

– Average term remains at 11 months

– Average monthly interest rate drops to 0.91%

– Average LTV was 45.9%

– Mortgage delays were most popular use for bridging loans

– 47% of bridging loans were regulated. An increase from 32% on the previous quarter

To see the Bridging Trends for Q2 2015, please see the image below or visit www.bridgingtrends.com.