bridging loan volume rises as competition across the sector increases

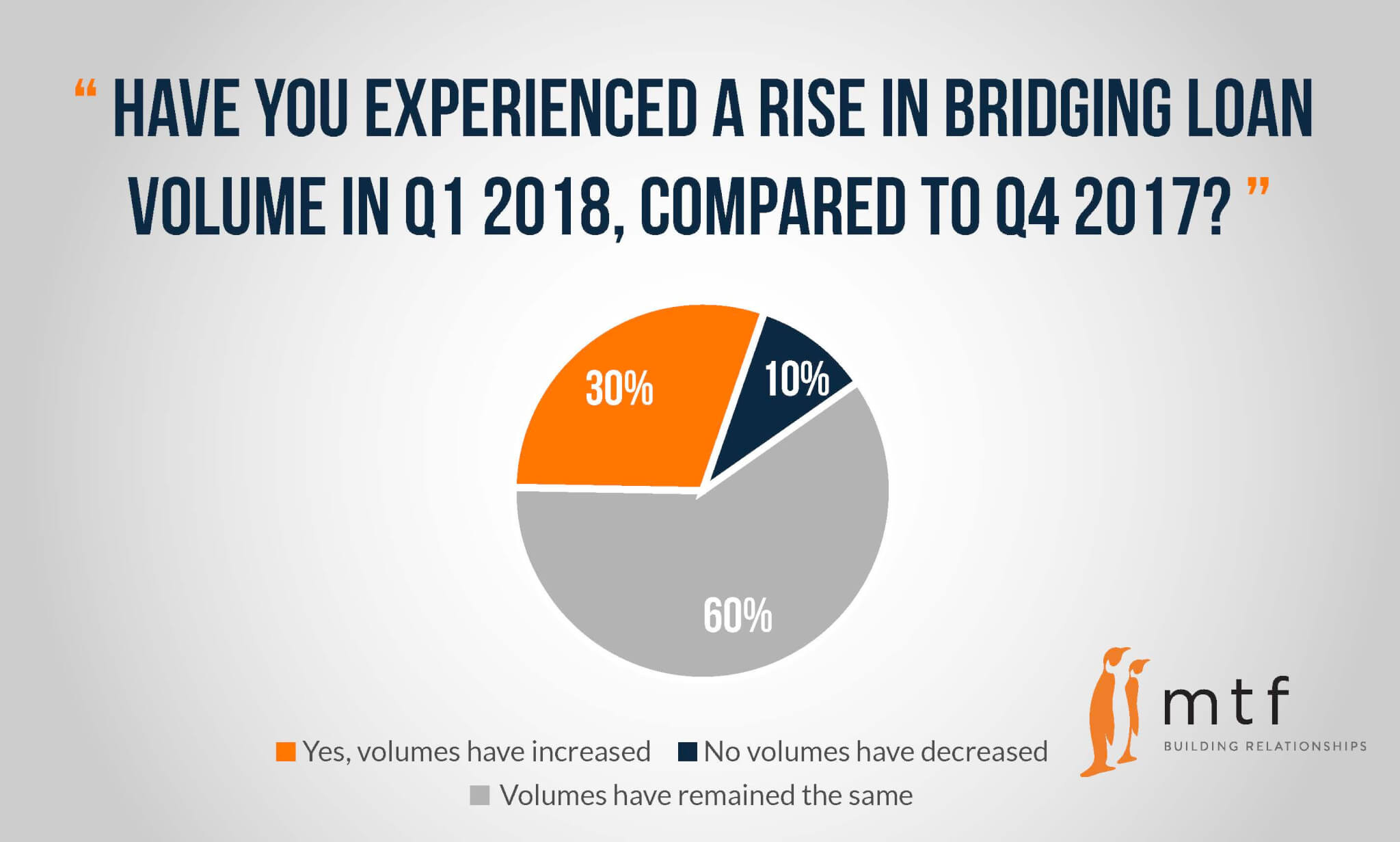

According to the results from our latest Broker Sentiment Survey, bridging loan volume rose by almost a third in the first quarter of 2018 as demand for short term finance remained strong.

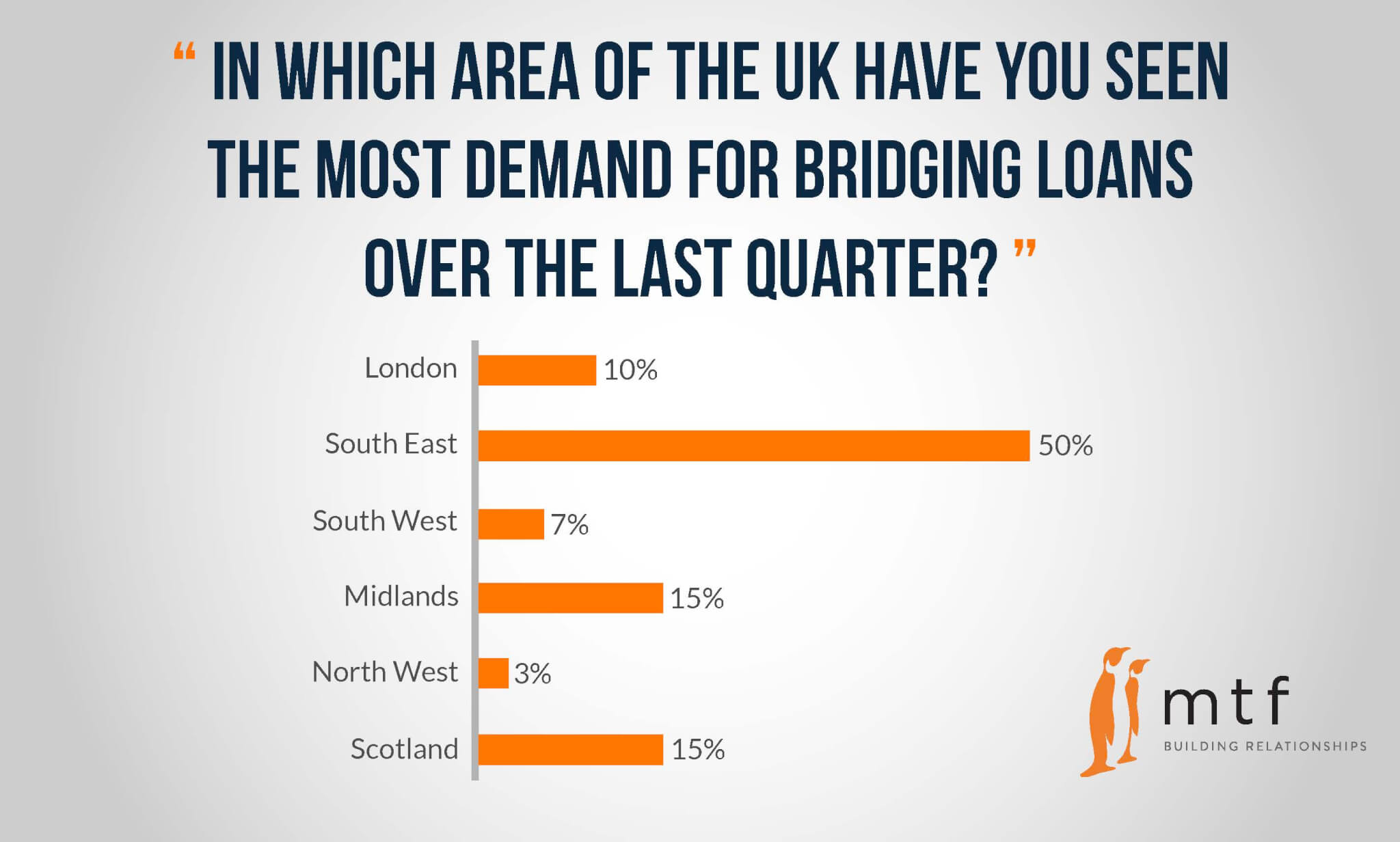

Some 30% of the 119 brokers surveyed experienced a rise in bridging loan volume, with the biggest demand coming from the South East at 50%, up from 47% in the last quarter of 2017. The second highest area of demand was the Midlands and Scotland, both at 15%. Only 10% of brokers said they’d seen the most demand in London in Q1.

Some 30% of the 119 brokers surveyed experienced a rise in bridging loan volume, with the biggest demand coming from the South East at 50%, up from 47% in the last quarter of 2017. The second highest area of demand was the Midlands and Scotland, both at 15%. Only 10% of brokers said they’d seen the most demand in London in Q1.

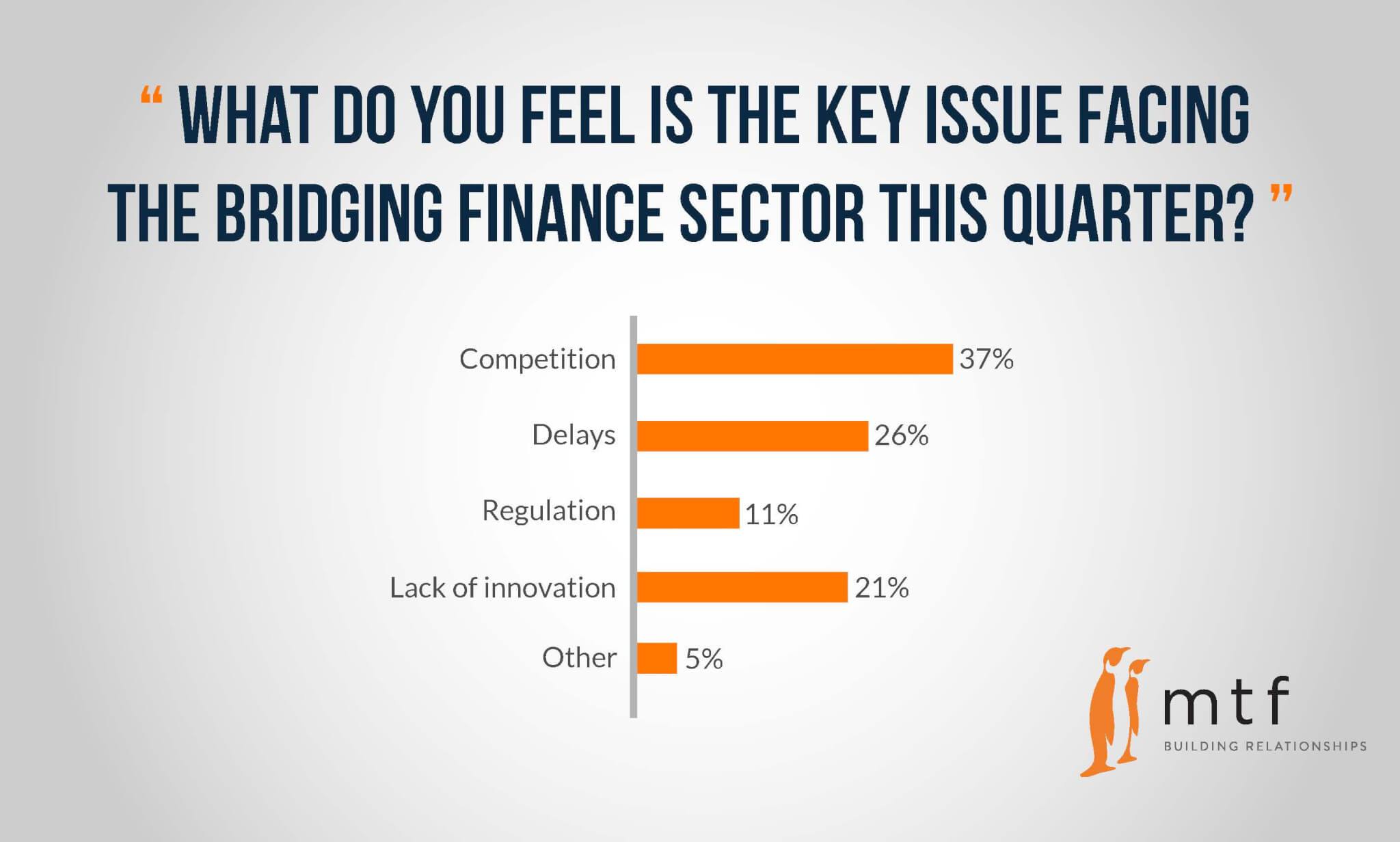

Demand for alternative finance and an influx of cash into the space given the comparative attractive yields on offer has prompted new borrowers, investors, lenders and brokers to the market, facilitating its growth and continued acceptance into the mainstream as a viable financial tool. As such, some 37% of brokers surveyed cited competition as a key issue facing the bridging finance sector during the first quarter of 2018.

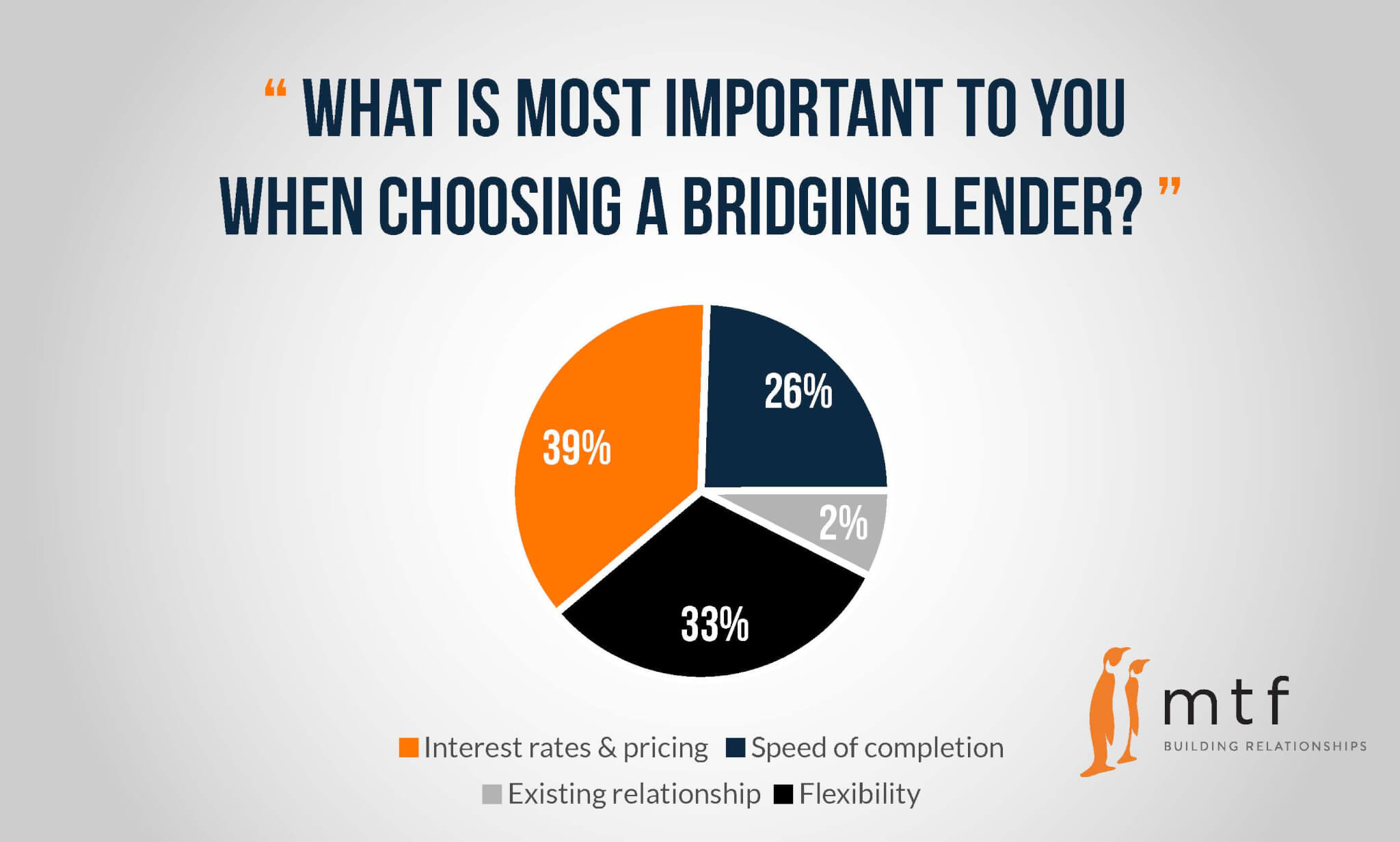

Interest rates and pricing emerged as most important when choosing a bridging finance lender at 39%, while 33% of respondents said flexibility was a key issue. Some 26% cited speed of completion as paramount. A mere 2% said an existing relationship with a lender was the most important factor.

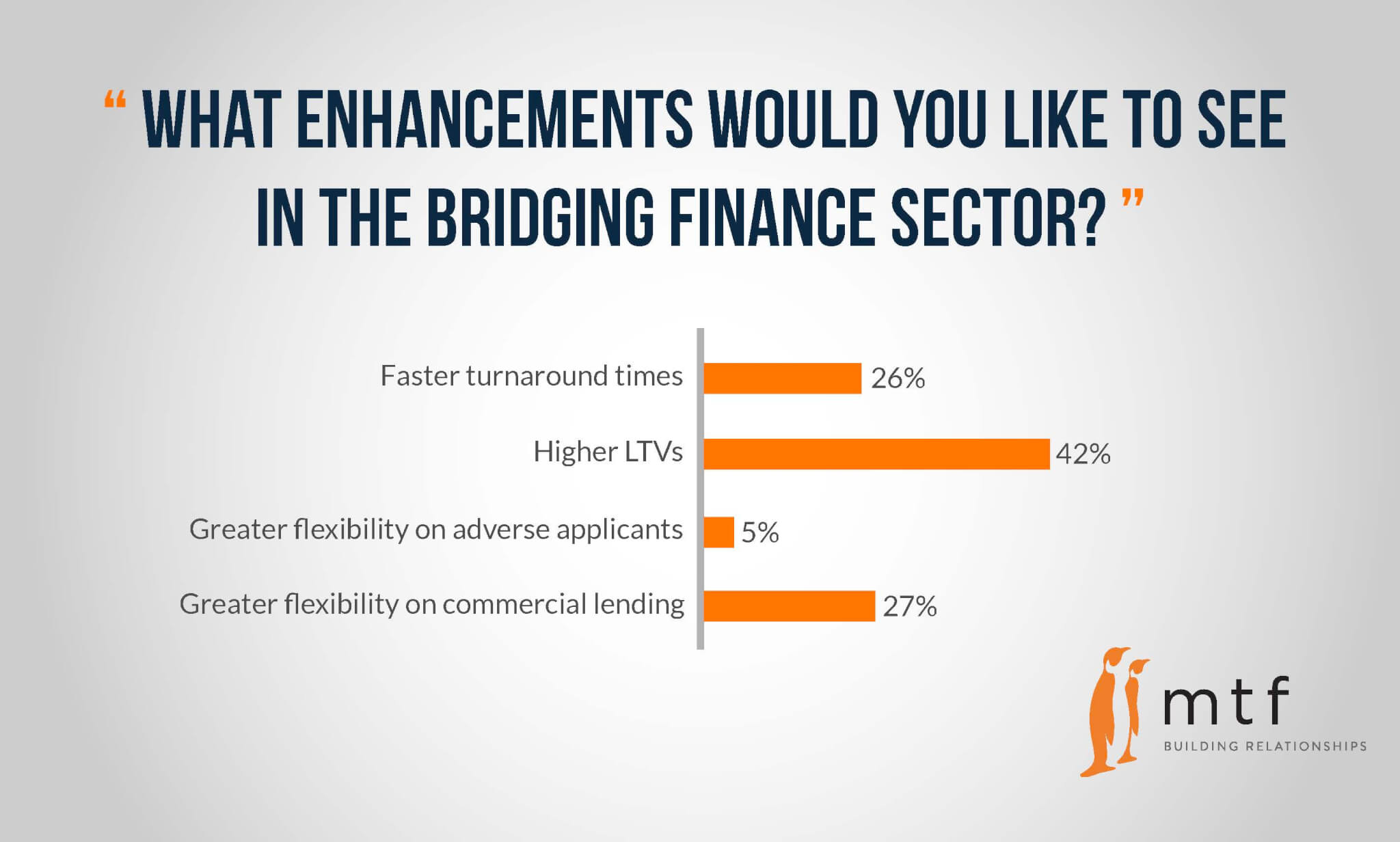

42% of brokers would like to see higher Loan-To-Values (LTVs) on offer in the bridging finance sector, while 27% of brokers want greater flexibility on commercial lending and 26% want faster turnaround times. None of the brokers surveyed felt the need for lower rates or further transparency.

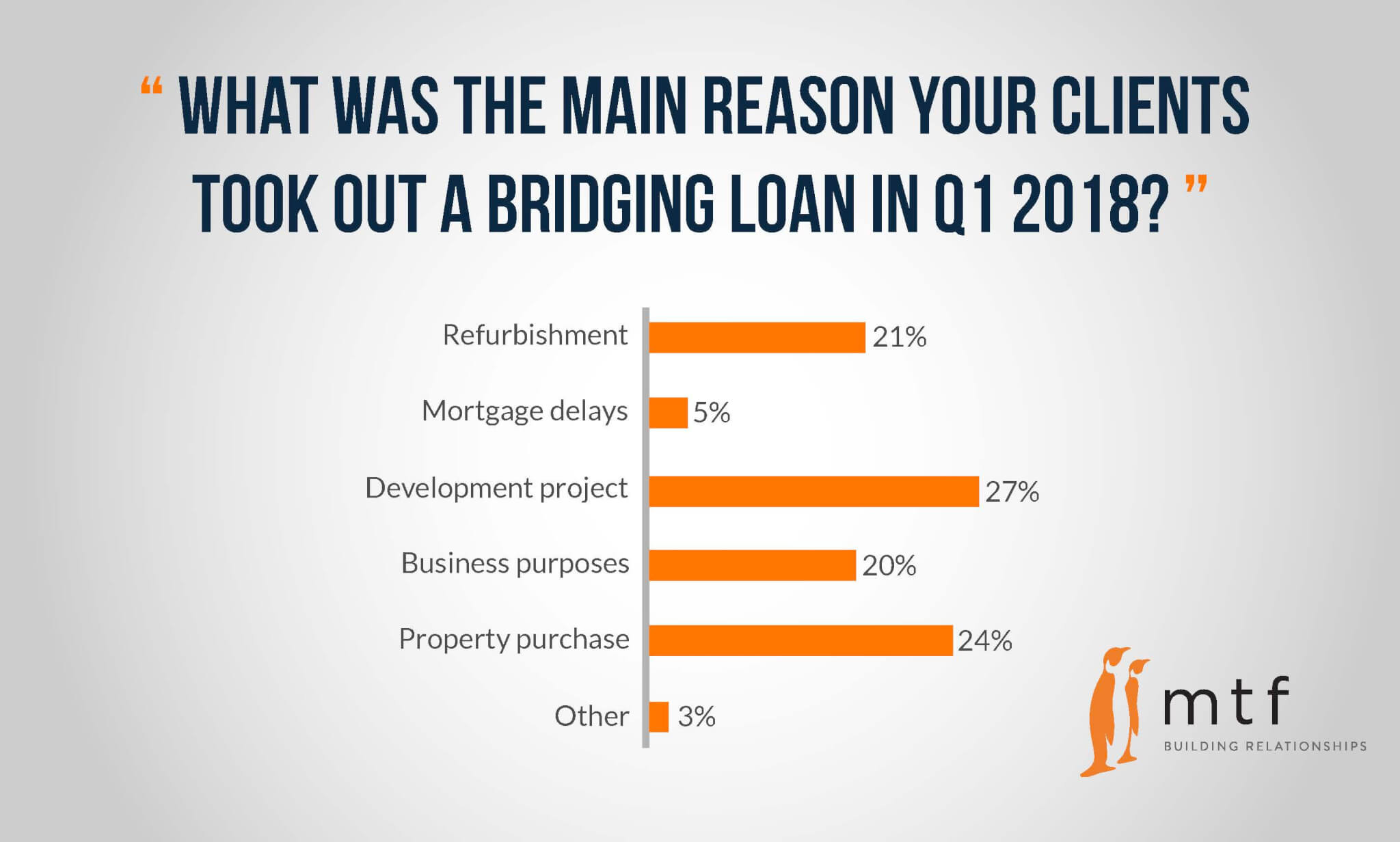

The most popular reason for taking out a bridging loan in the first quarter was to fund a development project at 27%, up from 19% in the fourth quarter of 2017. The purchase of an investment property was the second most popular reason at 24%, followed by refurbishment at 21%.

The feedback from brokers points to a strong need for specialist lending, particularly from developers who continue to support the housing market by providing further supply to meet the ever-constant demand. Bridging finance is increasingly being used as a viable financial tool to provide real time funding to plug any gap before longer term finance can be put in place.