bridging saves delayed property purchases in Q1

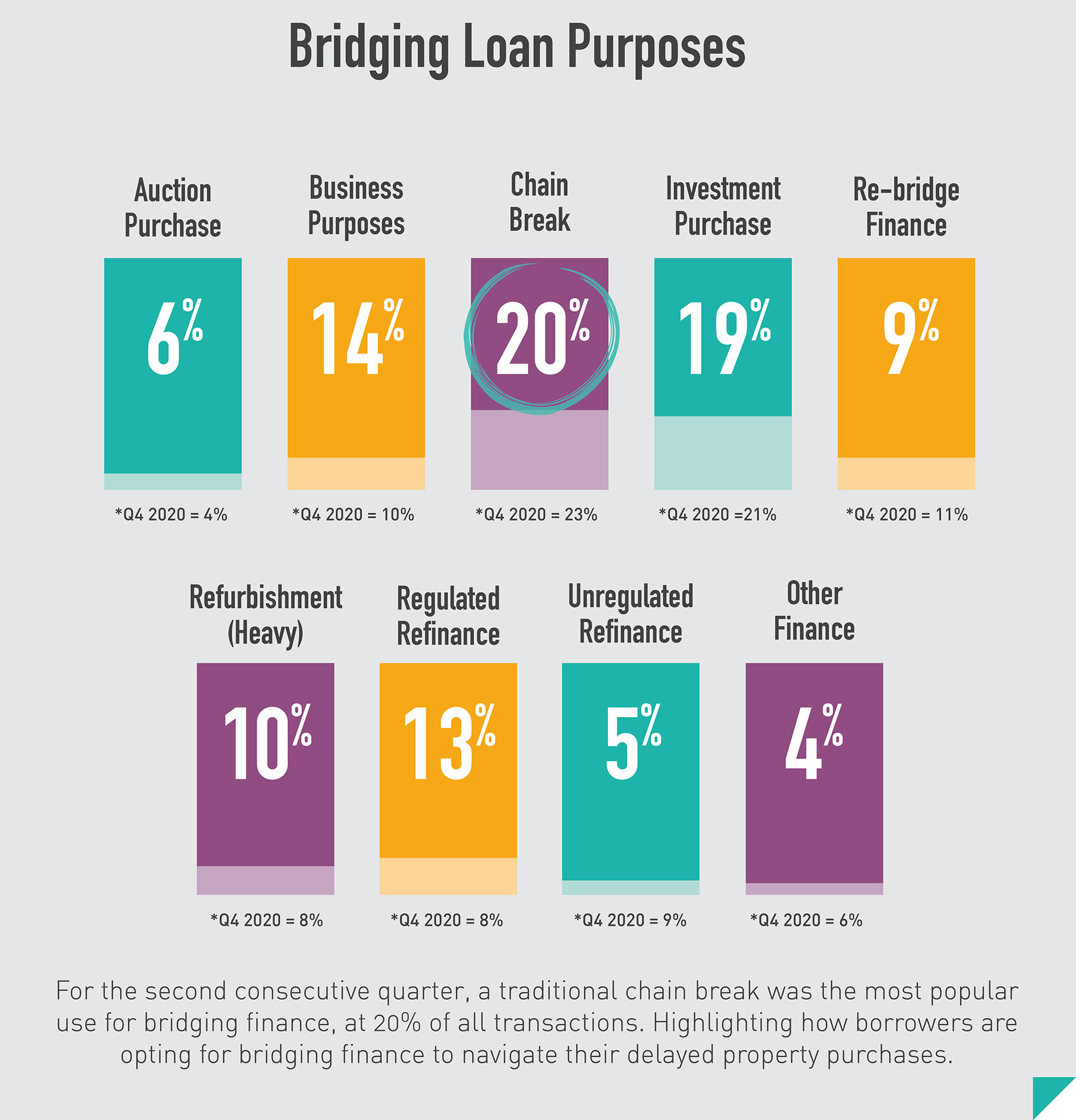

According to the latest figures from Bridging Trends, funding a chain break once again the most popular reason for obtaining bridging finance, contributing to 20% of all loans in Q1 2021, down from 23% during Q4 2020.

Purchasing an investment property was the second most popular use for bridging finance in Q1, falling to 19% of all lending, from 21% in the previous quarter.

The data highlights how bridging finance continues to be an increasingly attractive proposition to buyers who are looking to save their delayed property purchases.

Demand for bridging loans for business purposes increased from 10% to 14% in the first quarter of the year, as businesses quickly readied themselves for lock-down restrictions easing.

Elsewhere, figures confirm the UK bridging loan market stabilised in the first quarter of the year, as Covid-19 lockdown restrictions continued.

Total contributor lending increased to £144.51 million, a 5% rise on the previous quarter (£137.22m), largely attributed to new contributors joining Bridging Trends: LDN finance and Optimum Commercial Finance.

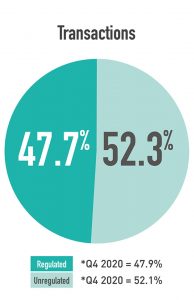

Regulated bridging loans transacted by contributors remained unchanged from the previous quarter, at 48% of total lending.

Meanwhile, second charge transactions remained at 22% of market share in Q1 2021.

The average weighted monthly interest rate in Q1 2021 was 0.74%. This was marginally higher (0.02%) than in Q4 2020, and still considerably cheaper than rates offered before the Covid-19 outbreak (0.80%).

The greatest shifts in Q1 2021 were the average loan-to-value (LTV), rising to 55.2%, from 51.3% in the previous quarter. This could be attributed to the increase in availability of higher LTV products over recent months, in response to borrower demand.

The average term of a bridging loan climbed by one month to 12 months, falling in line with the same quarter in 2020. Whilst the average completion time on a bridging loan application increased to 53 days in the first quarter of the year, up from 50 days in Q4 2020. This is the highest figure recorded since Bridging Trends launched in 2015.

The top criteria search made by bridging finance brokers during Q1 was ‘maximum LTV,’ according to data supplied by Knowledge Bank. Followed by ‘regulated bridging’ and ‘minimum loan amount.’ This further indicates the growing demand for higher LTV products on new home purchases.

Figures from the last two quarters have shown that the bridging finance market is stable and is continuing to support those looking to purchase new homes and take advantage of the stamp duty holiday.

Bridging Trends covers data gathered from several specialist packagers operating within the UK bridging market: Adapt Finance, Brightstar Financial, Capital B, Clever Lending, Complete FS, Enness, Finanta, Impact Specialist Finance, LDNfinance, Optimum Commercial, Sirius Group, and UK Property Finance. The data for top broker criteria searches is supplied by Knowledge Bank.

To view the Q1 2021 Bridging Trends infographic in ful, please visit: www.bridgingtrends.com

For more information about the Bridging Trends data, please don’t hesitate to contact the team on 02030512331 0r fill in our contact form and someone will be in touch with you shortly.