2015 bridging finance trends revealed

Bridging loans hit almost half a billion pounds during 2015 and are set to rise in 2016 as more people tap the fast form of funding and fill liquidity shortfalls.

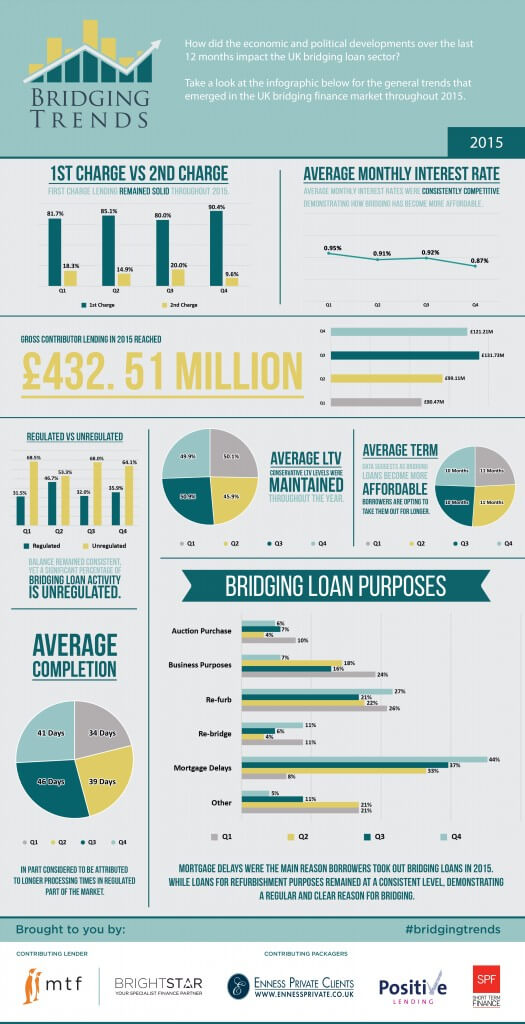

£432.5m of bridging loans were completed by its contributors in 2015, according to Bridging Trends data, a quarterly publication conducted by bridging lender MTF and a number of the industry’s specialist finance brokers: Brightstar Financial, Enness Private Clients, Positive Lending and SPF Short Term Finance.

The year kicked off to a strong start with £80.5m of bridging loans in Q1 2015, rising steadily to £99.1m in Q2 and £131.7m in Q3, before a slight decline in the fourth quarter to £121.2m, due to a Christmas slowdown.

Second half contributor lending totalled £252.9m, 40.9% higher than the first half as confidence returned to the market following volatility in the wider markets and an earlier slowdown in the run up to the General Election.

First charge bridging loans accounted for over 80% of the market in all four quarters, while the majority of bridging loans completed throughout the year were unregulated, the data shows.

Average Loan-To-Value (LTV) ratios were consistent throughout the year, reflecting a conservative and sensible approach to lending. The highest average LTV reached 50.9% during the third quarter of 2015.

Average monthly interest rates were under consistent downward pressure throughout the year falling to an average of 0.87% in the fourth quarter, down from 0.95% in the first quarter.

Mortgage delays were the most popular purpose for a bridging loan in 2015, rising consistently throughout the year to 44% in Q4 2015, up from 8% in Q1 2015. There was a big jump to 33% in Q2 2015 as uncertainty in the run up to the General Election prompted borrowers to tap alternative financing to secure properties.

Pressure on banks prompted by increased regulation and volatility in the wider markets also led people to tap bridging finance, amid mortgage delays.

Refurbishment was the second most popular reason for accessing a bridging loan in 2015, according to the data.

Key Data points from Bridging Trends in 2015 are as follows:

- Average loan term remained consistent at 10-11 months throughout 2015

- Consistent downward pressure on interest rates

- Lending peaked during Q3 2015 at £131.7m

- First charge bridging loans outperformed second charge bridging loans

- Unregulated loans outperformed regulated

For more information or to view the previous quarter’s trends, please visit www.bridgingtrends.com.